Exploring the Role of Student Loans in the Landscape of Financial Aid for Education

When we talk about support for learners pursuing higher knowledge, it’s essential to explore the different forms it can take. Many individuals rely on various resources to finance their educational journeys, and not all of these resources come without strings attached. Some options can ease the burden, while others might create a long-term financial commitment that requires careful consideration.

Understanding the nuances of educational support allows us to grasp how different mechanisms can either enhance or complicate one’s pathway to professional success. While some forms of support are designed to be gifts or grants, others involve a more complex repayment structure that raises questions about their true nature and impact.

As we delve into this topic, it’s crucial to analyze whether the assistance provided truly offers relief or if it comes with obligations that may overshadow its initial benefits. How do we categorize these resources, and what do they mean for individuals seeking to advance their knowledge without overwhelming financial strain? Let’s unpack this concept together.

Understanding Borrowing in Higher Education

When it comes to funding education beyond high school, many individuals find themselves exploring various options to cover the costs. The concept of borrowing money to facilitate learning is quite common and can seem a bit overwhelming at first. It’s essential to grasp what this entails, how it works, and what implications it has for the future.

In essence, this form of borrowing is a way to gain access to the resources needed for tuition, housing, and other expenses associated with academic pursuits. Different avenues offer varying terms, amounts, and conditions, which can make a significant difference in one’s financial situation later on.

The process can feel like navigating a maze, but it’s important to understand that not all borrowing options are created equal. Some are more beneficial than others, and recognizing the distinctions can lead to more informed decisions. The key is to evaluate the responsibility that comes with taking on debt and to plan for successful repayment.

In the end, embarking on this journey can open doors to opportunities that may not have been accessible otherwise. However, it’s crucial to engage with this system knowledgeably, ensuring that the benefits outweigh the potential drawbacks.

Types of Financial Support for Students

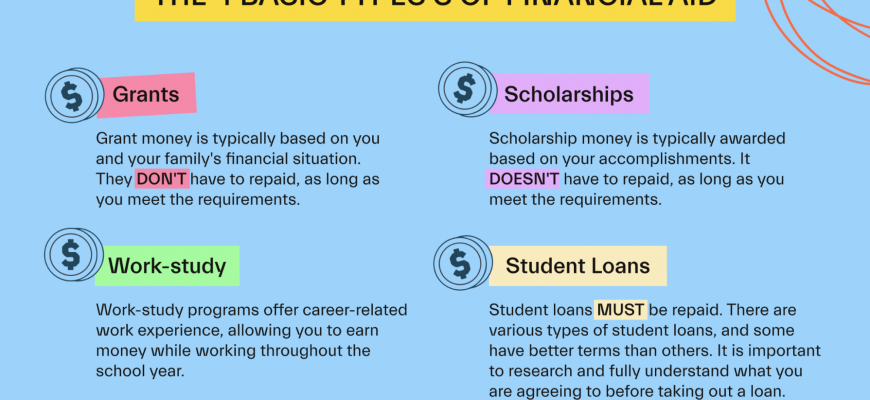

When it comes to pursuing higher education, there are various forms of assistance that can help alleviate the burden of costs. Understanding the different avenues available can make a significant difference in managing expenses and achieving academic goals.

- Scholarships: These are grants that don’t require repayment, awarded based on merit, need, or special talents.

- Grants: Typically need-based, these funds also don’t need to be repaid and can come from government or private organizations.

- Work-Study Programs: These offer part-time job opportunities to help cover costs while gaining valuable experience.

- Tuition Waivers: Certain institutions or states may offer these to cover all or part of the tuition for eligible individuals.

Exploring these options can empower individuals to find the best mix of support tailored to their unique situations. Combining different types can lead to a more manageable financial outlook throughout their educational journey.

- Research eligibility criteria for different support options.

- Compile a list of potential sources and their deadlines.

- Prepare necessary documentation to apply effectively.

Ultimately, approaching the process with a proactive mindset can unlock many opportunities to lessen the financial impact of higher education.

Impact of Borrowing on Future Economic Wellness

When individuals take on debt to finance their education or other aspirations, they are often faced with significant repercussions in their financial journeys. This decision can shape their economic stability for years to come, affecting everything from career choices to lifestyle. Understanding these effects is crucial for anyone contemplating how much to finance their future.

The burden of repayment can create a domino effect, influencing not only cash flow but also the ability to save for major milestones. As repayments start to kick in, many find themselves reallocating funds that could have gone towards homeownership, investments, or even retirement savings. This, in turn, can delay life events that often hinge on having a secure financial base.

Moreover, the psychological impacts of managing debt cannot be overlooked. Individuals may experience stress or anxiety, which can affect their decision-making abilities in both personal and professional contexts. As they navigate these challenges, the long-term trajectory of their finances can be influenced by how they balance repayment with everyday expenses.

Ultimately, it’s essential to approach borrowing with a thoughtful eye. By carefully considering the potential outcomes, individuals can better prepare for their futures and make informed choices that align with their personal and economic goals.