Exploring the Availability of Financial Aid Options for Graduate School Students

Embarking on the journey of higher education can be both exciting and daunting. Many individuals aspire to advance their knowledge and skills, yet the costs involved often raise concerns. Fortunately, a variety of options exist to help alleviate this burden, enabling ambitious learners to pursue their dreams without overwhelming financial strain.

Understanding the various pathways to receive assistance is crucial. Numerous programs, scholarships, and resources cater to those determined to enhance their academic journey. By exploring these opportunities, candidates can uncover potential support that aligns with their goals and needs.

Knowledge is power, particularly when it comes to navigating the complexities of funding options available to aspiring scholars. With the right information and preparation, individuals can take meaningful steps towards achieving their educational aspirations.

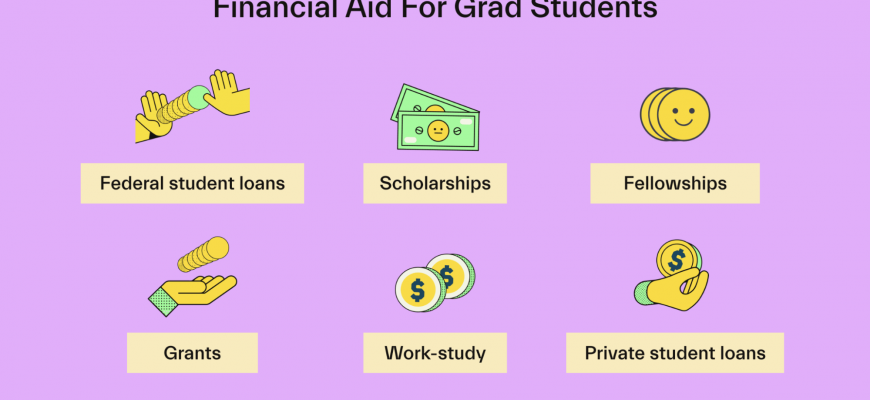

Types of Financial Assistance Options

When pursuing advanced education, many individuals often find themselves exploring various means to alleviate the burden of expenses. Knowing the right resources can make a significant difference in managing costs effectively while attaining one’s academic goals.

Scholarships serve as one of the most sought-after resources. These awards do not require repayment and can be based on merit, need, or specific criteria such as field of study or background. Often offered by universities, private organizations, or nonprofits, scholarships can substantially lessen tuition costs.

Grants are another excellent choice. Unlike loans, these funds typically do not need to be repaid. They are often awarded based on financial necessity, allowing students with limited resources to access higher education without incurring further debt. Government programs and universities frequently offer such support.

Work-study programs allow students to earn money while studying. These arrangements provide part-time employment opportunities, which not only help cover costs but also enhance work experience. Engaging in relevant job roles can be particularly beneficial in building a strong resume.

Student loans are commonly utilized, though they come with the expectation of repayment after graduation. Various options exist, from federal loans with favorable terms to private loans that may carry higher interest rates. It’s wise to fully comprehend the implications before committing to any borrowing.

Lastly, assistantships and fellowships offer different avenues for support. By working as teaching or research assistants, students can receive stipends along with tuition waivers. These positions often provide invaluable experience while contributing to educational expenses.

Exploring these diverse resources opens up possibilities for many who seek an advanced degree, making the journey a bit easier and more attainable.

Understanding Scholarships and Grants

When pursuing advanced education, many students look for opportunities that can help reduce the financial burden. Various forms of support can lighten the load and make obtaining a degree more accessible. Knowing the differences and benefits of these options can set students on the right path.

Scholarships are usually awarded based on merit, which may include academic achievements, artistic talent, or other special abilities. They can come from numerous sources, including institutions, private organizations, and even community groups. Understanding the eligibility criteria is essential, as it ensures that potential candidates maximize their opportunities.

Grants, on the other hand, often consider specific circumstances such as economic necessity. Unlike scholarships, which emphasize achievement, grants focus more on the individual’s financial situation. Many governmental and non-profit organizations provide this type of assistance, making it crucial for students to explore various possibilities that fit their profile.

Both scholarships and grants are wonderful options because they do not require repayment. This can translate into a significant advantage, enabling students to concentrate on their studies rather than worrying about accumulating debt. Researching well and applying widely can greatly enhance one’s chances of securing these valuable resources.

In summary, understanding what scholarships and grants entail helps potential students make informed decisions. By seeking out these options, individuals can pave a smoother path toward achieving their academic goals without overwhelming financial stress.

Loans and Repayment Plans Explained

When pursuing advanced studies, understanding borrowing options and repayment strategies becomes essential. Many individuals rely on loans to manage their expenses while navigating through academic life. It’s crucial to make informed choices to ensure that future financial obligations are manageable.

Various types of loans are available, each with its own terms and conditions. Federal loans often offer lower interest rates and more flexible repayment plans compared to private lenders. Knowing the difference can significantly impact long-term debt. Moreover, students should assess the total cost of borrowing beyond just the interest rate, considering fees and repayment options.

After completing studies, repayment options vary widely. Standard plans, income-driven repayment, and graduated options cater to different financial situations. Income-driven plans, for instance, adjust monthly payments based on earnings, providing some peace of mind during the transition into the workforce. Understanding these choices is vital to create a repayment strategy that aligns with personal financial goals.

In summary, being well-informed about loans and repayment plans can lead to better outcomes. Evaluating all available options and choosing wisely will empower students as they take their next significant steps in life. It’s all about making smart, strategic decisions that pave the way for a stable financial future.