Exploring the Investment Potential of Tilray as a Stock Option

As the cannabis industry continues to evolve, many individuals are curious about the potential avenues for investment within this rapidly growing market. With increasing legalization and a shift in public perception, the opportunities seem plentiful. However, navigating this landscape can be challenging for both seasoned investors and newcomers alike.

One key player in this arena has garnered attention due to its strategic moves and market presence. Investors often ponder whether entering into a position with such a company is a wise decision. Analyzing various factors is essential in determining the viability and prospects of any financial engagement.

In this discussion, we will delve into the critical aspects of performance metrics, market trends, and overall company fundamentals that could influence a well-rounded investment decision. With informed insights and a thoughtful approach, one can better assess the suitability of engaging with this intriguing sector.

Analyzing Market Performance

When it comes to evaluating the performance of a particular firm in the field of cannabis, it’s essential to look at various factors that influence its standing in the market. An in-depth analysis reveals trends, potential growth opportunities, and challenges that could affect its valuation. Understanding these aspects can provide valuable insights into whether this investment might suit your portfolio.

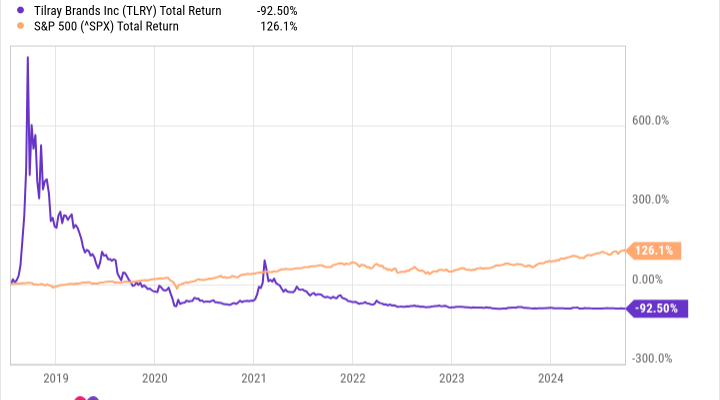

One of the key areas to consider is the firm’s recent financial results. Metrics such as revenue growth, profit margins, and operational efficiency can reveal how well the company is navigating its industry. Additionally, fluctuations in market price often correlate with broader economic factors, investor sentiment, and industry developments. Keeping an eye on these elements allows for a clearer understanding of how the firm is positioned against its competitors.

Furthermore, assessing the strategic moves made by the company is crucial. Partnerships, product expansions, and geographical diversification can greatly enhance market presence and profitability. These decisions can drive growth and potentially lead to increased shareholder value over time.

Lastly, external factors such as regulatory changes and consumer trends should not be overlooked. The cannabis industry is particularly susceptible to shifts in legislation, which can have significant implications for market dynamics. Staying updated on these trends will enable investors to better gauge the long-term potential and sustainability of their investment decisions.

Factors Influencing Tilray’s Stock Value

When considering the performance of any publicly traded entity, several key elements come into play that can significantly affect its market valuation. These aspects can range from industry trends and regulatory changes to financial health and investor sentiment. Understanding these dynamics can help individuals assess potential risks and rewards in their investment decisions.

One of the primary influencers is the regulatory landscape surrounding the cannabis industry. Changes in laws and regulations can have a profound impact on operations and profitability. As more regions move toward legalization, companies that are well-positioned to adapt can see their value surge, while others may struggle to keep up.

Market competition is another vital factor. As new players enter the sector, the level of competition can intensify, affecting market share and pricing strategies. Companies that can differentiate themselves through innovation or superior product offerings may maintain stronger valuations in a crowded marketplace.

Financial performance also plays a crucial role. Key metrics such as revenue growth, profit margins, and cash flow strongly influence how investors perceive the viability and future prospects of a company. Consistent financial health signals stability and can lead to increased confidence among shareholders.

Moreover, broader economic conditions affect investment choices. Economic indicators such as interest rates, inflation, and consumer spending patterns can influence market behavior. During uncertain times, investors may shy away from more volatile sectors, impacting overall pricing.

Lastly, the sentiment of investors and analysts can sway perceptions significantly. Public relations, social media presence, and overall market buzz all contribute to how a company’s actions are viewed. Positive news can amplify interest and drive up valuations, while negative headlines can lead to declines.

In summary, the value assigned to any entity in the market is a complex interplay of various factors. By keeping an eye on these key elements, one can make more informed decisions regarding potential investments in this dynamic field.

Expert Opinions on Tilray’s Potential

When it comes to assessing the future of a certain cannabis company, market analysts have a wealth of perspectives that can help shed light on its prospects. Various experts in the industry offer insights that go beyond mere numbers, delving into factors such as market trends, regulatory changes, and consumer behavior. These evaluations are crucial for anyone looking to understand the potential this company might hold.

Some experts highlight the significance of the company’s strategic partnerships and acquisitions, suggesting that these moves could position it favorably within the competitive landscape. They argue that a solid foundation built on innovation and effective scaling could lead to impressive growth in the long run. On the other hand, a few analysts express concerns regarding market saturation and pricing pressures that may impact profitability. This divergence in opinions showcases the complexity of the market dynamics at play.

A key point of discussion is the evolving legal environment surrounding cannabis. Experts emphasize that shifts in regulations could either bolster or hinder a company’s progress. Understanding these macroeconomic factors is vital for gauging long-term viability. Furthermore, comments on consumer trends reveal an increasing acceptance of cannabis products, which many believe could propel demand significantly.

Investors are often advised to weigh these expert insights carefully, considering both optimistic outlooks and cautionary notes. Ultimately, a balanced view informed by diverse opinions can empower individuals to make well-rounded decisions regarding their investments in this sector.