Understanding My Universal Credit Benefits and How to Make the Most of Them

We all find ourselves in situations where we may need a little assistance to get through tough times. Navigating the world of financial support can be tricky, especially when you’re unsure of what you’re entitled to. Understanding your eligibility and how it all works can be a daunting task, but it doesn’t have to be.

In this section, we’re going to break down the essentials of the aid system, clarifying the benefits available to you. Whether you’re a student, a job seeker, or someone going through a change, knowing what you can rely on financially is paramount. So let’s dive in and explore everything you need to know!

Feeling lost or overwhelmed is completely normal. Many individuals and families face challenges when trying to access their benefits. That’s why it’s crucial to stay informed and empowered about your options. Together, we’ll uncover the details so you can make the best possible decisions for your situation.

Understanding Benefits Systems

When it comes to navigating the financial assistance landscape, it’s important to grasp how these support programs function. They aim to help individuals and families manage their living expenses during tough times. This section will shed light on the various aspects of these government-backed resources, making it easier to understand your entitlements and how to access them.

Many people find themselves in situations where their income isn’t enough to cover all costs. That’s where this type of aid comes into play, providing a safety net that can ease financial strain. From aiding with housing costs to ensuring you can afford daily necessities, these programs have been designed to adapt to your needs and circumstances.

Eligibility is a crucial factor, as it determines who can benefit from this support. Factors such as income, savings, and household composition are taken into account. It’s essential to evaluate your situation against these criteria to see if you qualify. Additionally, different types of assistance might be available depending on your specific circumstances, so exploring all options is beneficial.

Once you establish your eligibility, the application process can seem daunting. However, it typically involves submitting necessary documents and providing accurate information about your finances. There are resources and organizations available to guide you through this process, ensuring you know what to expect.

Understanding the various facets of these assistance programs can empower you to make informed decisions. Doing so not only helps you secure the support you need but also provides peace of mind during challenging times.

Eligibility Criteria for Financial Assistance

Understanding who can access financial support is essential for those in need. The requirements for receiving this aid can vary, and it’s important to know if you meet the qualifications. Generally, several factors determine eligibility, ranging from personal circumstances to financial status.

Here are the key criteria that may influence your eligibility:

- Age: Typically, applicants must be at least a certain age to qualify.

- Residency: You need to be a resident or have lived in a particular area for a specified duration.

- Income: Your total earnings will be assessed, whether from employment or other sources.

- Savings: The amount of money you have saved can impact whether you qualify.

- Personal circumstances: Factors such as your living situation or dependents play a role.

Each case is unique, so it’s beneficial to review these points based on your individual situation. If you’re unsure, seeking guidance from a professional or local agency can help clarify your eligibility.

How to Manage Your Financial Support

Managing your financial assistance effectively can make a significant difference in your everyday life. It’s all about knowing how to navigate your resources and ensuring you make the most of the support available to you. Here are some practical tips to help you stay on top of things.

Stay Informed: First things first, keep yourself updated on the rules and requirements surrounding your assistance scheme. Changes can happen often, so understanding your entitlements will empower you to make well-informed decisions.

Budget Wisely: Creating a budget is essential. Break down your income and expenses to see where your money goes. This way, you can arrange your finances in a way that covers your needs while also allowing for some savings.

Use Online Tools: There are numerous online calculators and budgeting tools that can help you track your funds. Consider taking advantage of these resources to simplify your financial planning and management.

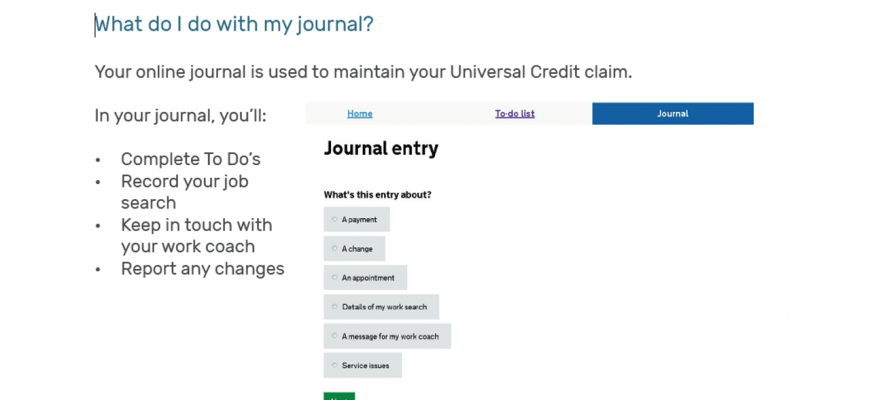

Communicate Regularly: Don’t hesitate to reach out to your caseworker or the relevant authorities if you have questions or concerns. Regular communication can result in quicker resolutions and important updates regarding your situation.

Seek Support: Don’t forget that you’re not alone in this. Various organizations offer advice and assistance for those receiving financial support. Connecting with these groups can provide you with the extra guidance you need to make the most of your circumstances.

By implementing these strategies, you can take control of your financial assistance and create a more stable future for yourself. Remember, staying proactive is key!