Exploring the Potential of Investing in the S&P 500 as a Smart Financial Move

Many individuals ponder whether placing their funds into a specific market index is a wise decision. With countless options available, evaluating various opportunities can be quite a challenge. Understanding potential risks and rewards may help in making informed choices.

Experts often discuss long-term growth and stability associated with broad-based indices. By analyzing historical performance, one might gain insights into how such portfolios can react during different market conditions. Considering diverse factors can illuminate paths toward, perhaps, more favorable outcomes.

Ultimately, assessing personal goals and risk tolerance is essential before embarking on any financial journey. Engaging with experienced professionals or conducting thorough research may provide clarity and confidence. With strategic thinking, one can navigate complexities of market dynamics effectively.

Understanding the S&P 500 Index

Grasping this popular stock market benchmark can provide valuable insights into broader financial trends. It represents a diverse selection of large companies, reflecting economic health and market dynamics. Many financial enthusiasts and analysts keep a keen eye on its movements, as they can indicate overall market sentiment.

Here are some key aspects to consider:

- Composition: This index features 500 of the largest publicly traded companies across various sectors, offering a broad perspective of market performance.

- Market Capitalization: Companies within this index are weighted by their market capitalization, meaning larger corporations have a more significant impact on overall performance.

- Historical Performance: Over time, performance analysis reveals trends that can assist in forecasting future movements, helping to identify patterns that may influence decisions.

- Risk and Diversification: Investing in this index allows exposure to a wide array of sectors, helping to mitigate risk associated with individual stock ownership.

Understanding these elements can empower individuals to make informed choices regarding their financial strategies. Whether one is looking to diversify a portfolio or track trends, familiarity with this index is essential.

Long-Term Performance and Historical Trends

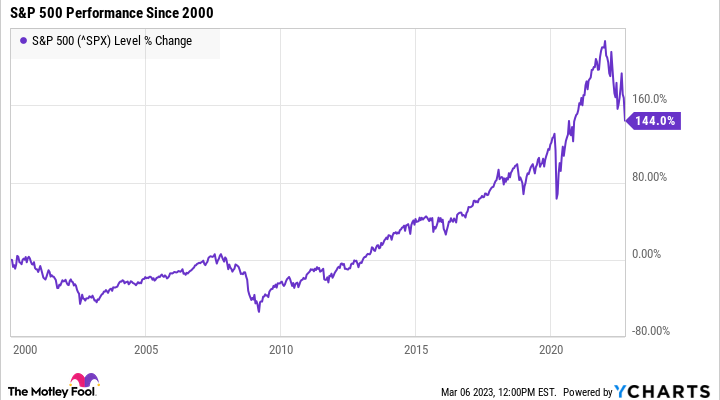

When considering placing resources into major market indices, it’s essential to examine how they have performed over extended periods. Historical data reveals intriguing trends that can offer valuable insights for future decisions. By understanding past fluctuations and overall growth patterns, investors can gauge potential outcomes when committing to such assets.

Long-term records reflect consistent upward trajectories, punctuated by inevitable downturns. Market corrections and recessions occur periodically but are often followed by significant recoveries. Analyzing these cycles provides a clearer picture of resilience and adaptability within marketplaces.

In the past several decades, one can observe substantial appreciation in value, which tends to outpace inflation rates. This attribute has made the index a centerpiece for many seeking steady appreciation and relative security. Additionally, recurring dividends contribute to total returns over time, reinforcing the appeal of maintaining a position in this arena.

Historical performance isn’t merely a collection of numbers; it tells a story of economic challenges and triumphs. These episodes highlight not only resilience but also strategic advantages for those willing to navigate various market conditions. Engaging with this landscape requires patience, as positive results often unfold over years rather than weeks or months.

In summary, examining significant historical trends and long-term outcomes can provide a comprehensive understanding of potential rewards and risks. Making informed choices based on these insights ultimately guides one towards sound financial decisions in dynamic environments.

Diversification Benefits of S&P 500 Investments

When considering strategies for wealth accumulation, diversification plays a crucial role in minimizing risks and enhancing potential returns. By distributing resources across various sectors, individuals can create a robust financial portfolio that withstands market fluctuations. A particular selection of stocks, encompassing a wide array of industries, allows for exposure to different economic trends without being overly reliant on a single company or market segment.

One of the significant advantages of investing in a broad market index is its inherent ability to reduce volatility. By including a diverse range of companies, fluctuations in any one stock can be balanced out by gains in others. This characteristic fosters stability, providing investors with peace of mind during turbulent economic periods. It’s essential to understand that while individual stocks may perform erratically, a joint investment strategy can smooth out those peaks and valleys.

Moreover, when you allocate resources across numerous sectors, you tap into various growth opportunities. Different industries often thrive under different conditions, and by having a stake in each, you position yourself to benefit from multiple growth drivers. This means that even if one area faces challenges, other sectors might be soaring, thereby safeguarding overall performance.

Additionally, a well-diversified portfolio can also lead to more consistent returns over time. By blending high-growth firms with more stable, mature businesses, investors can achieve a balance that may enhance overall performance. Ultimately, this strategy not only mitigates risks but also allows individuals to take advantage of varying risk-reward profiles within their financial pursuits.

Risks and Considerations for Investors

When exploring opportunities in various markets, it’s essential to understand potential pitfalls that come along with financial choices. Many factors can influence returns, and being aware of these can help shape a more informed approach. With varying market conditions and economic indicators, decision-making becomes crucial for anyone looking to grow their portfolio.

One significant factor to take into account is market volatility. Prices can fluctuate dramatically due to economic events, geopolitical tensions, or changes in investor sentiment. This uncertainty can lead to situations where short-term losses may occur, which can be unsettling for even the most seasoned investors. Developing a strategy to withstand such fluctuations is vital.

Another aspect worth considering is diversification. Relying solely on a single asset class can expose an individual to greater risk, especially during downturns. Spreading investments across different sectors and regions can mitigate potential losses, as not all markets move in the same direction at the same time.

Additionally, economic cycles can have wide-ranging effects on asset performance. Recognizing where an economy stands–whether in growth, recession, or recovery–can inform better choices. Historical trends can provide insight, but predicting future movements remains a challenge for even the most experienced professionals.

Lastly, individual goals and risk tolerance should guide decisions. What suits one investor may not align with another’s financial aspirations or appetite for risk. Identifying personal objectives helps in crafting an effective strategy that resonates with one’s unique circumstances.