Evaluating the Accuracy of Your Credit Karma Score and What It Means for Your Financial Health

In today’s world, understanding your financial health is more important than ever. Many people rely on various platforms to gauge their standing and assess their overall fiscal well-being. However, a common question lingers: how dependable are these assessments? Trusting the numbers can feel like a leap of faith, especially when they determine key aspects of life like loans or credit opportunities.

Beneath the surface, it’s essential to consider what these evaluations are based on and how they’re calculated. While the numbers can provide a decent snapshot of where you stand, discrepancies may arise due to numerous factors. It’s easy to be misled by a figure that seems precise but might not encompass the full picture of your financial situation.

Understanding the nuances of these evaluations can help you make informed decisions. Are you truly being given the right insights? By delving deeper into how these metrics work and what influences them, you can gain a clearer perspective and avoid potential pitfalls in your financial journey.

Understanding Credit Karma Scoring System

When it comes to the numbers that help lenders decide whether to approve your applications, understanding the method behind these evaluations is essential. Many people are curious about how these assessments are generated and what factors contribute to them. It’s not just about a single number; it reflects a combination of aspects that illustrate your financial behavior over time.

The system utilizes various data points, such as your payment history, the amount of debt you hold, and even the length of your credit history. Each of these elements plays a role in how the final calculation is made. For instance, if you consistently make payments on time, that positive behavior will enhance your standing. Conversely, having high balances on multiple accounts may pull those numbers down.

You might wonder how these evaluations compare to those used by financial institutions. It’s important to know that while different organizations may rely on various methodologies, the essence remains the same. They are all trying to gauge your reliability as a borrower. However, the specific algorithms and the weight assigned to each element can differ, which can lead to variations in the assessments you see.

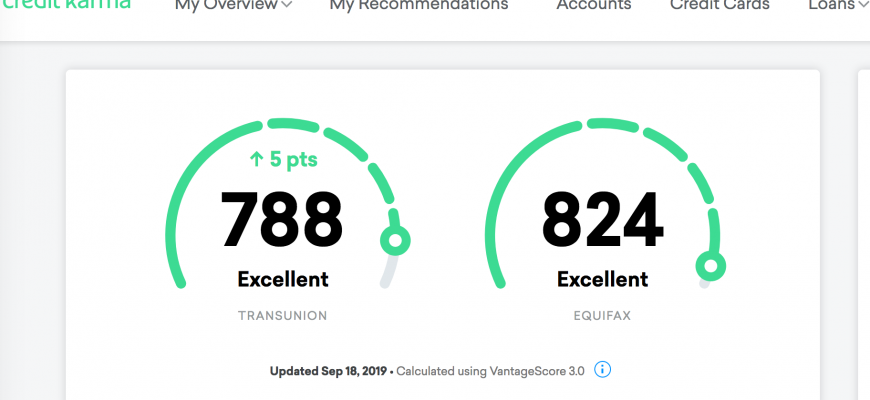

Another factor to consider is the frequency of updates. The evaluations you observe through various platforms can change as new information comes in. This means that your standing can fluctuate, reflecting your ongoing financial activities. Monitoring these changes regularly can give you a better understanding of your overall health within the financial landscape.

In summary, grasping the intricacies of this evaluation framework empowers you to make informed decisions. By knowing what influences these numbers, you can take proactive steps to enhance your financial profile, thus promoting a healthier economic future.

Factors Affecting Your Financial Rating

Your financial rating isn’t just a number; it’s influenced by various elements that reflect your money management habits. Understanding these factors can help you make better decisions and improve your standing over time.

- Payment History: Timely payments can significantly enhance your rating. Late payments, however, can have a negative impact that lasts for years.

- Amount Owed: The total balance on your accounts matters. A high ratio of used credit compared to what is available can signal potential risk to lenders.

- Length of Credit History: The longer your accounts have been active, the better it typically looks. Lenders prefer to see a well-established track record.

- New Credit: Opening multiple new accounts in a short period can raise red flags. Lenders may view this as a sign of financial distress.

- Types of Accounts: A mix of different account types, such as loans and revolving credit, can strengthen your profile and demonstrate financial versatility.

By being aware of these elements, you can take steps to enhance your financial health and ultimately achieve a more favorable rating. It’s all about responsible management and making informed choices.

How Reliable is the Data Provided?

Many people wonder about the dependability of the information they receive from various platforms that evaluate financial health. With numerous options available, understanding how trustworthy these insights are can significantly impact your financial decisions. It’s essential to discern where this data originates and how it is calculated.

These platforms typically gather information from major reporting agencies and other financial institutions. While this can provide a solid foundation, discrepancies can arise. Factors like different calculation methods and timing of updates can create variations in the figures you see. It’s important to recognize that the data may serve as a useful guideline, but should not be the sole authority on your financial standing.

Users should also consider the context in which this information is presented. Often, these platforms simplify complex data into user-friendly formats. While this is helpful, it can sometimes mask nuances that are critical for a full understanding. Incorporating additional sources of information and insights can lead to a more rounded picture of your financial profile.

In conclusion, while these platforms can offer an informative glimpse into your financial status, relying solely on them without cross-referencing with other resources can lead to misinterpretations. Being proactive in exploring various tools can empower you to make sound financial choices.