Evaluating the Investment Potential of Shopify as a Stock Purchase Opportunity

When it comes to investing in the ever-changing world of e-commerce solutions, many entrepreneurs and investors find themselves pondering a crucial question. They want to know if putting their resources into a certain platform is a smart move for the future. With the rise of online retail and the increasing number of businesses looking to establish their digital presence, this inquiry has become especially pressing.

Understanding the performance and prospects of a particular company can be a daunting task. There are several factors to consider, such as market trends, financial health, and competition. Investors often weigh these elements to determine whether it’s worth taking the plunge or waiting for a more opportune moment.

In this discussion, we will delve into the various aspects that can influence your decision regarding investment in a prominent player in the digital commerce sector. By examining recent developments and future possibilities, we aim to provide clarity on whether this venture aligns with your financial goals and risk tolerance.

Analyzing Market Performance

Diving into the financial landscape of a prominent e-commerce platform reveals interesting insights about its growth trajectory and overall market presence. Understanding how this company has performed in recent years is essential for any investor considering a potential investment opportunity. By examining key performance indicators and industry trends, we can gain a clearer picture of whether this firm stands out in a competitive environment.

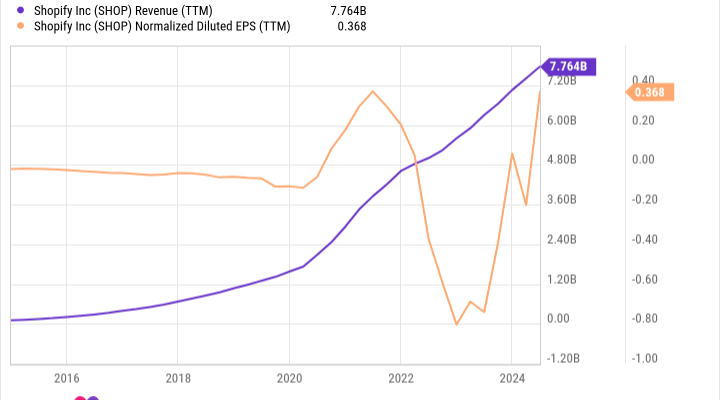

Over the past few quarters, the financial metrics have shown significant fluctuations, reflecting both challenges and opportunities in the digital marketplace. With an increasing number of merchants turning to online solutions, revenue growth seems promising. Evaluating annual reports and quarterly earnings helps to illuminate patterns in sales and profitability, indicating how well it adapts to market demands and consumer preferences.

Moreover, market sentiment plays a crucial role in shaping perceptions about future potential. Analysts’ projections, combined with consumer feedback, can significantly impact the valuation of this enterprise. Understanding the external factors, such as economic conditions and the competitive landscape, is vital for grasping the broader implications of its market strategy.

In addition to revenue streams, examining the expansion efforts into new markets provides further context. Strategic partnerships and innovative service offerings have positioned the company to capture a larger share of the e-commerce pie. Keeping an eye on these developments can offer clues about sustainability and long-term growth potential.

In summary, evaluating the performance of this e-commerce player involves a multifaceted approach, analyzing both its financial health and market positioning. This will help shed light on whether it remains an appealing prospect for those looking to diversify their investments in the tech-focused landscape.

Key Factors Influencing Shopify’s Valuation

When considering the investment landscape, there are several crucial elements that play a significant role in determining the worth of a technology-driven platform. Understanding these factors can provide valuable insights for those looking to assess potential opportunities in the market.

1. Revenue Growth: The pace at which a company is increasing its income can significantly affect its perceived value. Investors tend to favor businesses that show robust sales figures and potential for continuous growth, especially in the e-commerce sector.

2. User Base Expansion: A growing number of active users is a clear indicator of a platform’s popularity and effectiveness. When more entrepreneurs choose to utilize the services, it often correlates with increased revenue streams and improved market position.

3. Market Competition: The competitive landscape has an undeniable impact on valuation. Understanding how a platform stacks up against its rivals helps investors gauge its sustainability and future prospects in an ever-evolving industry.

4. Technological Advancements: Innovations and improvements in technological offerings can serve as a catalyst for growth. Platforms that continuously enhance user experience through new features or integrations often attract more customers and retain existing ones.

5. Economic Conditions: Broader economic indicators, such as consumer spending and confidence, also play a significant role. Economic downturns can affect e-commerce sales, while booming economies can spur growth and innovation.

By analyzing these key elements, investors can form a more informed perspective regarding the valuation of a leading player in the digital commerce arena. Recognizing how these factors interact provides a clearer picture of the potential risks and rewards involved.

Long-Term Growth Potential of Shopify

When considering the prospects of any leading e-commerce platform, it’s crucial to analyze what drives its expansion and sustainability in the market. This particular enterprise has established itself as a prominent player, continually adapting to shifts in consumer behavior and technological advancement. Such characteristics can often indicate a promising outlook for investors looking for longevity.

One of the primary factors contributing to growth lies in the increasing shift toward online shopping. As more businesses move to digital storefronts, the demand for effective solutions to manage that transition surges. This company has positioned itself uniquely to capture a significant share of this expanding market, providing tools that empower merchants to thrive in a competitive landscape.

Furthermore, the commitment to innovation cannot be overlooked. By constantly enhancing its offerings – whether through improved user experiences or advanced features – the company keeps pace with evolving market needs. Maintaining relevance in such a dynamic industry is essential for anyone considering the long-term trajectory of this venture.

Additionally, strategic partnerships and acquisitions play a vital role in bolstering future prospects. Collaborations with other tech and retail entities can open new avenues for growth and enhance operational capabilities. These efforts signal robust management and an understanding of the intricate market trends that shape consumer preferences.

Lastly, the potential for global expansion presents another layer of opportunity. Emerging markets present untapped possibilities for growth, and targeting these areas could substantially elevate the overall reach. With the right strategies in place, leveraging international demand can significantly impact long-term valuations.