Analyzing the Investment Potential of TSM as a Stock Purchase Opportunity

When it comes to exploring potential avenues for financial growth, many investors find themselves contemplating various entities in dynamic markets. With advancements in technology and shifts in consumer preferences, certain players emerge as particularly intriguing options. Understanding the factors that can influence their performance is essential for anyone looking to enhance their portfolio.

In this discussion, we will delve into the nuances surrounding a certain semiconductor giant known for its pivotal role in the global supply chain. From evaluating financial metrics to considering industry trends, there’s a lot to unpack. By examining the potential risks and rewards associated with this entity, investors can make a more informed decision.

Whether you’re a seasoned trader or a curious newcomer to the investment landscape, grasping the nuances of such considerations can greatly impact your strategy. Let’s get into the details and see what insights can be drawn about this compelling choice.

Understanding TSM’s Market Position

When diving into the world of technology investments, it’s essential to grasp where a major player stands in the industry landscape. This company’s influence can be measured not only by its financial metrics but also by its strategic partnerships and innovations. As we explore its role, we can uncover various elements that contribute to its prominence in the semiconductor sector.

One of the standout features of this enterprise is its ability to adapt to rapidly evolving market trends. By keeping a pulse on the demands of leading tech companies, it has positioned itself as a crucial supplier of advanced chips. This flexibility has allowed it to thrive even amidst global supply chain challenges, giving it a competitive edge over other firms.

Moreover, the firm’s commitment to research and development showcases its dedication to staying ahead. Investments in cutting-edge technology not only enhance its product offerings but also foster long-term relationships with clients seeking innovative solutions. This strategy reinforces its reputation as a leader in high-performance processes, which is increasingly vital as the industry moves toward more sophisticated applications.

Additionally, geopolitical factors can play a role in shaping its market dynamics. Navigating international relations and trade policies is crucial, as they impact production capabilities and market access. The company’s strategic moves in response to such challenges highlight its resilience and foresight, factors that investors often take into account when assessing potential choices in this sector.

Ultimately, understanding the market position of this technology leader involves a comprehensive look at its adaptability, innovation, and strategic maneuvering within a complex global landscape. These aspects paint a clearer picture of its potential trajectory, helping investors make informed decisions in a competitive arena.

Financial Performance and Growth Potential

Understanding the financial health and future trajectory of a company is crucial for making informed decisions. It’s not just about current revenues; it’s about how well the organization adapts to market changes, expands its capabilities, and positions itself for long-term success. Analyzing these elements can offer insights into whether it’s a fitting choice for investment.

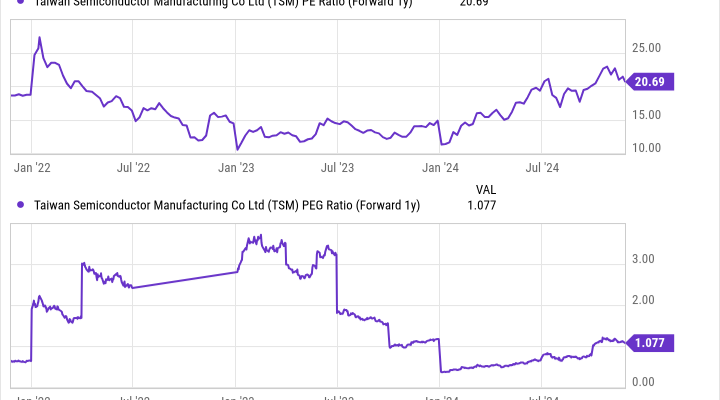

Recent financial results showcase the company’s steady revenue growth and impressive margins, which indicate a solid operational foundation. Investors often look for consistent earnings reports, as they reflect the organization’s ability to manage costs while maximizing revenues. Analysts have noted that a diversified customer base, along with strategic partnerships, has played a significant role in maintaining financial stability.

Moreover, considering future growth potential is essential. The industry is experiencing rapid innovation, and the company’s investment in research and development is indicative of its commitment to stay ahead of the curve. Expanding into emerging markets and exploring new technologies may provide exciting opportunities for additional revenue streams. As global demand for advanced solutions continues to rise, positioning itself effectively could mean substantial gains moving forward.

Overall, evaluating both past performance and future initiatives can provide a clearer picture of whether this company aligns with your investment aspirations. Careful examination of key financial metrics and strategic moves can reveal whether the organization is ready to thrive in an ever-evolving landscape.

Risks Involved in TSM Investment

When considering an investment in any tech-focused entity, it’s crucial to be aware of the potential pitfalls that may arise. While opportunities can be enticing, the landscape is not without its challenges. A thorough understanding of these risks will help you make more informed decisions.

- Market Volatility: The tech sector can experience significant fluctuations. Changes in consumer preferences or technological advancements can drastically affect valuations.

- Geopolitical Factors: International relations and trade agreements may impact operations. Tensions between nations can lead to uncertainties that could affect revenue streams.

- Regulatory Changes: The industry is often subject to new laws and regulations that can influence business practices and profit margins.

- Competition: The landscape is crowded with numerous players vying for market share. An increase in competition could affect market positioning and pricing strategies.

Before taking the leap, it’s vital to consider these aspects and evaluate how they could impact your portfolio in both the short and long term.