Is My Credit Union Protected by NCUA Insurance? Understanding the Benefits and Importance of Federal Coverage

When it comes to managing your funds, feeling secure is a top priority. You want to ensure that your hard-earned money is protected, no matter what happens in the financial landscape. But how can you be sure that your chosen organization has the safeguards in place to provide that peace of mind? These concerns are completely understandable, especially when it comes to where and how you keep your assets.

People often wonder about the security measures their local financial establishments have adopted. Whether you’re a long-time member or exploring new options, knowing your institution’s level of protection can significantly impact your decisions. It’s essential to cut through the jargon and get to the heart of what these protections mean for you and your savings.

In the world of personal finance, understanding the credibility and reliability of your chosen organization is crucial. As you navigate through various choices, it helps to familiarize yourself with the terms and guidelines that dictate how these protections work. This way, you can confidently assess if your financial resources are in safe hands, allowing you to focus on what truly matters.

Understanding NCUA Insurance for Members

When it comes to safeguarding your hard-earned money, there’s often a lot of confusion about how protection works–and that’s perfectly normal! Let’s dive into how your financial institution can help keep your deposits secure and what it means for you as a member.

It’s essential to know that not all institutions offer the same level of protection. Here are some key points to help clarify this important aspect:

- Government Backing: The protection system we’re discussing is backed by a federal agency, meaning there’s robust support to cover your deposits.

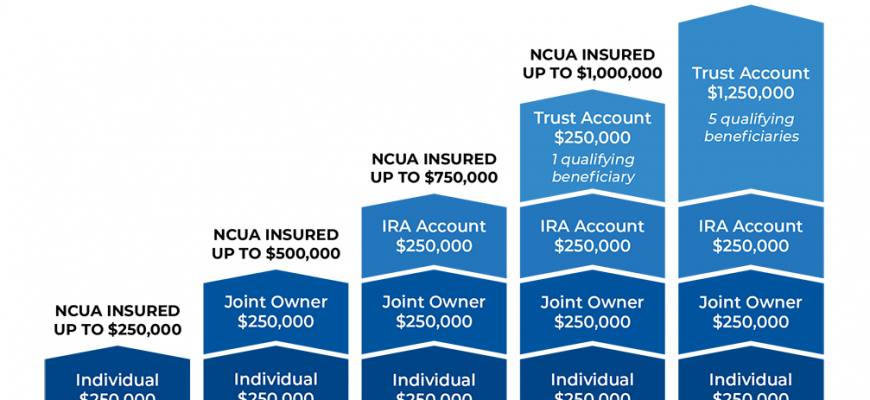

- Coverage Limits: There’s a specific limit to how much protection you can receive for your savings, so it’s a good idea to understand these caps on your deposits.

- Types of Accounts Covered: Not every account may qualify for perfect protection, so it’s wise to know which ones do.

- Eligibility: Only members of certain financial institutions benefit from this coverage. Knowing your institution’s status is key.

The peace of mind that comes from knowing your finances are safe can make a big difference. It’s like having a safety net that catches you when you fall, allowing you to focus on what’s truly important–your financial goals. Stay informed, ask questions, and make sure you understand how your funds are protected!

Benefits of Being NCUA Insured

Having the protection of a federal safety net for your savings can bring peace of mind. It’s a guarantee that your hard-earned money is shielded against unforeseen events, providing a layer of security that can enhance your overall banking experience. When you know your assets are backed by a government organization, it not only instills confidence but also allows you to focus on achieving your financial goals.

Enhanced Security: One significant advantage is the robust safeguard it provides for your funds. You can rest easy knowing that even in cases of financial difficulties faced by your financial institution, your deposits remain safe up to a certain limit. This assurance fosters trust and encourages individuals to engage more freely with their finances.

Peace of Mind: With the backing from a reputable entity, you don’t have to constantly worry about the stability of your financial institution. This peace of mind allows you to plan for the future, whether you’re saving for a home, education, or retirement without fear of losing your investments.

Encouragement to Save: When you know your savings are protected, you might find yourself more inclined to save additional funds. The knowledge that your savings are safeguarded can motivate you to establish and grow an emergency fund or boost your long-term savings strategy.

Credibility: Being part of an organization that receives federal backing often signals stability and trustworthiness. You may find that individuals feel more comfortable doing business with an institution that has this level of oversight, which can translate into better services and products for members.

Access to Resources: Institutions with this kind of protection often provide access to valuable resources and educational materials that can empower you to make informed financial decisions. This additional support can enhance your overall understanding and management of your finances.

How to Verify Your Financial Institution’s Status

When it comes to ensuring the safety of your hard-earned savings, knowing the legitimacy of your financial organization is crucial. There are several straightforward steps you can take to confirm that your chosen establishment is properly recognized and meets the necessary regulations. This can provide you with peace of mind as you manage your funds.

Start with the Official Website: The first place to look is the official website of your financial organization. Often, they will display relevant information regarding their status and any affiliations with federal agencies. Look for sections like “About Us” or “Our Membership” to gather insights.

Consult Regulatory Bodies: Various government agencies oversee financial institutions. Check their official websites for databases or tools that allow you to search for specific organizations. By entering the name or location, you can verify their standing and any safety measures they have in place.

Read Customer Reviews: Gathering feedback from current members can also provide valuable context. Look for testimonials or forum discussions to see if others have positive experiences. Keep in mind, however, to approach online reviews with a critical eye.

Contact Them Directly: Don’t hesitate to reach out to your financial institution directly. A quick phone call or email can clarify any uncertainties. Feel free to ask them about their oversight and what protections are available for accounts, and they’ll likely be happy to provide answers.

Seek Out Third-Party Ratings: There are several independent organizations that assess financial institutions based on their stability and trustworthiness. Research these ratings to gain an understanding of how your establishment stacks up in terms of reliability.

Taking a moment to verify the status of your chosen financial institution can save you from potential headaches in the future. By following these simple steps, you can ensure your funds are secure and enjoy a confident banking experience.