Understanding the Importance of Your Credit Card Account Number

Understanding the various elements of your financial tools can sometimes feel overwhelming. With all the jargon and codes floating around, it’s easy to get lost in the details. You’re not alone if you’ve ever wondered about the significance of that long string of digits associated with your financial transactions. Let’s unravel the mystery together.

In essence, the sequence you see plays a pivotal role in how your purchases are processed and how your funds are managed. It’s critical to know exactly what this representation entails, as it can impact not only your shopping experience but also your overall financial security. It connects your financial identity with the services you use daily.

So, let’s dive into the specifics and figure out whether that string of characters holds any hidden meanings or potential risks. By the end of this discussion, you’ll have a clearer picture of what it means to have this essential piece of information in your possession.

Understanding Your Credit Card Account Number

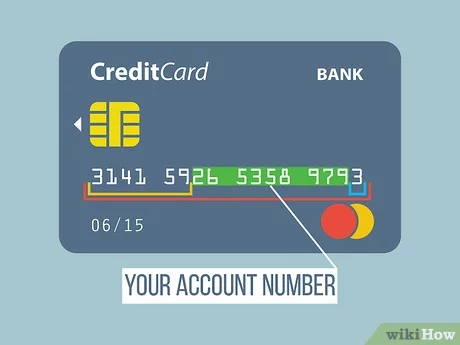

Have you ever wondered what those digits on your plastic wallet companion really mean? You’re not alone! For many, these sequences can seem like a jumble of characters with little significance. However, they hold important information about your financial identity and facilitate your transactions in ways you might not even realize.

Breaking it Down is key to grasping the structure of those codes. Each part has a purpose, from identifying the institution that issued your plastic piece to classifying the type of transaction you’re engaging in. Familiarizing yourself with their layout can help you feel more in control of your finances and your spending habits.

Security is paramount when it comes to these sequences. Always safeguard them; your financial well-being depends on it. Recognizing the significance of these digits not only aids in avoiding fraud but also empowers you when making purchases or managing your budget.

So, whether you use this tool for online shopping, managing expenses, or simply keeping tabs on your finances, understanding the basics gives you a firmer grip on your financial landscape. Embrace the knowledge and enhance your financial savvy!

Importance of Protecting Account Information

In today’s digital landscape, safeguarding sensitive details is essential to ensure your financial well-being. With the rise of online transactions and mobile payments, the risk of data breaches has increased significantly. It’s crucial to understand that a little caution can go a long way in keeping your personal information secure.

Unauthorized access to your financial details can lead to severe consequences, including identity theft and fraud. When your data falls into the wrong hands, it can disrupt not only your finances but also your peace of mind. By taking proactive steps to protect your information, such as using complex passwords and enabling two-factor authentication, you can significantly minimize the threat of cyberattacks.

Moreover, staying informed about the latest security measures helps you recognize potential risks. It’s not just about securing your assets but also about establishing a habit of vigilance in your financial dealings. Remember, a single lapse in judgment can have lasting effects, so always prioritize the safety of your private information.

Common Issues with Credit Card Numbers

Many people encounter challenges when dealing with their financial identifiers. These problems can arise from various factors and can sometimes lead to frustrating situations. Here’s a look at some of the most frequently experienced dilemmas.

- Incorrect Details: One of the most common issues is entering wrong information, such as an incorrect sequence of digits. Always double-check to avoid mistakes.

- Expired Validity: Using an outdated sequence can lead to transaction failures. It’s essential to keep track of when your information is valid.

- Fraudulent Activity: Unrecognized transactions can signal unauthorized use. Regularly monitoring your transactions helps in identifying suspicious behavior early.

- Technical Glitches: Sometimes systems fail, leading to what seems like non-working identifiers during purchases. Patience is key in these annoying instances.

By being aware of these typical complications, you can better manage your financial tools and navigate any issues more effectively.