Exploring the Potential of Nvidia Stock as a Smart Investment Choice

In the ever-evolving landscape of technology, making decisions about financial opportunities requires careful consideration. With numerous companies vying for attention, investors often find themselves pondering the potential of various players in the market. The focus here is on assessing whether the current environment suggests a favorable moment to engage with a particular entity in the realm of digital innovation.

Understanding the dynamics behind a corporation’s performance is essential. Factors such as market trends, competitive positioning, and financial health play pivotal roles in shaping perceptions around investment prospects. Investors must delve deeply into recent developments and just how they align with long-term goals.

As you explore the potential of this tech powerhouse, it’s crucial to evaluate both qualitative and quantitative aspects. Analyzing revenue growth, product advancements, and the broader context of industry shifts will equip you with a more comprehensive perspective. Let’s embark on this journey to uncover the true essence of what makes this opportunity worth considering.

Understanding Nvidia’s Market Position Today

In today’s fast-paced technology landscape, one company stands out for its innovative approaches and influence on various industries. As the market continues to evolve, it’s essential to analyze how this enterprise is faring amidst fierce competition and shifting consumer demands.

The organization has established itself as a leader in graphics processing units, with a portfolio that extends into artificial intelligence and data centers. This diversification helps create a robust foundation, making it resilient against market fluctuations. With advancements being made daily, the company’s ability to adapt is crucial in maintaining its edge.

Moreover, partnerships with key players in sectors like gaming, automotive, and cloud computing amplify its presence. These collaborations not only enhance its product offerings but also pave the way for groundbreaking developments that can re-shape entire markets. As more industries embrace high-performance computing, the potential for growth looks promising.

Monitoring financial health is another aspect worth considering. With consistent revenue growth driven by demand for advanced technologies, stakeholders remain optimistic. The balance sheet indicates sound management practices, which is an encouraging sign for anyone looking into the company’s future trajectory.

In summary, evaluating the company’s market position involves examining its product innovation, strategic alliances, and financial performance. As technology continues to advance, staying informed about this entity’s developments can provide valuable insights into its ongoing relevance and impact across various fields.

Analyzing Nvidia’s Financial Performance Metrics

When it comes to evaluating a company’s financial health, diving into its performance indicators can provide valuable insights. Understanding the metrics that reflect growth, profitability, and market position can help investors make informed decisions. In this section, we’ll break down the key financial metrics that highlight the performance of this tech giant.

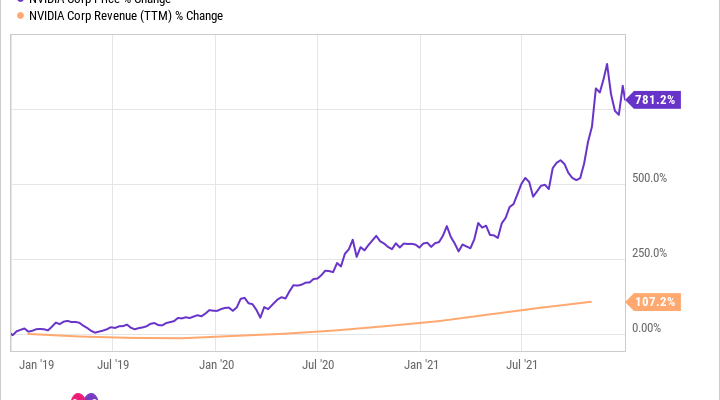

One of the most critical figures to examine is revenue growth. This metric illustrates how effectively the company is increasing its sales year over year. Additionally, profitability ratios, such as net margin, give a clear picture of how well the business is managing its operational costs while generating profits. A consistent increase in these figures can signal robust business practices and market demand for its offerings.

Moreover, examining earnings per share (EPS) allows stakeholders to gauge how much profit is attributable to each share, making it easier to evaluate past performance and predict future growth. A rising EPS typically indicates a company’s profitability trend, whereas a declining EPS might raise red flags for potential investors.

Another important aspect to look into is the price-to-earnings (P/E) ratio, which provides insight into how the market values the company’s earnings. This ratio can help determine whether the organization is potentially overvalued or undervalued compared to its competitors. Understanding the relationship between the P/E ratio and growth rates can enhance an investor’s perspective.

Finally, considering cash flow metrics is essential. Positive cash flow reflects a company’s capability to support its operations without relying heavily on external financing. A strong cash flow position not only facilitates reinvestment into future growth but also provides a buffer during economic downturns.

By analyzing these financial performance metrics, one can gain a comprehensive understanding of the company’s present status and future potential, allowing for a more informed approach to investment decisions.

Future Growth Prospects and Industry Trends

As we look ahead, the landscape of technology is evolving at a breakneck pace, presenting remarkable opportunities for certain companies. The ongoing advancements in artificial intelligence, machine learning, and data processing are particularly noteworthy. These developments are not only reshaping existing markets but are also giving rise to entirely new sectors, making it an exciting time for investors seeking to understand the potential trajectories of key players in the field.

One of the primary drivers of this transformation is the increasing demand for high-performance computing. Businesses across various industries are recognizing the necessity of powerful processing capabilities to handle vast amounts of data. As a result, companies positioned at the forefront of this technological wave are likely to witness substantial growth. Furthermore, the rise of cloud computing is playing a pivotal role, with enterprises migrating to cloud-based solutions that require robust infrastructure and support.

Additionally, the integration of graphics processing units (GPUs) into a wide array of applications, from gaming to autonomous vehicles, is fostering innovative uses that were previously unimaginable. As these technologies continue to mature, the competitive landscape is expected to intensify, with firms that lead the charge in innovation potentially reaping significant rewards.

Lastly, the global shift towards sustainable practices is creating new avenues for growth. Companies focusing on energy efficiency and eco-friendly technologies may find themselves on the cusp of major breakthroughs. This blend of sustainability with technological advancement could not only enhance their reputations but also bring financial gains in a world increasingly oriented towards responsible investment. Overall, the future looks promising for those willing to explore the evolving dynamics of this sector.