Exploring Whether Open Sky Functions as a Credit Card Alternative

In today’s fast-paced world, where convenience often reigns supreme, the evolution of financial services has taken on exciting new forms. Many individuals are constantly on the lookout for alternatives that not only simplify transactions but also offer innovative benefits. It’s fascinating how companies are rethinking traditional payment methods, proposing something refreshing that could attract savvy spenders and technology enthusiasts alike.

The concept we are discussing might just redefine how you engage with your finances. Imagine a solution that merges accessibility with flexibility, allowing for effortless management of your expenses. This intriguing idea goes beyond the conventional, leading consumers to explore different avenues for handling their monetary affairs.

As we dive deeper into this phenomenon, you’ll discover the attributes that distinguish it from typical monetary instruments. With features designed to cater to various lifestyles and preferences, this groundbreaking option is drawing attention. The question remains: can this tool keep pace with the demands of modern spending habits while offering a wealth of opportunities?

Understanding Open Sky Program

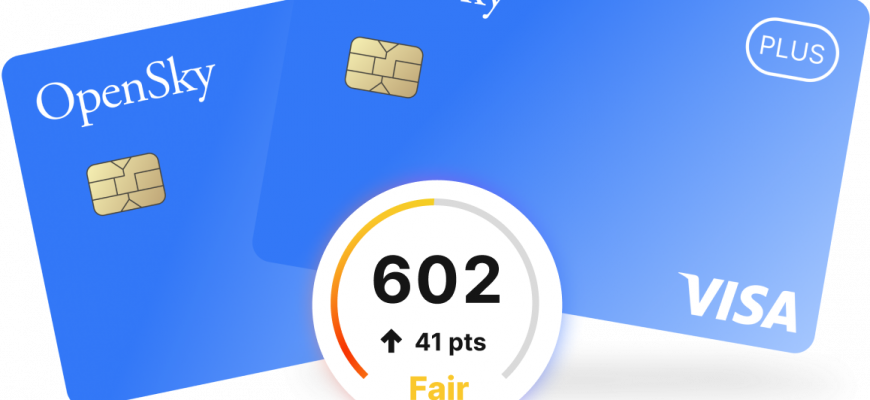

The initiative we’re discussing is designed to enhance your financial journey, especially for those looking to build or rebuild trustworthiness in financial matters. It provides an opportunity for individuals with less-than-stellar histories to gain access to tools that help establish a solid financial foundation.

This program operates in a straightforward manner, allowing participants to engage with a system that doesn’t require traditional evaluations. Instead, it focuses on responsible usage and timely payments, making it a viable option for many who have faced challenges in the past.

What’s great about this setup is its accessibility. There’s no need to jump through hoops or provide excessive documentation; instead, you can start participating with minimal barriers. Moreover, it emphasizes the importance of managing your resources wisely, offering a rewarding path towards financial stability and growth.

In essence, this initiative not only serves as a stepping stone to financial recovery but also equips users with the tools necessary to enhance their monetary habits. It’s all about creating opportunities and fostering a sense of responsibility in managing finances.

Benefits of Alternative Financial Options

When considering various financial solutions, many people overlook the advantages that come with flexible payment methods. These options can provide a myriad of benefits tailored to your individual needs.

- Accessibility: Many alternative financial products have less stringent requirements, making them available to a wider audience.

- Building Credit History: Utilizing these methods responsibly can help you establish or improve your credit score over time.

- Flexible Payment Options: Various plans allow for tailored payment schedules that align better with personal financial situations.

- No Hidden Fees: Transparency is key; many options offer clarity in terms of fees and expenses, allowing for easier financial planning.

- Rewards and Perks: Some alternatives provide benefits such as cashback, discounts, or points for future purchases, adding extra value.

Overall, these financial solutions can be a great addition to your fiscal toolkit, offering many perks that fit different lifestyles and goals. When chosen wisely, they can enhance your financial health and provide peace of mind.

How to Apply for an Open Sky Card

Getting started with a new financial tool can seem daunting, but it’s not as complicated as it may appear. In this section, we’ll guide you through the steps to secure this unique financial option that can help you manage your expenses and build your financial profile.

First, ensure you meet the basic requirements, such as age and residency. Usually, candidates need to be at least 18 years old and a resident of the country where they are applying. Checking these factors beforehand can save you time and effort.

Next, gather all necessary documents such as identification and proof of income. These will help verify your identity and financial standing. Sometimes, additional information might be required, so it’s good to be prepared with your financial history as well.

Once everything is in order, head to the appropriate website or local branch to fill out the application. Be honest and detailed in your responses to ensure the best results. Many platforms now allow you to apply online, making the process even more straightforward.

After submitting your application, you’ll likely receive a response within a few hours to a few days. During this time, it’s crucial to check your email for any updates or requests for further information. If approved, you can start enjoying the benefits in no time!

Lastly, don’t hesitate to reach out to customer service if you have any questions during the application process. They can provide valuable assistance and clarification as needed, making your experience smoother and more enjoyable.