Understanding the Public Accessibility of Your Credit Report and Its Implications

Have you ever wondered how accessible your financial background really is? In today’s world, where transparency and privacy seem to clash, many people find themselves curious about what details others can see regarding their financial dealings. This raises an important question: are the details of your financial behavior available for anyone to dig into?

As you navigate through life, decisions related to loans, purchases, and other financial commitments can leave a trail of data. But just who can access that trail? Understanding the boundaries of your privacy and the rights of those who may be interested in your history can be quite beneficial. Let’s delve into this intriguing topic and clarify what is shared and what remains strictly yours.

While some aspects of your financial activity can be viewed by potential lenders or employers, there are laws and regulations that govern what can be accessed and by whom. This is a crucial point to consider, especially if you’re concerned about maintaining a degree of confidentiality in your financial dealings. So, how much can be shared, and what safeguards are in place to protect your personal details?

Understanding Privacy of Financial Histories

When it comes to the details surrounding your financial background, many people wonder how much of it is exposed to the world and who has access. This topic raises important questions about personal data and the level of confidentiality you can expect. After all, your financial history is a reflection of your economic habits and decisions, and it’s crucial to understand how your privacy is maintained or compromised.

The layers of privacy surrounding these records can be tricky. Certain entities, like lenders or credit agencies, might require access, while others are strictly limited. It’s essential to know that not everyone can just take a peek into these records; there are laws governing who can view this sensitive data and under what circumstances.

Moreover, maintaining your privacy is not a passive effort. You have the right to review your own records and ensure that everything is accurate. If you find inaccuracies, you can dispute them and request corrections. Staying proactive about your financial history can give you peace of mind and help safeguard your personal details from unwanted eyes.

In conclusion, grasping the nuances of this subject will empower you to manage your personal data effectively, ensuring that your financial history is treated with the respect and confidentiality it deserves.

Who Can Access Your Financial History?

When it comes to your financial background, it’s important to know who has the right to take a peek at your history. Various individuals and organizations may seek access for different reasons, and understanding this can help you feel more in control of your personal data.

Lenders are among the most common entities that will want to review your financial track record. When you apply for a loan or a credit line, they assess your reliability by looking into your past. This helps them determine the level of risk involved in lending to you.

Employers may also inquire about your financial history as part of their hiring process. Particularly in positions that involve financial responsibilities, a company might want to ensure that you manage your finances wisely.

Insurance companies can access this data too, often to set premiums based on your financial behavior. They believe that responsible individuals are less likely to file claims, making them a lower risk.

Landlords might check your financial background when you apply for a rental property. They want to ensure that you’ll be able to meet your rent obligations on time.

In certain cases, government agencies may also request this type of information for various purposes, including eligibility checks for assistance programs or background assessments for certain licenses.

In summary, your financial history can be accessed by multiple parties, each with their own reasons. Being aware of this can empower you to manage your data proactively.

Implications of Public Credit Information

Understanding the ramifications of accessible financial records can be quite enlightening. When individuals and organizations can view a person’s financial history, it creates a landscape filled with both opportunities and challenges. Let’s delve into some key aspects of this reality.

- Transparency: Having financial details available allows for a more open environment. Landlords, employers, and lenders can make informed decisions based on an individual’s financial behavior, fostering accountability.

- Risk Assessment: Entities can better gauge the potential risks associated with lending or engaging in business transactions. This can lead to safer investments and partnerships.

- Access to Opportunities: On the flip side, a clean financial slate can unlock better deals and terms. Individuals with a strong history may gain access to premium services and lower interest rates.

However, there are also significant downsides to consider.

- Privacy Concerns: The knowledge that others can access your financial background may feel invasive. Many people value their financial discretion.

- Potential for Discrimination: Unfavorable financial histories can lead to unjust treatment in various areas, including housing and employment.

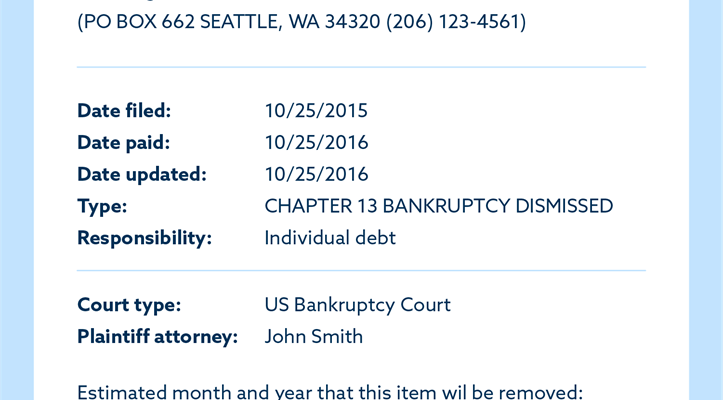

- Errors and Misrepresentation: Inaccuracies in available records can harm individuals, as mistakes may be misinterpreted by those reviewing the data. Correcting such issues can be a daunting task.

As we can see, having financial histories in the public eye influences both the individuals concerned and the entities wanting to assess them. The balance between opportunities and privacy issues continues to be a topic of ongoing discussion.