Evaluating the Potential of Nasdaq 100 as a Smart Investment Choice

When it comes to the world of finance, there are numerous avenues that individuals can explore for potential growth. One particular index has gained significant attention due to its composition of formidable companies that are at the forefront of innovation and technology. Many investors find themselves pondering whether engaging with this index is a wise choice.

With a diverse range of prominent players in sectors such as technology and consumer services, it offers a unique opportunity to tap into the performance of some of the strongest entities in the market. As you navigate through the intricacies of this financial landscape, it’s essential to weigh the benefits and risks that come with participation.

Understanding the underlying trends, historical performance, and the current economic climate can prove invaluable in making an informed decision. Ultimately, the question arises: is this index a path worth embarking on for those seeking to diversify their portfolios?

Analyzing the Performance of the Technology-Centric Index

When it comes to evaluating the performance of a technology-focused index, there are a few key factors to consider. This analysis delves into historical trends, market fluctuations, and the underlying companies that shape the landscape. Understanding these elements can provide valuable insights into potential future movements and overall market health.

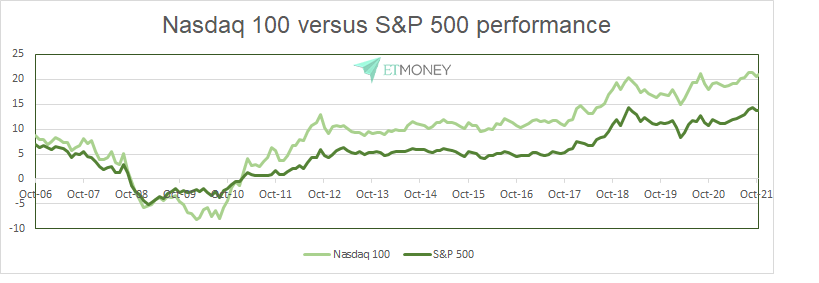

One important aspect to examine is the historical growth trajectory. Over the past few decades, this collection of innovative firms has shown remarkable resilience, often bouncing back from downturns with impressive gains. Observing these patterns can help guide expectations and decision-making for anyone considering diversifying their portfolio with similar assets.

Additionally, it’s crucial to look at economic indicators that impact this grouping of stocks. Factors such as interest rates, inflation, and technological advancements play a significant role in shaping market dynamics. By keeping an eye on these variables, investors can better assess risks and opportunities within this segment.

Lastly, analyzing the performance of individual constituents is essential. Some companies within this index outperform others, and understanding their business models and market strategies can provide further context. This careful examination helps in gauging potential volatility and short-term performance trends.

Factors Influencing Investment Decisions

When considering where to allocate your resources, there are several key elements at play that can shape your choices. Each individual’s unique circumstances, preferences, and goals can significantly impact their approach to wealth creation. Understanding these components can help clarify what drives financial decisions and overall strategy.

One of the primary aspects to consider is risk tolerance. This refers to how comfortable you are with the possibility of losing some or all of your capital. Some individuals eagerly embrace risk in hopes of higher returns, while others prefer more conservative approaches to ensure stability and security in their financial assets.

Additionally, market trends and economic indicators play a crucial role. Keeping an eye on the performance of various sectors can provide valuable insights into potential opportunities and pitfalls. It’s important to stay informed about global events that could affect the market landscape, as these factors can lead to fluctuations that may impact your overall strategy.

Then there’s the personal investment horizon to contemplate. Are you looking to grow your resources for the long term, or are you aiming for more immediate gains? This timeline can greatly influence your choice of where to place your finances, as different avenues can yield varying results depending on how long you plan to stay in the game.

Lastly, emotional factors can also come into play. Sometimes, personal biases or experiences can cloud judgment and sway decisions. Being aware of these emotional triggers can help investors make more rational choices, focusing on data and research rather than feelings.

Alternatives to Tech-Heavy Index Investments

When considering where to allocate your resources, it’s beneficial to explore various opportunities beyond the high-tech benchmarks. Different asset classes can offer unique advantages and diversification benefits, allowing you to tailor your financial strategy to your specific goals and risk tolerance.

One option is to delve into international markets. Investing in foreign stocks can provide exposure to economies that may be growing at a faster pace than domestic ones. Additionally, sectors such as healthcare, consumer goods, or renewable energy often present appealing alternatives that focus more on fundamental growth rather than technology trends.

For those interested in real estate, real estate investment trusts (REITs) can serve as a way to gain exposure without the need to purchase physical properties. This avenue not only offers potential income through dividends but also presents a hedge against inflation.

Bonds also stand out as a classic alternative, providing income and stability. Government and corporate bonds can serve as a buffer against market volatility seen in more equity-heavy portfolios.

Lastly, consider looking into exchange-traded funds (ETFs) that focus on specific sectors or strategies. These funds can span everything from commodities to dividend-paying stocks, giving you flexibility and a multitude of choices based on your investment philosophy.