Evaluating the Potential of Sony Stock as a Smart Investment Choice

When considering where to allocate your resources, it’s essential to dive deep into the performance and prospects of major players in the tech industry. With a rich history of innovation and a diverse portfolio, one prominent company piques the interest of both seasoned investors and newcomers alike. Exploring its current standing in the market can provide valuable insights into whether it’s a wise choice for your investment strategy.

The company’s accomplishments in gaming, entertainment, and electronics prompt many to question its potential for future growth. By examining recent financial data, competitive advantages, and industry trends, stakeholders can make informed decisions about the suitability of this entity for their portfolios. Evaluating risk versus reward is key, as well as understanding how external factors like market conditions and consumer demand may influence its trajectory.

Ultimately, delving into this analysis equips individuals with the knowledge needed to determine if now is the right moment to consider involvement with this influential corporation. The journey of assessment involves not only looking at historical performance but also projecting future possibilities based on expert analyses and forecasts.

Analyzing Financial Performance

When it comes to evaluating a company’s monetary health, we have to take a closer look at various metrics that reveal how well it is performing in the market. A thorough examination of recent earnings reports, revenue growth, and overall profitability can provide valuable insights for interested investors. Understanding these elements can help gauge the strength and sustainability of operations.

Revenue Trends play a vital role in deciphering a company’s trajectory. Consistent growth in sales figures often indicates a robust demand for products and services, which is essential for long-term viability. Observing fluctuations can also signal market changes or shifts in consumer preferences that need to be addressed.

Profit Margins act as another critical indicator of financial health. High margins suggest effective cost control and a strong pricing strategy, allowing a company to thrive even in competitive environments. Conversely, narrowing margins may raise concerns about efficiency and market positioning.

Furthermore, examining debt levels is crucial. A manageable debt-to-equity ratio can reflect a solid capital structure, while excessive leverage could pose risks. Investors should look for a balance that allows for growth opportunities without compromising financial stability.

Lastly, analyzing cash flow statements is essential for understanding liquidity. Healthy cash flow ensures that a business can meet its obligations and invest in future projects. Positive free cash flow is often a sign of a company that can sustain its operations and reward shareholders.

In summary, diving deep into the financials provides a clearer picture of the company’s current standing and potential for future growth. Prospective stakeholders should keep these aspects in mind when assessing whether to proceed with involvement.

Market Trends Influencing Sony’s Value

When examining the financial landscape of a renowned electronic manufacturer, it’s crucial to consider the numerous factors that can sway its market valuation. Various trends shape its performance, influencing investor sentiment and future prospects.

- Technological Advancements: The rapid evolution of technology plays a significant role. Innovations in gaming, entertainment, and electronics can enhance the company’s market appeal. Staying ahead in VR and AI integration could redefine user experiences.

- Consumer Preferences: Shifting demands from users can unpredictably impact profitability. As preferences lean towards streaming services and mobile gaming, companies must adapt promptly to seize emerging opportunities.

- Global Economic Conditions: Economic fluctuations often dictate spending habits. Economic downturns might lead to more cautious consumer behavior, while growth periods can boost sales.

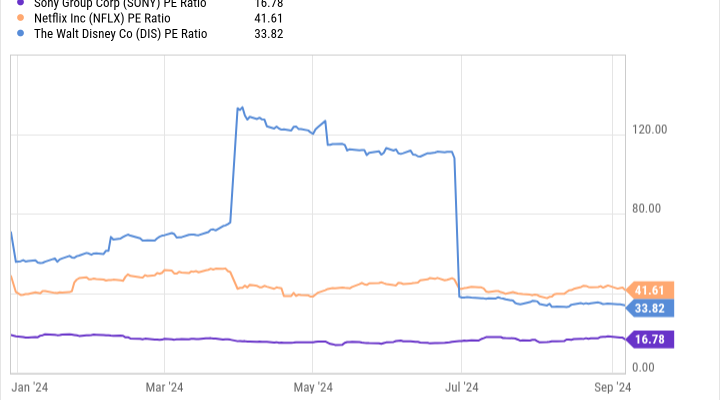

- Competitive Landscape: Rival firms continuously vie for market share. Analyzing competitors is vital to understanding one’s position and potential areas for growth.

- Regulatory Changes: Government policies and regulations can affect operational strategies. Compliance can either open new markets or limit potential revenue streams.

Overall, the convergence of these elements creates a dynamic environment, influencing perceptions of the company’s financial health and prospects. Staying informed about these trends is essential for making sound investment decisions.

Investment Risks and Opportunities with Sony

When considering the potential for financial growth in a tech-driven enterprise, it’s crucial to weigh both the challenges and prospects that come into play. Each corporation presents its unique landscape, filled with both hazards and avenues for prosperity. In the case of this well-known multinational, understanding what lies ahead can be pivotal for investors looking to navigate the complexities of the market.

Opportunities abound in sectors like gaming, entertainment, and electronics, which this firm has heavily invested in. The burgeoning demand for immersive experiences in gaming and streaming services can lead to increased revenue streams. Moreover, innovations in technology often translate into significant competitive advantages, positioning the company favorably against its rivals. If execution is solid, these areas could provide remarkable returns.

However, along with these possibilities, certain risks are inherently tied to the industry. Market volatility, changing consumer preferences, and global economic shifts can impact profitability. Additionally, reliance on a few key markets or products may create vulnerabilities. Investors must stay informed about regulatory changes and competitive dynamics that could affect future performance.

In summary, while there are enticing prospects for growth, it is essential to remain vigilant about the potential pitfalls. A well-informed strategy that considers both sides of the equation may pave the way for successful investment in this notable entity.