Evaluating the Investment Potential of Symbotic as a Stock Purchase Opportunity

In today’s rapidly evolving financial landscape, making informed decisions about potential investments can be quite a challenge. Numerous options continually emerge, each promising different levels of growth and risk. With so many choices, how do you discern which ones are truly worthwhile? This section aims to shed light on evaluating the attraction of a particular entity in the market.

Understanding the fundamentals behind a company’s performance is crucial. This includes analyzing its technological advancements, market position, and broader industry trends. By diving deep into these aspects, investors can form a clearer picture of whether this entity aligns with their financial goals and risk appetite. Knowledge is power, and arming oneself with the right information can pave the way for strategic investment decisions.

Furthermore, stakeholder sentiments and external factors play a significant role in shaping market dynamics. Keeping an ear to the ground and staying updated with news related to the company can provide essential insights. As we navigate through this discussion, let’s explore the various elements that can influence one’s decision-making process regarding this particular investment opportunity.

Evaluating Financial Performance

When it comes to assessing the financial health of any enterprise, there are numerous factors to consider. Understanding how a company performs financially can give insights into its stability, growth potential, and overall market positioning. A thorough analysis often involves examining key financial metrics, trends, and ratios that help paint a clearer picture of the organization’s economic status.

First off, revenue growth is a critical indicator. Consistent increases in sales figures over time can signal strong demand for a company’s offerings and an ability to capture market share. It’s also essential to look into profit margins. High or improving margins often highlight operational efficiency and effective cost management, which are pivotal for long-term sustainability.

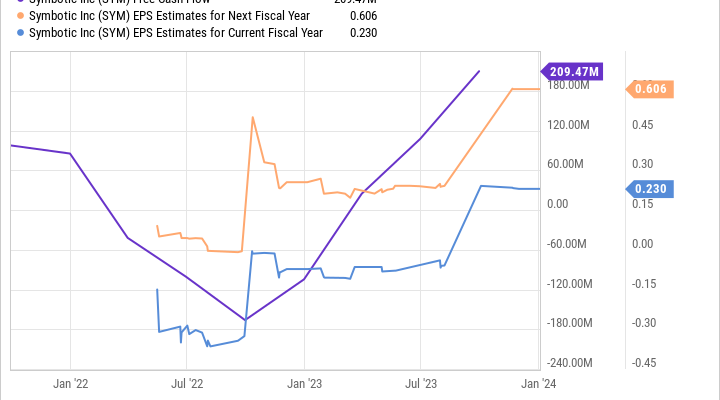

Additionally, exploring cash flow statements can reveal how well a company generates cash to meet its obligations. Positive cash flow is crucial since it affects the ability to reinvest in the business, pay dividends, or handle unforeseen challenges. Debt levels also warrant attention. A manageable debt load can indicate a healthy balance sheet, while excessive liabilities may pose risks in economic downturns.

Moreover, comparing these financial metrics against industry benchmarks can provide context regarding performance. A company might excel in certain areas yet fall short in others when assessed alongside peers. Hence, recognizing where it stands within its sector can offer valuable insights for potential investors.

Ultimately, evaluating all these elements helps create a holistic view of an organization’s financial performance. This understanding not only aids individuals in making informed decisions but also sheds light on the company’s strategic positioning and future prospects.

Market Trends Impacting Symbotic’s Future

As technology continues to evolve, the landscape of automation and logistics is changing rapidly. Companies are increasingly seeking innovative solutions to enhance efficiency and reduce operational costs. These shifts in consumer behavior and industry demands play a crucial role in shaping the trajectory of emerging players in the market.

One significant trend is the growing emphasis on supply chain optimization. With disruptions affecting global logistics, businesses are prioritizing investments in systems that can streamline their processes. Organizations are turning to automation tools that offer flexibility and responsiveness, positioning them for better resilience in fluctuating markets.

Another aspect to consider is the rising interest in artificial intelligence and machine learning applications. The integration of these technologies into warehouse management systems is not just a passing fad; it’s becoming a vital component for those looking to maintain a competitive edge. As data becomes more accessible, the potential for predictive analytics to guide inventory decisions is increasing dramatically.

Furthermore, sustainability initiatives are influencing modern business approaches. Companies that adopt greener practices and reduce their carbon footprint are likely to resonate with environmentally-conscious consumers. This shift to sustainable operations often includes the incorporation of cutting-edge technologies to minimize waste and optimize energy usage.

In summary, while evaluating the prospects for specific entities within this sector, it’s essential to consider how macroeconomic forces, technological advancements, and changing consumer preferences will collectively shape future opportunities and challenges. Keeping an eye on these trends will provide valuable insights for anyone interested in navigating the evolving marketplace.

Analyst Opinions on Symbotic Stock

This section delves into the insights and evaluations provided by experts regarding the potential of this emerging technology enterprise. With the continuous evolution of the market, analysts have been closely observing various metrics and trends, contributing to a broader understanding of the company’s positioning and future prospects.

Many market observers express a cautious optimism about the innovative capabilities and operational efficiencies demonstrated by the firm. They highlight how recent advancements set them apart from competitors, suggesting that this could lead to a stronger foothold in the industry. Evaluators often cite positive indicators in financial performance and growth strategies as reasons for their favorable outlook.

However, not all opinions are unanimously positive. Some experts recommend a careful approach, pointing to potential risks associated with an ever-changing technological landscape. These critics urge prospective investors to consider market volatility and the competitive environment before making decisions. Ultimately, the diverse array of perspectives underscores the complexity of evaluating this particular entity in the current economic climate.