Exploring the Status of the Child Tax Credit for the Year 2025

As families continue to navigate various economic challenges, questions arise about available government assistance aimed at easing financial burdens. Many people wonder what support mechanisms might be on the horizon, particularly those designed to help with raising young ones. Understanding potential benefits can significantly impact planning and budgeting for households.

Recent discussions have circulated around financial incentives targeted at families, reflecting changing priorities in governmental policies. With evolving economic landscapes, it’s crucial to stay informed about possible initiatives that could provide crucial support during crucial developmental years. These financial boosts not only promote well-being but also encourage positive growth and stability.

Looking ahead, examining anticipated changes is essential. Engaging with current trends and proposed strategies ensures that families can prepare effectively and make informed decisions about their financial futures. As more information emerges, clarity will be vital in understanding how upcoming provisions can play a role in everyday life.

Understanding Changes in Financial Support for Families

As parents navigate through various financial responsibilities, it’s crucial to be aware of any modifications in available assistance programs. These adjustments have a significant impact on household budgets, influencing how families plan for the future. Simplifying this process can empower caregivers to make better financial decisions, ensuring they have the resources necessary for raising their little ones.

Recently, there have been notable shifts aimed at enhancing support mechanisms aimed at nurturing and caring for dependents. Understanding these new provisions, including eligibility criteria and benefit amounts, can unlock greater opportunities for families. Staying informed about these changes can also help in optimizing available resources, providing peace of mind for managing day-to-day expenses.

It’s advisable to keep an eye on official announcements and guidelines that detail any adjustments in benefits. Being proactive enables families to fully grasp their potential financial advantages and navigate through uncertainties that can arise with evolving policies. Every bit of information counts when planning for the welfare and future of dependents.

Eligibility Requirements for 2025 Benefits

Understanding who qualifies for financial assistance can be a bit tricky, but it’s essential to know what factors could play a role in accessing available benefits. There are several key aspects to consider when determining eligibility. Individuals must meet certain guidelines that define their circumstances and household structure.

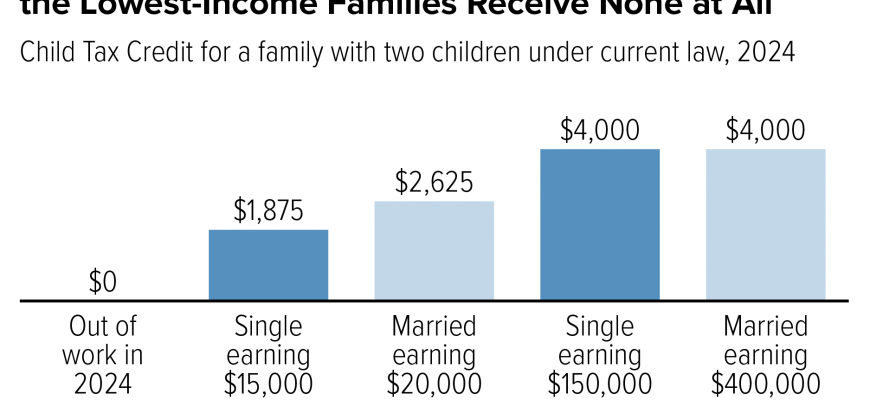

First, income limits are a crucial consideration. Applicants will need to provide documentation to demonstrate their earnings, as this often impacts the level of support received. Lower-income families typically stand a better chance of receiving greater financial help.

Another important factor revolves around dependents. Having qualifying individuals within a household can significantly influence potential benefits. This typically includes younger members, but specific age ranges or situations might apply, so it’s wise to verify these details.

Additionally, filing status plays a role in determining benefits. Single filers may have different eligibility compared to those filing jointly or as heads of households. Each status comes with its own set of guidelines that can affect overall qualification.

Lastly, keeping an eye on changing regulations is vital. Policies can shift from year to year, so remaining informed about any legislative alterations ensures families are prepared to take advantage of all available resources.

Impact of Financial Assistance on Family Finances

When families receive financial support aimed at easing their budgeting challenges, it can significantly influence their overall economic health. This kind of aid often provides a vital resource that helps cover essential expenses, allowing families to allocate funds toward other important areas in daily life.

With additional resources in hand, households often find themselves in a better position to manage expenses like education, healthcare, and housing. This empowerment can foster a sense of security, helping to alleviate stress related to financial uncertainties. Moreover, families can start saving for future investments or emergencies, which is crucial in building a stable financial foundation.

Furthermore, such support may enhance children’s quality of life by enabling access to better opportunities and resources. When families thrive economically, it creates a ripple effect that benefits communities, promoting overall well-being and development. Therefore, understanding how such assistance impacts family finances is essential for sustainable growth and improvement in society.