Exploring the Potential of Oracle as a Promising Investment Opportunity

When considering the landscape of technology enterprises, one might often wonder how to navigate the complexities of investment opportunities. With the rapid pace of innovation and changes in market dynamics, discerning whether a particular company holds promise for future gains requires a thorough analysis.

Investors frequently seek out firms that demonstrate resilience, adaptability, and growth potential. It’s crucial to dive deeper into financial metrics, market influences, and overall industry trends to gauge whether a certain entity is worth the attention. Making informed choices hinges on understanding both the company’s fundamentals and the broader economic context.

In this exploration, we’ll assess key indicators that highlight whether this tech giant is in a favorable position for prospective investors. Factors such as revenue growth, competitive advantages, and market presence play pivotal roles in shaping the narrative surrounding potential financial engagements.

Current Performance of Oracle Stock

Let’s take a closer look at how this tech giant is performing in the ever-changing financial landscape. Analyzing the recent trends and figures can provide us with valuable insights into the company’s health and stability. With fluctuations in its valuation and market sentiment, it’s crucial to understand what’s happening right now.

The latest figures reveal a mix of optimism and caution among investors. The company has shown a steady growth trajectory, with an increase in revenue and a solid quarterly report that exceeded market expectations. This positive performance often leads to increased interest from stakeholders, reflecting a strong operational foundation.

On the flip side, there are some challenges that may impact future growth. Competitive pressures in the tech space, along with global economic uncertainties, can inject a note of caution into potential investments. Still, many analysts maintain a hopeful outlook, buoyed by innovative products and strategic initiatives that could enhance profitability in the long run.

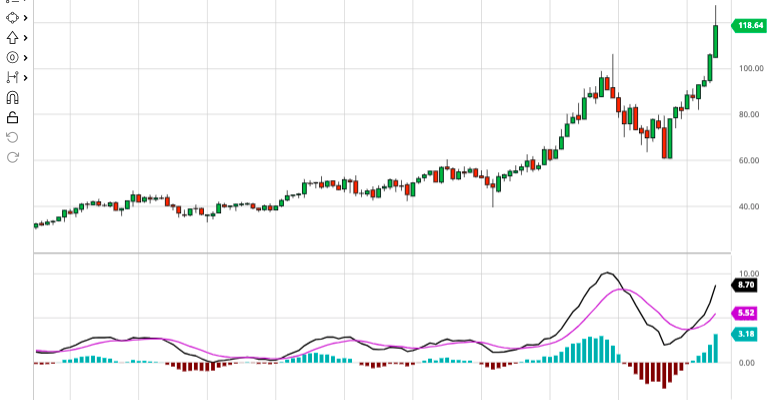

In examining recent price actions and volume trends, it’s clear that the market remains dynamic. Short-term volatility can create opportunities as investors look to capitalize on price movements. Keeping an eye on market reactions to upcoming announcements and earnings calls could be vital for gauging future directions.

Overall, while the financial performance is currently favorable, it’s essential to approach any decisions with a comprehensive understanding of both the positives and the potential hurdles ahead.

Future Growth Prospects for Oracle

When we think about the future potential of a tech giant, it’s essential to examine various factors that could influence its trajectory. The evolving landscape of technology, coupled with the increasing demand for cloud solutions and data management, positions the company in an interesting light. With a robust strategy in place, there’s much to consider regarding how these elements might come together to foster growth.

One of the primary drivers of expansion is the shift towards cloud computing. As businesses migrate towards more efficient, scalable solutions, those who can provide reliable and innovative services stand to benefit immensely. This enterprise has been focusing on enhancing its cloud offerings, which could translate into significant revenue increases as more companies seek to optimize their operations.

Moreover, the rise of artificial intelligence and machine learning is changing the way organizations analyze data. By investing in these technologies, this entity is positioning itself to lead in a market that values data-driven decision-making. Companies that can integrate AI capabilities into their solutions are likely to attract a broader client base, further fueling growth prospects.

Another aspect to consider is strategic acquisitions. The ability to integrate complementary businesses can accelerate innovation and broaden the service portfolio. This tactic not only enhances competitive advantage but can also facilitate entry into new markets, providing additional avenues for revenue generation.

Finally, the commitment to research and development cannot be overlooked. By prioritizing innovation and staying ahead of industry trends, this corporation can ensure it continuously meets the evolving needs of its customers. Such a forward-thinking approach is crucial for long-term sustainability and success.

Market Trends Influencing Oracle’s Value

In today’s fast-paced financial landscape, various market dynamics play a crucial role in shaping the valuation of tech giants. Understanding these influences can provide valuable insights for investors looking to navigate the complexities of the market. By observing shifts in consumer preferences, advancements in technology, and competitive forces, one can gauge the potential trajectory of leading companies in the industry.

One significant trend is the increasing demand for cloud-based solutions. As organizations rapidly transition to digital platforms, firms that offer robust cloud services are likely to see a surge in their financial standings. Additionally, with the rise of artificial intelligence and machine learning, companies that integrate these technologies into their offerings can significantly enhance their appeal and market position.

Moreover, economic fluctuations, such as interest rates and inflation, can impact investment decisions and consumer spending. Keeping an eye on macroeconomic indicators can reveal underlying patterns that affect company performance. Furthermore, regulatory changes and geopolitical factors can also influence market perception and investment strategies, making it essential for investors to stay informed.

Lastly, the competitive landscape is ever-evolving. New entrants and established players vying for market share can create both challenges and opportunities. Understanding how key competitors are positioning themselves in relation to market trends can help project potential growth for established entities within the sector.