Exploring the Availability of Financial Aid Options for Graduate School Students

Choosing to pursue advanced studies is a significant decision that can open many doors. However, the costs associated with further education can feel overwhelming at times. Many individuals wonder what kinds of resources might be available to assist them in this journey. Understanding these options can help make the pursuit of knowledge more achievable and less stressful.

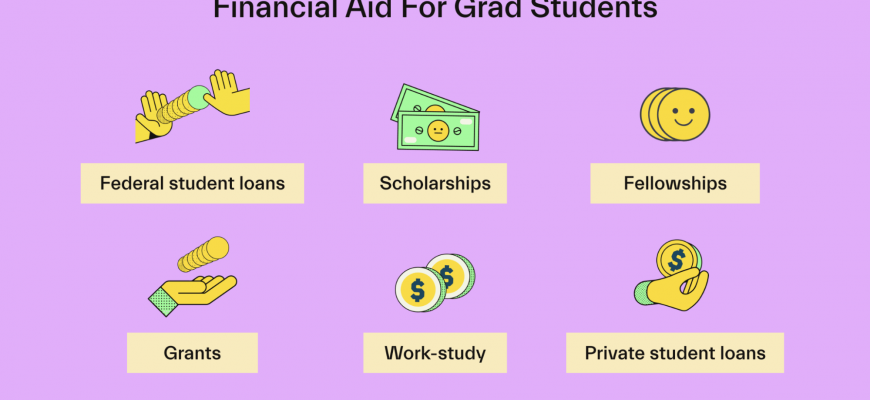

Numerous possibilities exist to alleviate the burden of expenses linked to higher learning. Scholarships, grants, and assistantships are just a few examples of the various forms of assistance that might be accessible. Each program comes with its unique criteria and benefits, making it essential to research carefully and explore what suits your needs best.

In addition, personal loans and work-study programs can offer further opportunities to support your ambitions. With careful planning and the right information, aspirants can find ways to make their dreams a reality without being encumbered by high debt. Let’s dive deeper into the types of support available and how they can impact your educational journey.

Types of Assistance Available

When pursuing higher education, options exist to alleviate the burden of expenses. Understanding various resources can make a significant difference in managing costs associated with advanced studies. Different kinds of support are available, each tailored to meet diverse needs of learners.

Scholarships represent one of the most sought-after forms of help. These funds do not require repayment and can come from numerous sources, including institutions, government programs, and private organizations. Some scholarships focus on academic excellence, while others may consider financial needs, personal backgrounds, or specific fields of study.

Grants are another excellent opportunity. Like scholarships, they do not demand repayment, making them an appealing choice. Generally awarded based on different criteria, grants often come from federal or state governments, as well as educational institutions aiming to support students in need.

Loans provide a means to finance education through borrowed money. Unlike the previous options, these require repayment over time, potentially with interest. A variety of loan programs exist, including federal student loans, which often offer lower interest rates and flexible repayment plans compared to private loans.

Work-study programs enable students to earn money while completing their studies. These positions usually occur on or near campus and allow individuals to balance work and coursework effectively. Such programs not only help financially, but they can also provide valuable work experience relevant to one’s chosen field.

Lastly, assistantships and fellowships offer unique opportunities for students to receive support while contributing to research, teaching, or administrative tasks. Often providing stipends and tuition waivers, these positions allow individuals to deepen their expertise while gaining practical experience.

Exploring these various forms of support can ease the journey through advanced education, ensuring that a brighter future is accessible to more individuals.

Understanding Scholarships and Grants

When pursuing advanced education, many individuals seek out opportunities that can reduce their overall expenses. Scholarships and grants are two appealing options that provide monetary assistance without the burden of repayment. They can alleviate the stress of tuition fees and living costs, making higher learning more accessible to a broader audience.

Scholarships typically reward students based on merit, which may include academic achievements, talents in specific areas, or involvement in community service. Each scholarship has its own criteria, allowing individuals with varied backgrounds to find opportunities that suit their skills and interests. On the other hand, grants usually focus on financial circumstances, helping those who may struggle to afford educational expenses due to economic challenges.

It’s essential to explore various sources when searching for these funding opportunities. Numerous institutions, organizations, and foundations offer special programs aimed at supporting learners. Additionally, many schools have their own resources to assist students in finding scholarships and grants that align with their needs. Taking the time to investigate these options can lead to significant savings and a more manageable academic journey.

Applying for scholarships and grants often involves completing detailed applications and essays. While this process may seem daunting, it also allows individuals to showcase their passions and goals. Standing out from the competition can increase the chances of receiving aid, so it’s important to invest effort into crafting compelling applications.

Using scholarships and grants not only eases the financial burden but also opens doors to new experiences and opportunities. Embracing these forms of support can lead to a rewarding and enriching educational experience, empowering students to focus on personal growth and career development.

Student Loans: Pros and Cons

When considering options to fund advanced education, many individuals find themselves weighing the benefits and drawbacks of borrowing money. While loans can provide necessary funds for tuition and living expenses, they also come with responsibilities and potential challenges.

On the plus side, loans offer immediate access to funds that can help cover educational costs, allowing students to pursue their dreams without the burden of upfront payments. Additionally, payment plans often have flexible terms, making it easier to manage finances after graduation. Interest rates can be relatively low compared to other forms of credit, and certain programs allow for loan forgiveness based on career choices or income levels.

Conversely, accumulating debt can be daunting. Repayment starts after graduation, which might lead to financial strain if job opportunities are limited or if earnings are lower than expected. Interest can accumulate over time, increasing the total amount owed. Moreover, the pressure of repaying loans can discourage some from pursuing further education or making career choices based solely on salary.

Ultimately, it’s essential to carefully evaluate your situation before making any decisions. Weighing the positive aspects against the potential complications will help ensure you make the best choice for your future.