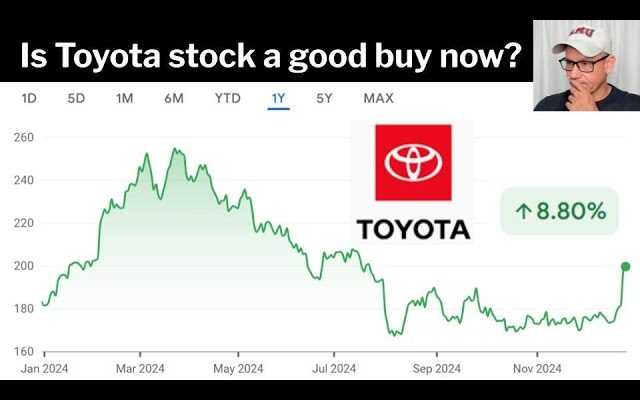

Is Investing in Toyota a Smart Choice for Your Portfolio

Investing in the automotive sector can be both exciting and daunting, especially when considering the long-term potential of a well-known manufacturer. With numerous factors influencing the market – from economic fluctuations to technological advancements – potential shareholders often find themselves weighing various aspects before making a financial commitment. Understanding the intricacies behind this industry leader is crucial in making informed decisions.

As we delve into the financial health, innovation strategies, and global presence of this esteemed company, it becomes clear that there are opportunities and challenges to navigate. Conducting thorough research is essential, as every investment decision carries inherent risks and rewards. By analyzing key metrics and expert opinions, one can gain insights into whether this company aligns with their financial goals.

In this discussion, we will explore the company’s performance, industry standing, and future outlook. Are the prospects encouraging, or do potential pitfalls warrant caution? Join us as we unravel the complexities of this automotive powerhouse and help you determine if it deserves a spot in your financial portfolio.

Analyzing Financial Performance

Diving into the financial landscape of a prominent automotive manufacturer, it’s essential to evaluate various aspects that contribute to its overall economic health. These metrics help investors gauge the reliability and future prospects of the company.

When examining the financial results, here are some key areas to consider:

- Revenue Trends: Observing revenue growth or decline over recent quarters can provide insight into market demand and consumer preferences.

- Profit Margins: Examining profit margins helps in understanding the efficiency of the company’s operations and pricing strategy.

- Debt Levels: Assessing the level of debt versus equity is crucial for determining financial stability and risk.

Moreover, a look into historical performance can reveal patterns:

- Reviewing quarterly earnings reports to track fluctuations in profitability.

- Comparing current performance with past periods to identify growth trajectories.

- Investigating cash flow statements to assess liquidity and cash management.

Finally, it’s important to factor in external influences such as economic conditions, regulatory changes, and competition. These elements can significantly impact future growth and profitability, providing a comprehensive perspective for potential investors.

Future Outlook for Toyota’s Market Position

Looking ahead, the trajectory for this automotive giant appears promising as it navigates an ever-evolving landscape of challenges and opportunities. The emphasis on innovation, particularly in electric and hybrid vehicles, positions the company favorably against competitors. By investing in sustainable technologies, it aims to align with global trends toward greener transportation solutions.

Moreover, the brand’s reputation for quality and reliability continues to be a strong pillar in a competitive marketplace. Consumer loyalty is bolstered by consistent performance and a robust after-sales service network. This commitment to customer satisfaction not only enhances its market share but also solidifies enduring relationships with clients.

Additionally, strategic partnerships and collaborations in the technology sector could provide further advancements in autonomous driving and connectivity features. By embracing these innovations, the automotive manufacturer is poised to meet the demands of future consumers who prioritize advanced technological integration.

Finally, navigating economic fluctuations and supply chain challenges will be crucial. With adaptability and resilience, the company is equipped to manage potential disruptions and sustain its market presence. Overall, the outlook reflects a blend of tradition and modernity, ready to face the exciting future that lies ahead.

Comparing a Leading Automaker with Competitors in the Industry

When it comes to the automotive sector, various players vie for attention, each bringing unique strengths and challenges to the table. Analyzing how a prominent manufacturer stacks up against others can provide valuable insights into market dynamics and potential growth opportunities. This discussion will explore key metrics and characteristics to help in understanding the competitive landscape.

One major aspect is innovation in technology. Several firms have made significant strides in electric vehicle (EV) development, which is becoming increasingly crucial in today’s market. Evaluating how these companies integrate sustainable practices and cutting-edge technologies can reveal their long-term viability.

Another important factor is market share and brand loyalty. While some enterprises boast a long-standing heritage, others have captured consumer interest through aggressive marketing strategies and diverse offerings. Understanding brand perception can shed light on each player’s positioning in the marketplace.

Additionally, financial health is a critical component of any comparison. Reviewing revenue growth, profit margins, and overall operational efficiency helps determine which entities are best equipped to navigate economic fluctuations. This financial backdrop is essential for making informed assessments and predictions for the future.

Lastly, examining geographical presence can offer insights into a company’s growth potential. Firms that successfully penetrate emerging markets may provide exciting opportunities compared to those focusing primarily on established territories. Overall, a comprehensive comparison will highlight essential factors that influence the success and challenges faced by industry participants.