Understanding If Your Credit Is Frozen and What It Means for You

Have you ever wondered whether your financial options have been limited? It’s a question that can bring about a mix of anxiety and curiosity. Knowing the state of your financial profile is essential, especially if you plan to make significant purchases or apply for loans. Understanding this concept can help you navigate your financial landscape more smoothly.

People often take precautionary measures to safeguard their information from potential misuse. However, these protective steps can sometimes lead to confusion about their current status. You may find yourself asking if your access to various financial services is temporarily halted or if everything is in order. Being informed can make a world of difference when it comes to making confident decisions about your personal finances.

In this piece, we’ll help you uncover the signs and answers you need to determine whether you need to take any further actions. By exploring this topic, you’ll gain a clearer picture of your financial standing and what steps you might need to consider moving forward.

Understanding Credit Freezes

When it comes to personal finances, ensuring the safety of your information is key. One effective measure individuals can take is to restrict access to their financial profiles, making it harder for unauthorized parties to operate in their name. This practice is essential for anyone looking to safeguard their financial wellbeing, especially in today’s digital age.

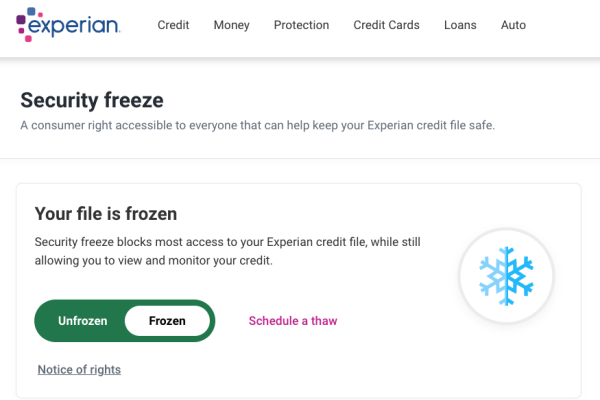

Essentially, this process involves placing a temporary hold on your financial details. This means that lenders cannot access your records unless you take specific steps to lift this restriction. It’s a powerful tool that helps prevent identity theft and other fraudulent activities, giving you peace of mind while navigating various financial commitments.

Before implementing such a safeguard, it’s crucial to understand the implications. While it strengthens your defense against fraud, it can also complicate legitimate financial activities, like applying for loans or new accounts. Therefore, it’s important to weigh both the benefits and potential downsides before proceeding.

How to Check Your Financial Standing

Knowing where you stand financially is crucial for making informed decisions. If you’re wondering about the accessibility of your information and whether everything is in order, you’re not alone. Many people find it helpful to periodically assess their situation to ensure that everything is smooth and secure.

To start, reach out to the major reporting agencies. They provide comprehensive summaries of your history, which can reveal any potential issues or discrepancies that may need your attention. You can request these reports online, by phone, or through mail, depending on your preference.

Look for any alerts or warnings. If your records indicate any suspicious activities, take immediate action. It’s essential to stay vigilant to avoid any complications in the future. Additionally, ensure that all listed accounts are active and correct; inaccuracies can lead to problems down the line.

Finally, consider utilizing tools that monitor changes to your reports. With alerts set up, you’ll be notified promptly of any updates, helping you maintain a clear picture of your financial health. By regularly checking, you can ensure that your information remains accurate and that you’re prepared for any necessary actions.

Benefits of Freezing Your Credit

When it comes to safeguarding your financial identity, taking measures to restrict access to your personal information can be a game changer. By implementing a hold on the ability to access your financial records, you create a protective barrier against unauthorized activities. This simple step can provide you with peace of mind, knowing that potential threats are minimized.

One of the primary advantages is the heightened security it offers. With your details locked down, it becomes significantly more difficult for someone to impersonate you and open accounts in your name. This can save you from a lot of stress and potential financial loss. Additionally, it allows you to maintain greater control over who has the ability to view your information, making it easier to manage your personal data.

Another key benefit is the ability to act proactively rather than reactively. Instead of waiting for suspicious activities to occur, you take a preemptive approach to protection. This can enhance your overall sense of financial safety and allow you to navigate your financial life with confidence.

Also, freezing your records typically doesn’t obstruct your own ability to manage existing accounts or apply for new ones when you need to. Often, it’s a straightforward process to thaw the access temporarily whenever you wish, allowing you to keep your security measures flexible and efficient. This balance of safety and accessibility is crucial in today’s fast-paced financial world.