Understanding Whether Retained Earnings Are Classified as Debits or Credits in Accounting

When we dive into the world of corporate finance, one term often pops up: the concept of profits that a company retains for future use. These funds play a crucial role in a business’s growth, allowing for reinvestment, expansion, and stability. But have you ever wondered about how these funds are categorized in accounting? Let’s explore the implications of this classification and clarify whether this accumulation is seen as an asset or liability in financial statements.

In essence, the way these funds are recorded can influence not just the company’s balance sheet but also its perceived financial health. Understanding this categorization can reveal a lot about a business’s operational strategy and its approach to growth and sustainability. To grasp this concept fully, it’s important to understand the underlying principles that dictate how businesses manage their financial resources.

So, as we unravel this topic, we’ll take a closer look at the classification of these retained resources. What does it mean for businesses, and how does it impact their financial reporting? Let’s find out more and decode this intriguing area of financial management.

Understanding Retained Earnings in Accounting

In the realm of finance, there exists a particular concept that plays a crucial role in assessing a company’s profitability and growth potential. This financial figure reflects the profits that a business has chosen to reinvest rather than distribute to its shareholders. It serves as an essential indicator of a company’s ability to generate wealth over time.

When you delve into financial reports, you’ll notice that this concept is categorized within the equity section. It represents the cumulative profits over the years after accounting for distributions made to shareholders. Think of it as a pool of resources available for future projects, expansions, or any other strategic initiatives the company might pursue.

Understanding how this figure operates can provide valuable insights into a firm’s operational strategies and long-term goals. A growing amount suggests that the management is opting to plow back profits into the business, which can lead to enhanced value in the long run. However, a decreasing balance might raise questions about a company’s financial health and decision-making processes.

Moreover, this concept also interacts with various accounting principles, influencing both the balance sheet and income statement. Grasping its significance is vital for investors, analysts, and anyone interested in the financial landscape of a business. After all, it’s not just about how much a company makes, but also about how it chooses to utilize those funds for future endeavors.

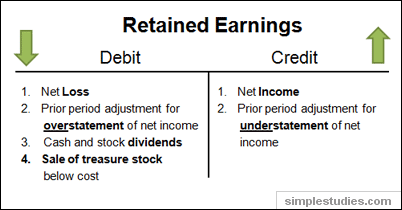

Role of Debits and Credits Explained

Understanding the mechanics behind financial transactions is essential for comprehending how businesses operate. Two fundamental components of accounting play a vital role in this process. These elements help create a clear picture of a company’s financial situation, ensuring that every transaction is properly recorded and balanced. By grasping how these components function, one can gain deeper insights into the world of finance.

At the core of this system is a framework that categorizes transactions into two distinct types. One type represents an increase in resources or assets, while the other signifies a decrease. This dual nature ensures that there is always a corresponding entry, which maintains balance within the accounting records. Every time an action occurs, it results in a transformation in the financial statements, allowing stakeholders to understand the impact on the overall health of the entity.

The significance of these components extends beyond mere record-keeping; they provide a structured way to analyze and interpret a company’s performance. For instance, when resources are gained or liabilities incurred, the effects ripple through the financial statements. Thus, mastering this pairing is not just for accountants. It empowers business owners and managers to make informed decisions based on accurate financial data.

In summary, these essential components are the backbone of accounting practices, enabling clear visibility into a company’s transactions. Whether you’re tracking growth, evaluating financial health, or planning future strategies, understanding this fundamental relationship is crucial for anyone involved in the financial realm.

Impact of Retained Earnings on Company Value

When a business decides to hold onto a portion of its profits instead of distributing them to shareholders, it can have significant implications for the overall worth of the organization. This decision to reinvest funds often influences various aspects of the company’s financial health and growth potential.

Let’s explore how this practice can enhance the valuation of a firm:

- Funding for Growth: By keeping profits within the company, it provides a crucial source of capital for expansion. This could involve launching new products, entering new markets, or upgrading technology.

- Financial Stability: Retaining profits can improve financial resilience, allowing companies to weather economic downturns without needing to rely heavily on external financing.

- Signal to Investors: A company that consistently retains profits may be viewed positively by investors, as it indicates confidence in future earnings and a commitment to long-term value rather than short-term payouts.

- Enhanced Creditworthiness: Strong reserves boost a company’s credit profile, which can lead to more favorable borrowing terms and lower interest expenses when seeking loans.

Overall, the strategy of keeping profits rather than distributing them can create a foundation for sustainable growth and a solid financial framework, ultimately enhancing a business’s valuation in the eyes of stakeholders.