Is My Apple Credit Card Compatible with Apple Pay? Exploring the Connection

In today’s fast-paced world, many of us rely on innovative technology to handle our financial transactions seamlessly. With the rise of digital wallets and mobile payment solutions, it’s essential to understand how various financial instruments interact with these convenient options. You might be wondering if your digital banking tool plays well with modern smartphone payment systems.

It’s important to dive into the specifics to ensure you maximize the potential of your financial companion. Many users ask themselves whether their chosen solution integrates smoothly with mobile transaction platforms. It’s all about compatibility and ease of use, allowing for quick, safe, and efficient transactions with just a tap of your device.

As we explore the connection between these financial instruments and mobile payment systems, we’ll shed light on the features that enhance your experience. By understanding how they work together, you can unleash the full power of your digital resources and enjoy the convenience they offer in everyday situations.

Understanding Features of Your Financial Tool

Having a modern financial solution can enhance your purchasing experience significantly. This innovative option not only provides convenience but also offers a variety of functionalities that help you manage your expenses better. Grasping these characteristics can empower you to make the most of your transactions.

One of the standout features is the ability to track your spending in real-time. You can easily access detailed insights into your expenditures, helping you stay within your budget. Additionally, interactive charts and classifications allow you to see where your money goes each month.

Another important aspect is the rewarding system that provides benefits for every transaction. This can include cash back, exclusive offers, and discounts from selected retailers, which can translate into valuable savings over time.

Moreover, security features are top-notch, ensuring your information remains protected. Biometric authentication and advanced encryption methods are in place to safeguard your financial data, giving you peace of mind during your purchases.

Lastly, integration with various digital wallets makes it easier than ever to use your financial tool on the go. Whether you’re shopping in-store or online, the seamless interface ensures a smooth experience without any hassle.

How to Use Digital Payment Options

In today’s fast-paced world, managing transactions through your mobile device has become a seamless experience. With modern technology, making purchases, whether in-store or online, is easier than ever. This guide will walk you through the various methods to utilize these advanced payment solutions effectively.

First, ensure your mobile device is set up properly. You’ll need to download the appropriate app and link your banking information or other payment sources to facilitate transactions. Once everything is in order, you can start enjoying the benefits of contactless purchasing.

When in a physical store, look for the designated payment terminals that support these services. Simply hold your device near the terminal to initiate the transaction. You might be asked to authenticate using your fingerprint or face recognition for added security, making the process not only quick but also safe.

For online shopping, check if your favorite websites support these options during checkout. You can often find specific icons indicating that this service is accepted. Selecting this method typically redirects you to a secure interface where you can finalize your order rapidly and without hassle.

Remember, managing your settings is key. Regularly review your linked accounts, and ensure that you can track your spending through the corresponding app. This way, you stay organized and aware of your financial activities. Enjoy the convenience and let technology simplify your transactions!

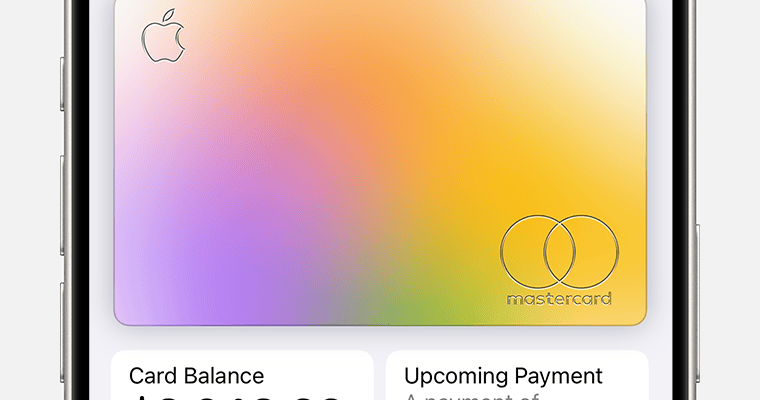

Links Between Apple Card and Wallet

There’s a fascinating connection between a certain financial tool and a mobile application that allows users to handle their transactions effortlessly. This relationship enhances user experience, making it simpler to manage expenses and track spending habits. The integration opens up a world of convenience, blending technology with personal finance in intuitive ways.

This financial tool is seamlessly incorporated into the app, allowing users to access their account details, view statements, and make payments all in one place. Notifications help to keep track of expenditures in real-time, offering insights into spending trends. This integration, coupled with various features available in the app, provides a comprehensive solution for managing finances efficiently.

Additionally, this synergy offers rewards and perks that users can take advantage of. By using the app, individuals can optimize their financial decisions and receive tailored recommendations based on their spending behavior. The process is designed to be user-friendly, making it easier for anyone to navigate through their financial journey.

With this combination, the convenience factor skyrockets. Users can make transactions simply by tapping their devices, eliminating the need for physical cards. This creates a more secure and streamlined experience, reflecting the growing trend towards digital solutions in personal finance. In essence, the relationship between these two innovations provides a holistic approach to managing money that’s both modern and efficient.