Evaluating the Investment Potential of Microsoft Stock for Your Portfolio

In today’s fast-paced financial landscape, making informed decisions about investing in well-established tech companies can be a daunting task. Investors are consistently on the lookout for promising opportunities that align with their financial goals. Given the rapid advancements in technology and its pervasive influence on various sectors, assessing the value of prominent players in this arena is more crucial than ever.

Among the candidates vying for attention, one particular corporation has garnered significant interest due to its robust performance and innovative strategies. The question on many minds revolves around whether now is the right moment to consider adding this powerhouse to their investment portfolio. As we navigate this discussion, it’s essential to explore various facets that contribute to the company’s standing in the market.

Analyzing key indicators such as financial stability, technological advancements, and market position can shed light on the potential for future growth. Furthermore, understanding current trends and consumer behavior can provide valuable insights into the likely trajectory of the company’s valuation in the coming years. In this article, we’ll delve deeper into the relevant factors that could influence your decision regarding this tech giant.

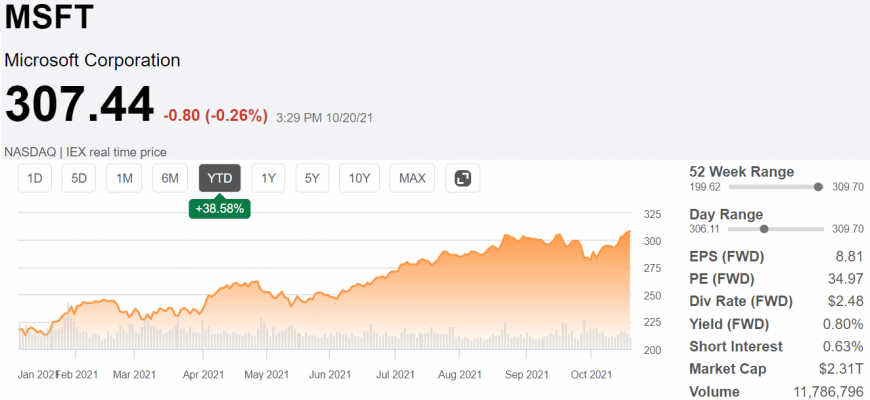

Evaluating Microsoft’s Market Performance

When it comes to analyzing the financial standing of a tech giant, it’s vital to take a closer look at various aspects that contribute to its overall valuation. Investors often seek insights into the company’s revenue growth, market share, and competitive positioning within the rapidly evolving technology landscape. Understanding these elements can provide a clearer picture of how well the enterprise is performing in the market.

Recent trends indicate that the corporation has sustained its prominence through innovative product offerings and strategic acquisitions. By constantly adapting to consumer demands and technological advancements, it has managed to maintain a robust market presence. The shift towards cloud solutions has also played a significant role in enhancing its revenue streams, positioning the entity as a leader in this growing sector.

Another aspect worth noting is the financial health of the company. A strong balance sheet, marked by substantial cash reserves and manageable debt levels, signifies the capability to invest in research and development, as well as the potential for returning value to shareholders. This resilience can often be a reassuring factor for those considering an investment in the company’s future prospects.

Moreover, the company’s commitment to sustainability and social responsibility is increasingly attracting attention from a new generation of investors. By embracing eco-friendly practices and supporting community initiatives, the corporation not only enhances its reputation but also aligns itself with evolving consumer values.

In summary, evaluating the market performance of this tech powerhouse involves a comprehensive analysis of growth trajectories, financial reliability, and commitment to ethical practices. As these components interplay, they contribute to shaping the decisions of potential investors in today’s dynamic marketplace.

Future Growth Prospects for Microsoft

As we look ahead, the potential for expansion and innovation within this tech giant is truly exciting. With a robust portfolio of services and products, the company continues to adapt to evolving market demands and technology trends. The integration of artificial intelligence, cloud computing, and emerging platforms promises to enhance their offerings significantly.

Analysts are particularly optimistic about the ongoing development in cloud services. As businesses increasingly migrate to digital solutions, the demand for scalable and secure cloud infrastructure is surging. The company’s significant investments in this area position it well to capture a larger share of this growing market.

Moreover, advancements in AI are set to revolutionize numerous aspects of the digital landscape. By leveraging machine learning and AI-driven tools, the organization can provide more efficient solutions, thereby attracting a broader customer base. This commitment to innovation not only enhances user experience but also drives long-term loyalty.

Additionally, the focus on expanding their gaming division, particularly with initiatives related to cloud gaming and subscription services, opens up new revenue streams. By tapping into the vibrant gaming community and aligning with current consumer trends, there’s potential for substantial growth in this sector as well.

All these elements highlight a landscape of opportunities. With a forward-thinking strategy and a strong foothold in key technology sectors, the organization seems primed for sustained success in the future.

Risks to Consider Before Investing

When diving into the world of equities, it’s crucial to keep a close eye on potential challenges that may arise. The financial landscape can be unpredictable, and various factors can influence the performance of a company. Understanding these risks can help you make more informed decisions that align with your financial goals.

Market Volatility: One of the most significant dangers involves fluctuations in the market itself. Prices can soar or plummet based on economic indicators, investor sentiment, or geopolitical events. This volatility can impact your investment’s value, even if the underlying business remains solid.

Company-Specific Issues: No venture is immune to internal problems. Leadership changes, operational inefficiencies, or product failures can significantly affect a company’s trajectory. Keeping up with company news and reports can help you identify any red flags that might arise.

Regulatory Changes: Changes in laws and regulations can impact various industries differently. New policies introduced by governments can create opportunities for some and pose significant hurdles for others. Staying informed about potential legislative shifts is essential to mitigate these risks.

Economic Factors: Broader economic conditions, such as inflation or recession, can also influence an enterprise’s performance. A downturn can lead to decreased consumer spending, which may ultimately affect revenue and profits.

Technological Advancements: In today’s fast-paced world, keeping up with technological trends is vital. A company that fails to innovate or adapt may find itself losing market share to more agile competitors, which can impact long-term growth.

In summary, while the prospect of entering the equity market can be enticing, it’s essential to be aware of these potential pitfalls. Being proactive and diligent in your research can safeguard your investments and help you navigate the complexities of the financial world more effectively.