Exploring the Benefits and Implications of the Child Tax Credit

In today’s world, families often look for ways to ease their financial burdens, especially when raising little ones. Various incentives and support systems exist to help parents navigate these challenges. One such initiative has sparked considerable conversation and debate among households and financial experts alike.

Evaluating this particular allowance can lead to important insights about budgeting, planning, and overall family well-being. Many wonder how it truly impacts finances and whether it proves beneficial in the long run. Understanding its nuances may assist caretakers in making informed choices regarding their financial future.

As discussions unfold, it’s essential to explore the intricacies surrounding this allowance. By delving into details, we can uncover which families benefit most and what considerations are vital for maximizing outcomes. Ultimately, knowing the facts empowers individuals to make choices suited to their unique situations.

Understanding the Child Tax Credit

Grasping the concept behind financial assistance for families with dependents can be quite enlightening. This support aims to alleviate some of the burdens associated with raising kids, allowing households to manage their expenses more effectively. Various forms of aid exist, but this particular one focuses on reducing overall financial obligations for families.

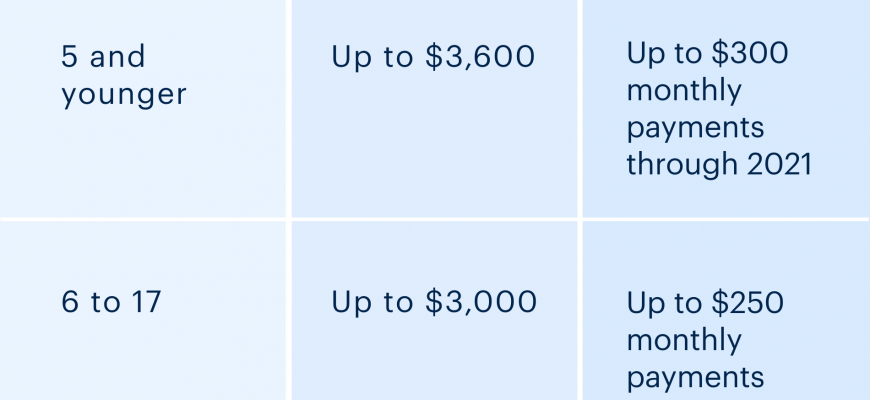

Essentially, this program provides monetary relief based on specific criteria, helping parents maintain a better quality of life for their little ones. By offering a certain amount for each dependent, it acts as a fiscal buffer, making it easier to cover essential needs like education, healthcare, and daily expenses.

Moreover, understanding the eligibility requirements is crucial for families seeking assistance. Factors such as income level, number of dependents, and filing status can influence the amount received. Therefore, getting familiar with these aspects can empower families to take full advantage of the support available to them.

Overall, knowing how this program works and how it can benefit families lays the groundwork for making informed financial decisions and enhancing overall well-being.

Eligibility Criteria for Families

When it comes to financial assistance for households, understanding who can qualify is crucial. Various factors determine eligibility, including income levels and family size. This section aims to clarify what is needed for families to access these benefits, ensuring everyone knows where they stand.

First off, income plays a major role. Most programs set specific thresholds that families must stay within to be considered eligible. Larger households typically have higher limits, recognizing their additional needs. It’s important to track your annual earnings, as exceeding a set amount might disqualify you.

Additionally, residency status is essential. Generally, participants must be U.S. residents, and in some cases, legal citizenship is required. Families should also have dependents, which leads to another consideration: age. Usually, children must meet certain age criteria to be counted, impacting how much assistance a family can receive.

Lastly, some programs might prioritize specific groups, such as low-income families or those facing unique circumstances. Awareness of these factors helps many determine their eligibility and plan accordingly. Understanding these criteria opens doors to potential support, improving financial stability for those in need.

Impact on Family Finances

When it comes to enhancing household budgets, various financial perks can play a significant role. These incentives are designed to ease expenses and offer a bit of relief to parents managing the day-to-day costs of raising little ones. Understanding how such benefits influence overall financial stability is crucial for families seeking to navigate their economic landscape more effectively.

Receiving occasional monetary boosts allows families to allocate funds toward essential needs or savings. This adjustment creates a buffer against unplanned expenditures, making it easier for parents to cover essentials like groceries, healthcare, and education. In many cases, these financial assistance programs can lead to a decrease in stress, contributing to improved well-being for both guardians and their loved ones.

Moreover, with added resources, families may find themselves in a position to invest in opportunities that promote growth and development. Whether it’s engaging in educational activities or saving for future endeavors, having that extra financial room can facilitate planning for a brighter tomorrow. Overall, benefits related to dependent support play an integral role in shaping a more secure financial future.