Understanding Whether Your Credit Report is Frozen and What It Means for You

Have you ever wondered about the status of your personal financial data? It’s a topic that many people don’t think about until they’re faced with a situation that requires clarity. Whether you’re considering a significant purchase or simply trying to manage your finances better, understanding the protection of your sensitive information is crucial. It’s like having a security system for your identity, ensuring that only you have access to your financial history.

When it comes to safeguarding your information, it’s important to know if you’ve taken the steps to restrict access to your profile. Many individuals opt for a safety measure when they suspect potential threats to their privacy. But how can you confirm whether this precautionary step has been put in place? You might be surprised at how easy it is to check and what it means for your financial transactions. Knowing the status of your protective measures can save you time and headaches down the road.

In the following sections, we’ll explore the signs that indicate whether your information is protected and how to proceed if you need to unlock it. Don’t let uncertainty cloud your financial decisions; understanding your current situation is the first step toward greater peace of mind. Let’s dive in and explore this important topic together!

Understanding Credit Report Freezes

Many individuals find themselves wondering about the mechanisms that protect their financial identities. By creating barriers, one can safeguard personal information from unauthorized access. This process plays a crucial role in ensuring that sensitive data remains secure from potential threats and fraud.

So, what does it mean to put such protections in place? Essentially, it involves notifying financial institutions that you want to limit who can view your financial history. This can be particularly beneficial in cases of compromised information or when individuals suspect that their details may be exploited.

To initiate this precautionary measure, a few simple steps are usually required. Typically, accessing your information through one of the major agencies is necessary. You’ll provide personal details to verify your identity, after which you can implement the barriers as per your desired level of security.

Once the process is complete, keep in mind that while your data is secured, it also means that legitimate access by lenders or service providers may be temporarily blocked. Therefore, having a plan in place to lift these barriers when necessary is essential. It’s a balancing act between safety and accessibility.

In summary, understanding how to protect your sensitive information is vital in today’s digital age. By employing this strategy, you ensure greater control over who has access to your details, thereby minimizing the risk of unauthorized use.

How to Check If It’s Frozen

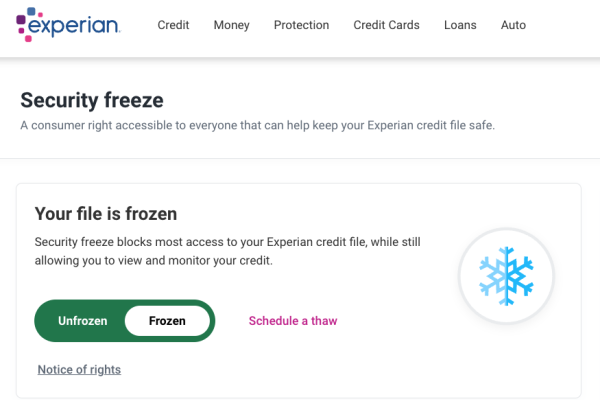

Have you ever wondered whether your financial details are temporarily inaccessible? It’s essential to ensure that everything is in order before applying for loans or credit. There are simple steps you can take to find out the status of your information if you’re unsure.

First, visit the official website of the agency that manages your financial details. They usually provide a straightforward process for verification. You may need to provide personal information, so make sure you have your identification documents handy.

Next, look for options labeled something like “Account Status” or “Access Restrictions.” This should give you a clear indication of whether your information is currently open for review or not.

It’s a good idea to contact customer service directly if the online method seems unclear. They can guide you through the steps and offer additional assistance if needed. Clear communication can help resolve any doubts you may have about your financial standing.

Lastly, always remain vigilant about your financial health. Regularly checking your status helps you stay informed and prepared for any opportunities that come your way.

Advantages of Freezing Your Financial Access

When you take steps to secure your financial history, you gain peace of mind and a better grip on your personal information. This process acts as a powerful shield against potential threats, making it more challenging for fraudsters to misuse your identity. By temporarily restricting access, you can feel safer in today’s digital landscape.

Protection from Identity Theft: One of the most significant benefits of this preventive measure is the drastic reduction in the chances of becoming a victim of identity theft. With your records locked, it becomes nearly impossible for someone to open new accounts in your name.

Control Over Your Information: You gain the ability to manage who gets access to your personal details. Instead of allowing everyone to obtain your financial data freely, you can selectively choose when to share it, putting you back in the driver’s seat.

Peace of Mind: Knowing that your personal information is safeguarded provides comfort, especially in a world where data breaches are common. This sense of security allows you to focus on other aspects of your financial life without constant concern about potential threats.

Cost-Free Option: Freezing your access comes at no expense, making it an accessible choice for anyone looking to enhance their security. It’s a straightforward method that can effectively protect your interests without affecting your budget.

Overall, taking this precaution can empower you and create a more secure financial experience. When your information is well-guarded, you can navigate your financial journey with confidence and assurance.