Exploring the Investment Potential of QQQ Stocks and Their Suitability for Your Portfolio

In today’s dynamic financial landscape, many individuals find themselves asking whether it’s wise to invest in particular instruments that have gained traction among investors. With an ever-evolving marketplace, it’s essential to weigh the potential benefits and pitfalls before making any commitments. This section delves into the nuances of a popular vehicle, exploring its trends and performance metrics to determine if it’s aligned with your investment goals.

Understanding the Appeal of such an opportunity often requires a closer examination of its underlying components. Investors are drawn to certain properties due to their historical achievements, market positioning, or expected growth trajectories. By taking a deeper look at these factors, one can better ascertain whether this vehicle aligns with personal investment strategies and risk tolerance.

Moreover, considering the market environment is crucial. Economic conditions, technological advancements, and shifting consumer preferences all play significant roles in shaping the prospect of any financial asset. Analyzing these elements provides context to the decision-making process, enabling prospective investors to make informed choices based on a blend of data and personal judgment.

Analyzing QQQ’s Market Performance

When it comes to evaluating the performance of a particular investment vehicle, a closer look at its trends, movements, and market reactions offers valuable insights. Understanding how it has fared in various economic conditions can illuminate its potential future trajectory. This section will delve into the recent price fluctuations, overall returns, and external factors influencing its standing in the market.

One of the key aspects to consider is how this investment instrument has reacted to significant market events, such as interest rate changes or economic downturns. By examining past data, we can gauge resilience and responsiveness to such stimuli. Particularly, a strong historical performance during volatile periods can hint at a robust underlying framework.

Additionally, tracking its performance against other indices provides a context that is crucial for making informed decisions. Comparative analysis can reveal whether it outpaces its competitors and how its risk-return profile stands relative to broader market trends. Investors often look for such indicators to determine overall attractiveness.

Lastly, understanding the sectors that predominantly influence its movements can also reveal much about its future prospects. Technological advancements and shifts in consumer behavior are pivotal elements that can create opportunities for growth or present challenges. By keeping an eye on these factors, one can form a more comprehensive picture of what lies ahead.

Factors Influencing Investment Appeal

When considering whether to add a particular asset to your portfolio, several key elements come into play. Understanding these factors can help you gauge the overall attractiveness of the opportunity and make a more informed decision. From the performance of the underlying companies to broader market trends, each aspect plays a vital role in shaping perception.

Market Trends: The direction of the financial landscape significantly impacts sentiment. A rising market often boosts confidence in growth-oriented investments, while downturns can create hesitation. Keeping an eye on economic indicators and trends is essential.

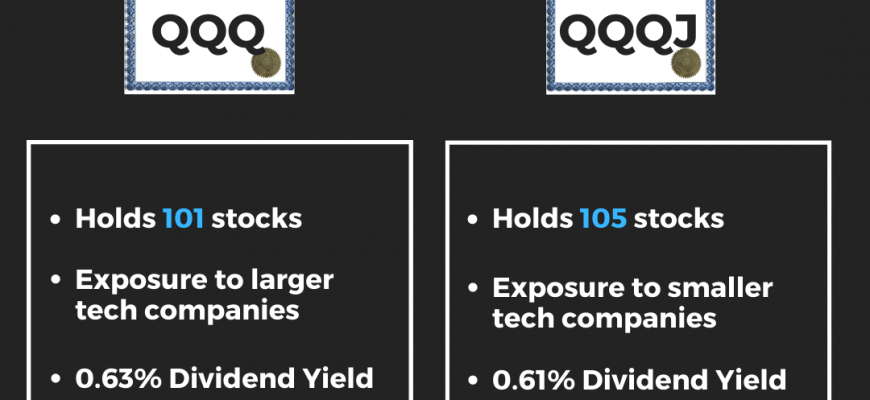

Technology Sector Insights: The underlying companies in this opportunity primarily belong to the technology sector. Their growth potential, driven by innovation and consumer demand, can spell great promise. Analyzing advancements, market share, and competitive positioning can provide valuable insights.

Global Economic Conditions: Events happening on the world stage, such as geopolitical tensions or changes in monetary policy, can influence the attractiveness of an investment. Economic stability tends to enhance appeal, whereas instability might create caution.

Investor Sentiment: How investors feel about a particular segment can lead to shifts in demand. Positive sentiment can drive prices upward, while negativity might lead to declines. Monitoring social media trends, news articles, and investor polls can offer a glimpse into prevailing attitudes.

In summary, taking into account these diverse influencing factors can greatly assist investors in forming a well-rounded view of potential opportunities, ensuring that decisions are made on a foundation of thorough analysis.

Alternative Investment Options to Consider

If you’re exploring ways to diversify your financial portfolio, you might want to look beyond the usual avenues. There are a variety of alternatives that can potentially enhance your investment strategy, offering unique benefits and opportunities. Whether you’re interested in tangible assets or emerging markets, numerous options can align with your personal financial goals.

Real estate is an avenue many investors find appealing. Unlike traditional investments, property can provide both passive income through rents and long-term appreciation in value. Additionally, the tangible nature of real estate can offer a sense of security that is often missing from more abstract investments.

Another intriguing option is peer-to-peer lending. This method connects borrowers with lenders directly, often resulting in better rates than traditional banking systems. As an investor, you can earn attractive returns by financing personal or small business loans, contributing to economic growth in the process.

Cryptocurrencies have also garnered significant attention. While they can be volatile, the potential for high returns and the opportunity to be part of an innovative financial movement are appealing to many. Just ensure to do thorough research before diving in, as the market can be unpredictable.

Art and collectibles present a different alternative. Investing in artwork, vintage cars, or rare coins can provide not just financial returns, but also aesthetic enjoyment. Values can fluctuate, but the right pieces can appreciate significantly over time.

Lastly, consider exploring commodity investments, like gold or silver. These materials often serve as a hedge against inflation, offering stability when traditional markets are uncertain. They can act as a buffer, helping to preserve your wealth during economic downturns.

In summary, while conventional equities are a popular choice, numerous alternatives exist that can diversify your investment portfolio. Each option carries its own risks and rewards, so it’s essential to assess your personal situation and conduct thorough research before proceeding.