Checking the Status of My Credit Freeze

Have you ever felt uncertain about the status of your financial profile? It’s a common concern that can lead to confusion and, at times, frustration. Whether you’re considering a new loan, trying to get a credit card, or simply want peace of mind, understanding the current state of your financial identity is crucial.

Knowing if your financial history is secured can keep you one step ahead, especially in today’s world where personal information is often at risk. You might wonder if your ability to make significant purchases is impaired or if your financial history is accessible to lending institutions. It’s essential to stay informed about the measures you’ve taken to protect your identity.

In this article, we’ll walk you through the signs that could indicate whether your financial information is safeguarded and what steps you can take to confirm your status. Let’s tackle those questions together and ensure that you’re fully aware of your options!

Understanding Freezes and Their Purpose

Have you ever wondered how to protect yourself in today’s digital world? One effective method is a temporary halt on your personal financial information, which prevents unauthorized access. This strategy helps maintain your security and ensures that your sensitive data remains safe from potential threats, especially when you’re concerned about identity theft.

The main goal of such protective measures is to give you control over who can view your financial details. By implementing this safeguard, you significantly reduce the risk of someone opening new accounts in your name. It’s a proactive step towards enhancing your privacy and safeguarding your financial future.

Understanding this mechanism is crucial. You can effectively lock down your information when needed, and you also have the option to easily lift the restriction when you want to apply for loans or new services. This flexibility allows you to manage your personal details according to your needs, ensuring an extra layer of security while still being able to access essential financial resources.

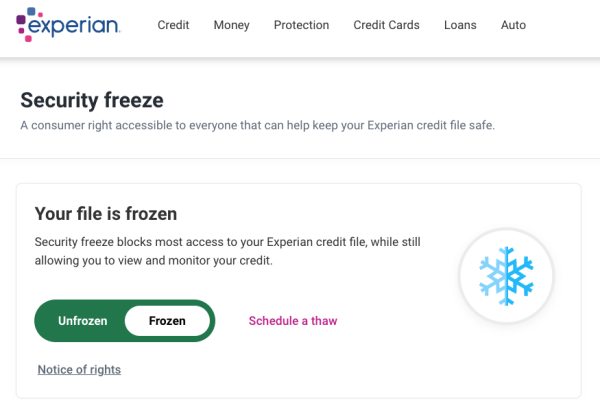

How to Check if Your Access is Restricted

Wondering whether your financial profile is securely locked? Knowing the status of your restrictions is crucial to managing your financial health efficiently. Fortunately, there are a few simple steps you can follow to verify if your access is limited.

Start by reaching out to the major reporting agencies. Each agency has its own process, so be prepared to provide some personal information for verification. You might want to have your social security number, address history, and other identifying details on hand. This will make the process smoother and faster.

Next, log in to the online portals of these agencies, if available. Many institutions offer secure access where you can instantly check your account status. Look for sections related to security features or restrictions, and see if there’s any indication of limits placed on your report.

Additionally, consider reviewing your recent statements or any communication received from these agencies. They often send updates regarding account status changes or any actions taken that might affect your accessibility.

If you’re still uncertain after checking online and through customer service, you can request a formal report. These reports will detail whether any restrictions are currently active on your profile. Just remember that while monitoring your information is essential, ensuring it remains secure should always be a priority.

Steps to Unfreeze Your Report

If you’ve decided to lift the hold on your financial report, the process can be straightforward if you know the steps to take. Whether you’re looking to apply for a new loan or simply want to give access to your information, it’s important to follow the right procedures to ensure everything goes smoothly.

First, identify which of the three major bureaus you need to contact. Each one has its own process for removing the restriction. You’ll usually need to provide some personal details for verification, so have your information handy.

Next, you can either reach out via phone or online. Many people find the online method quicker, as it often allows for immediate action. If you choose to call, be prepared for some automated prompts and possibly longer wait times.

Once connected, request the removal of the hold. Depending on your situation, this may be temporary or permanent. Make sure to specify your preference clearly.

After submitting your request, it’s wise to follow up. Confirm that the request was processed and check if there are any additional steps needed from your end. It’s always better to stay proactive and ensure that everything has been taken care of.

Finally, remember to keep records of all correspondence. This information can be invaluable if any issues arise later on. With these steps, you’ll be back on track in no time!