Understanding the Student Aid Index and Its Impact on Financial Support for Education

In today’s world, navigating the landscape of financial assistance for education can feel overwhelming. With various tools and mechanisms designed to evaluate and distribute resources, it’s crucial to comprehend how these systems work and their implications for individuals seeking funding. This article will break down a specific metric that plays a key role in this process, shedding light on its importance and functionality.

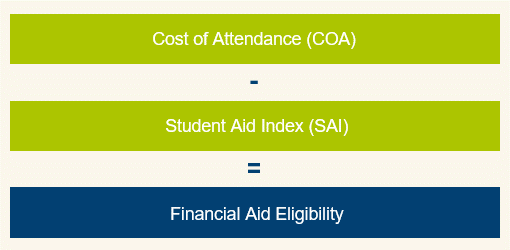

The concept at hand is essentially a numerical representation that seeks to gauge the ability of individuals to contribute to their educational expenses. It’s designed to streamline the allocation of resources, determining who qualifies for support and to what extent. By analyzing financial backgrounds and other pertinent factors, this measurement serves as a cornerstone of support systems, influencing decisions for many aspiring learners.

As we dive deeper into this topic, you’ll discover how this pivotal calculation not only influences funding opportunities but also reflects broader economic trends and personal circumstances. Understanding this metric is essential for prospective applicants aiming to make informed choices about their financial futures.

Understanding the Student Aid Index

Grasping the concept of financial support metrics can be key to navigating the world of higher education financing. These metrics play a crucial role in determining how much assistance individuals may qualify for, helping to bridge the gap between tuition costs and personal resources.

Let’s dive into the essentials of these financial evaluations:

- Purpose: These metrics are designed to assess an applicant’s ability to contribute to educational expenses, influencing the level of financial help one can receive.

- Calculation: Factors such as family income, assets, household size, and number of dependents are evaluated to arrive at a figure that reflects financial capability.

- Impact: A comprehensive understanding of these factors can empower individuals to make informed decisions regarding funding options.

Moreover, knowing how these metrics function can help in planning for future educational goals:

- Application Process: Understanding the documentation required can streamline the submission process for grants and loans.

- Maximizing Opportunities: Familiarity with available funding sources allows individuals to strategically seek relevant financial resources.

- Long-term Planning: Awareness of how these evaluations affect future financial situations can guide educational and career choices.

By grasping how these financial resources assessments operate, one can effectively navigate the complex landscape of funding opportunities and make educated choices for educational pursuits.

How the Financial Support Metric Affects Learners

Understanding how financial assistance evaluations influence individuals pursuing education is crucial. These assessments shape the amount of support one can receive, ultimately guiding choices about institutions and managing expenses related to studies.

Determining Eligibility: The financial evaluation plays a vital role in determining access to funding. A higher score may open doors to various scholarships and grants, while a lower score could lead to reduced options. This process can significantly impact the overall experience of individuals as they embark on their academic journeys.

Impact on Choices: The outcome of the financial evaluation influences decisions regarding schools. Individuals with favorable evaluations might choose prestigious institutions, while those with challenging circumstances may need to consider more affordable alternatives. This can affect not only academic life but also long-term career prospects.

Managing Finances: Those seeking opportunities must navigate their finances wisely. A clear understanding of their financial evaluation helps in budgeting effectively, avoiding potential debt, and making informed choices about loans. This knowledge empowers them to plan their future responsibly.

Emotional Implications: The stress of financial evaluations can weigh heavily on individuals. Anxiety around securing enough resources to meet educational goals is common. Awareness of available support can alleviate some of this pressure, making the journey of learning more enjoyable and fulfilling.

In conclusion, the financial support metric has a profound impact on learners, shaping their opportunities, choices, and overall experiences in the world of education.

Application Process for Financial Assistance

When you’re looking to secure funding for your education, the application journey is a crucial step. It might seem overwhelming at first, but understanding what to expect can make a significant difference. The process involves a series of steps that help determine eligibility and potential support you can receive to ease the financial burden of your studies.

To begin, the first thing you need to do is gather necessary documents. This usually includes information about your family’s income, your academic achievements, and any other relevant financial information. Being organized will help you move through the steps smoothly.

Next, you’ll need to fill out specific forms that provide details about your financial situation. One of the most common forms is a comprehensive application that collects all pertinent data. Make sure to check for any deadlines, as submitting late could mean missing out on available opportunities.

Once you have submitted your application, it may take some time for the reviewing bodies to evaluate your situation and determine what options are available to you. During this waiting period, it’s a good idea to explore various alternatives or additional sources of funding, as there may be scholarships or grants suited to your profile.

Finally, once decisions are made, you’ll receive notifications regarding the assistance you qualify for. Take the time to carefully review the offers and understand your commitments. With careful planning and awareness, you can navigate this process successfully and secure the necessary resources to pursue your educational goals.