Exploring the Investment Potential of TQQQ for Savvy Investors

When it comes to navigating the complex world of the stock market, many individuals often find themselves pondering the right paths to take. The quest for growth and potential returns leads to the exploration of various financial products that leverage the performance of specific indexes. Understanding these options can be both exciting and daunting, as the potential for reward often comes hand-in-hand with certain risks.

One particular avenue that has gained attention involves a fund designed to amplify the movements of an established index. This strategy attracts both seasoned traders and newcomers alike, all eager to uncover whether such a choice will yield beneficial outcomes. As we delve deeper, it’s essential to weigh the advantages and drawbacks, considering factors such as market volatility and personal financial goals.

In this article, we’ll explore the nature of this leveraged option, examining its historical performance, inherent risks, and who might find it appealing. It’s crucial to approach this topic with a balanced perspective, as what works for one investor may not align with another’s strategy. Let’s journey into the world of leveraged equity funds and discern whether they align with your financial aspirations.

Understanding TQQQ’s Market Performance

When diving into the world of leveraged exchange-traded funds, one often finds a unique attraction to those designed to amplify the returns of a particular index. These financial instruments aim to deliver returns that are a multiple of the daily performance of their underlying benchmark. It’s essential to unpack what drives these funds and how they manage to perform in various market conditions.

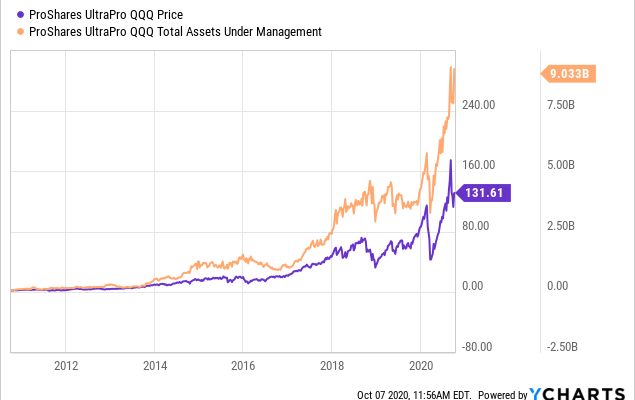

One of the key factors influencing performance is market volatility. In bullish scenarios, these leveraged funds can outpace the traditional index significantly, offering the potential for increased profits. However, investors should also be mindful of the pitfalls associated with these aggressive strategies. In bearish trends, the opposite can occur. The amplified losses can be steep, leading to potentially significant drawdowns.

Additionally, understanding the management of such instruments is crucial. The mathematical mechanisms behind leverage can lead to compounded returns, which might seem appealing but come with inherent risks. This compounding effect means that short-term price movements can disproportionately affect long-term outcomes, making them a double-edged sword for market participants.

The appeal lies in the prospect of rapid gains, but it’s wise to approach with caution and do thorough research before committing funds to these dynamic entities. Balancing potential rewards against the volatility and risks will guide one in making more informed decisions in the financial landscape.

Risks Associated with Leveraged ETFs

When it comes to trading with leveraged exchange-traded funds, it’s essential to understand that while they can amplify returns, they also come with a unique set of challenges. These financial instruments aim to provide a multiple of the daily returns of a particular index or asset, which means both profits and losses can be significantly magnified. This can make them appealing for certain traders looking for quick gains, but it also introduces a layer of complexity that deserves careful consideration.

One of the primary concerns with these funds is volatility. Given their structure, leveraged ETFs can experience dramatic price fluctuations within short periods. This volatility can test the nerves of even seasoned traders, as it increases the risk of making impulsive decisions based on short-term movements. Additionally, the compounding effect can be detrimental for investors who hold these funds over more extended periods, as daily resets may lead to returns that diverge significantly from the underlying index over time.

Another factor to keep in mind is the potential for higher trading costs. Leveraged ETFs often come with increased management fees and may incur additional expenses due to frequent rebalancing. These costs can erode profits, especially for those who engage in frequent trading. It’s critical to weigh these fees against the potential benefits before diving into such high-stakes products.

Lastly, market conditions can have an outsized impact on these investment vehicles. In bearish trends, losses can accrue quickly, putting upward pressure on the risk factor. For those not adequately prepared for these scenarios, the results can be financially devastating. Understanding the risks associated with leveraged ETFs is vital for anyone considering them as part of their trading strategy.

Long-term vs. Short-term Investment Strategies

When it comes to navigating the financial markets, adopting an approach that aligns with your goals and risk tolerance is crucial. Two prominent strategies often come into play: the long-term perspective, which revolves around sustained growth, and the short-term approach, focusing on rapid gains. Each method carries its own set of advantages and challenges that can significantly influence one’s overall financial journey.

Long-term strategies are typically characterized by patience and a commitment to holding assets for extended periods. Investors who embrace this tactic often benefit from compounded returns and the ability to ride out market fluctuations. This approach requires a deep understanding of market trends and the capability to identify undervalued assets, positioning oneself to capitalize on their growth over time.

On the other hand, short-term strategies are all about quick returns and frequent trading. This method demands a keen eye for market movements and the agility to make prompt decisions. While the potential for quick profits is enticing, this strategy also comes with increased risk and the necessity for constant monitoring. Adept traders who can leverage market volatility often thrive in this environment, but it can be a rollercoaster ride of wins and losses.

Ultimately, the choice between these strategies boils down to individual preferences, financial aspirations, and risk appetite. Understanding where you stand can help you tailor your approach, fostering a clearer path toward achieving your financial goals.