Exploring the Investment Potential of Plug as a Stock Choice

As the market evolves, many investors are constantly on the lookout for promising opportunities. With the rise of innovative companies, the question arises: which ones stand out as worthy of attention? Thorough analysis and informed decision-making play crucial roles in navigating these waters.

In this discussion, we’ll dive into a particular player within the renewable energy sector. This company has garnered significant interest due to its cutting-edge technology and ambitious vision for a sustainable future. Understanding the driving factors behind its performance will be key in assessing its potential for growth.

We’ll explore the company’s financial health, market trends, and competitive landscape, allowing you to form a well-rounded perspective. By examining essential indicators and recent developments, you can determine whether this investment aligns with your financial goals and risk appetite.

Overview of Plug Power’s Market Position

In the rapidly evolving energy sector, the company has carved out a significant niche. With a focus on alternative energy solutions, it has garnered considerable attention for its innovative approaches to fuel cell technology and hydrogen production. This position allows it to tap into emerging markets and cater to the growing demand for sustainable energy sources.

Competitive Landscape: The environment is dynamic, with several players vying for dominance. However, this company stands out due to its strategic partnerships and commitment to research and development. Such alliances have not only strengthened its portfolio but also enhanced its credibility within the industry. As more entities shift towards environmentally friendly practices, its relevance continues to rise.

Market Opportunities: The transition to renewables presents numerous opportunities. Increased governmental support and a societal shift towards sustainability have opened new avenues for growth. This trend positions the enterprise favorably to attract investments and expand operations, further solidifying its stance as a leader in the eco-friendly energy market.

Challenges Ahead: Despite its strong position, the path is not without obstacles. Regulatory hurdles and competition from established companies can pose risks. However, with a proactive approach and a commitment to innovation, there is potential to navigate these challenges effectively and continue to flourish.

Overall, this company’s unique position allows it to be at the forefront of the green energy revolution, making it a noteworthy player in the industry landscape.

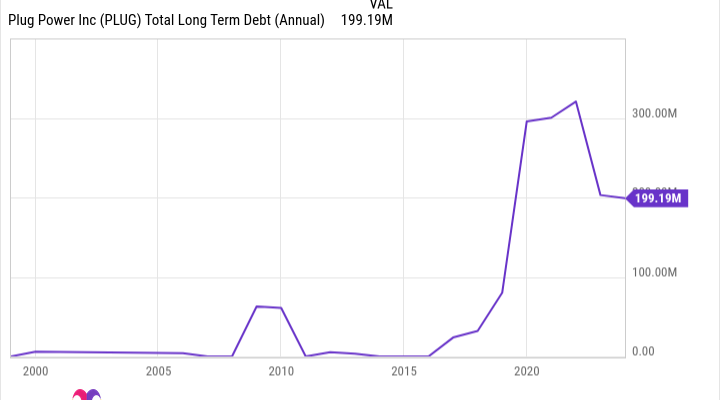

Financial Performance and Recent Trends

When considering an investment opportunity, it’s essential to examine the company’s financial health and current market dynamics. This analysis provides valuable insights into how the company has performed over time and what trends might influence its future trajectory. Investors often look for indicators of stability, growth potential, and the ability to navigate changing economic conditions.

In recent quarters, the organization has shown promising growth in revenue, driven by increasing demand in the renewable energy sector. Year-over-year comparisons illustrate a significant uptick in sales, with a corresponding reduction in operational costs, indicating improved efficiency. This positive trajectory is bolstered by strategic partnerships and an expanded customer base, allowing for enhanced market penetration.

However, it’s crucial to also consider the challenges that lie ahead. The fluctuating costs of raw materials and regulatory developments could impact future margins. Investors should keep an eye on earnings reports and market reactions to these factors, as they often serve as barometers for overall financial wellness. Staying informed about these developments enables better decision-making in the ever-evolving landscape of investments.

Future Outlook and Growth Potential

When considering the long-term trajectory of a company, it’s crucial to explore the evolving landscape and opportunities that lie ahead. The energy sector is undergoing significant transformations, driven by advancements in technology and an increasing focus on sustainability. This shift opens the door for innovative solutions aimed at reducing carbon footprints and enhancing energy efficiency.

Looking ahead, the demand for clean energy alternatives is expected to rise substantially. Governments worldwide are implementing policies and incentives that encourage the transition to renewable sources. This environment creates fertile ground for firms focusing on sustainable energy infrastructure, allowing them to tap into new markets and expand their reach. The potential for strategic partnerships and collaborations with other entities is also promising, as companies seek to leverage collective expertise to accelerate growth.

Moreover, technological advancements are likely to play a pivotal role in shaping the future. Innovations in energy storage and distribution systems could significantly enhance operational efficiency and lower costs. As these technologies mature, they position entities to capitalize on emerging trends and shifting consumer preferences toward greener solutions.

Overall, the combination of a supportive regulatory framework, growing consumer awareness, and ongoing technological progress suggests a bright future for companies operating in this realm. As the market evolves, those well-prepared to adapt and innovate will likely find themselves at the forefront of this dynamic industry.