Exploring the Differences Between the Student Aid Index and the Expected Family Contribution

Navigating financial aspects related to higher learning can be quite overwhelming. Families often find themselves facing a myriad of terms and metrics that aim to clarify how much support one can expect. With various figures thrown around, it’s only natural to question how they relate to each other.

Comprehending financial calculations that determine eligibility for financial resources is crucial for prospective learners. Many individuals wonder if different metrics actually convey the same information or if they serve distinct purposes. Clarifying this can ease concerns and aid in planning for post-secondary pursuits.

By delving into these concepts, one can gain a clearer picture of financial readiness and the funds available to tackle educational expenses. Whether you’re preparing for college or simply looking to understand the landscape better, exploring these financial instruments will provide valuable insights.

Understanding Student Support Metrics

Navigating financial assistance for higher education can be tricky. It’s important to grasp how various formulas and calculations impact the help available to individuals pursuing their academic goals. Insights into these measures can significantly affect planning and decision-making regarding financing education.

When discussing financial contributions expected from families, different terminologies may arise. These calculations aim to determine a household’s ability to support educational expenses, reflecting resources and financial circumstances. Knowing how these figures are derived helps in anticipating potential financial support and understanding overall requirements.

A key aspect lies in recognizing how these metrics influence award processes. Institutions use these calculations to tailor funding opportunities suited for applicants, ensuring that financial resources are allocated effectively. Grasping this concept can empower candidates to make informed choices about their education without overwhelming pressure due to financial constraints.

Furthermore, engaging with available resources and seeking guidance can illuminate the nuances of these evaluations. Educational institutions, financial advisors, and numerous online tools provide valuable insights that can demystify these processes. As candidates delve deeper into these calculations, they find greater clarity and confidence in approaching their educational financing.

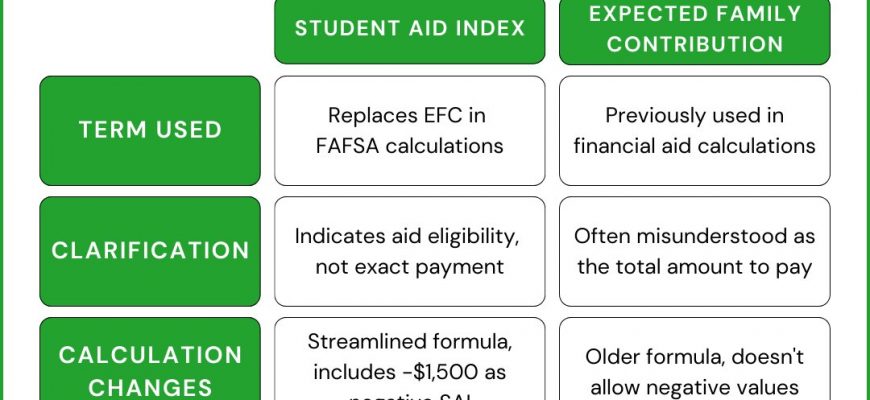

Differences Between SAI and EFC

When navigating financial support for educational purposes, many find themselves confused by acronyms and formulas. Understanding distinctions between various metrics is crucial for maximizing resources, ensuring clarity regarding funding options. Here, we will explore key differences that can impact financial planning for pursuing higher education.

- Calculation Methodology: Each metric employs a distinct approach for determining family contribution. Variations in the formula can lead to different outcomes, influencing eligibility for financial resources.

- Components Considered: Factors taken into account for computation can differ significantly. Some include income, assets, and family size, while others may emphasize different criteria or weight them unevenly.

- Impact on Financial Packages: Variations in numbers derived from these calculations can directly affect how much support institutions provide. A higher or lower value could change awarded scholarships or grants.

- Evaluation by Institutions: Different educational entities may interpret these figures in various ways, leading to inconsistent funding outcomes. Awareness of institutional policies can help in making informed choices.

Grasping these differences not only aids in better preparation but also streamlines decision-making processes regarding educational financing. Being well-informed enables individuals to navigate options effectively, ensuring they receive adequate resources on their academic journey.

How SAI Affects Financial Support

Understanding financial assistance can be quite a journey, especially when navigating various calculations and formulas that determine what families can contribute toward educational costs. One key metric plays a crucial role in shaping how much funding is available, impacting overall affordability. This number influences decisions taken by institutions when awarding grants or scholarships to students in need.

When assessing eligibility for financial resources, factors like household income, family size, and other economic elements come into play. The calculated figure provides insight into a family’s ability to contribute, which then directly affects how much support is offered by colleges and universities. A lower figure often means more financial help, making higher education more accessible for those who require it.

Additionally, this assessment not only determines monetary contributions but also serves as a guideline for schools to balance their budgets while ensuring equitable access to education. With rising tuition fees, understanding this metric becomes essential for families striving to make informed decisions about higher learning options.

Ultimately, this component serves as a bridge, linking financial realities of families with resources allocated by educational institutions. By grasping how it operates, students and their families can better navigate the complexities of funding opportunities, aiming for a smoother path toward achieving their academic goals.

Her beauty is mesmerizing! You can’t take your eyes off her;and that’s what makes this video so special. She radiates grace and poise.