Exploring Whether MO Represents a Strong Investment Opportunity in the Stock Market

In the ever-evolving landscape of financial markets, discerning potential opportunities often becomes a captivating puzzle for investors. As we delve into the specifics of one particular entity, it’s essential to consider various factors that may influence its future trajectory. This analysis will provide insights into what makes this choice appealing or not, equipping you with the knowledge necessary to make informed decisions.

Evaluation of performance metrics and market sentiment often play significant roles in determining the viability of any investment. Various indicators, such as financial health, competitive position, and broader economic conditions, all weave together to create a comprehensive picture. As we explore these elements, we’ll highlight why this entity has caught the attention of many and whether those considerations align with your investment philosophy.

Ultimately, assessing whether this option aligns with your strategic goals requires thorough examination. So, let’s dive deeper into the nuances surrounding this intriguing possibility and discover what it may hold for those willing to explore new avenues.

Understanding MO’s Market Position

When it comes to MO, it’s essential to take a closer look at how the company fits within its industry landscape. This examination goes beyond mere numbers; it delves into market dynamics, competitive edges, and the overall economic environment that influences its performance. By considering these elements, we can gauge how MO stands relative to its peers and what potential opportunities may lie ahead.

MO operates in a sector characterized by both significant challenges and unique advantages. Regulatory pressures and shifting consumer behaviors create a complex backdrop, impacting how the company navigates its operations. However, MO also possesses a well-established presence and brand loyalty that can serve as solid foundations for resilience in tough times.

Another aspect worth assessing is MO’s approach to innovation and adaptation. The ability to pivot in response to market trends can often determine success or stumbling in this environment. By investing in new products or aligning with evolving consumer preferences, the company may enhance its relevance and longevity in the marketplace.

Moreover, analyzing MO’s financial health provides further insight into its market standing. Strong revenue streams and prudent cost management are indicators that can suggest the company’s capacity to sustain itself in fluctuating conditions. Investors keep an eye on these metrics to evaluate the potential for future growth.

Ultimately, understanding MO’s place in the market requires a comprehensive look at both the challenges it faces and the strengths it possesses. This balanced perspective allows for more informed judgments regarding its future trajectory in the industry.

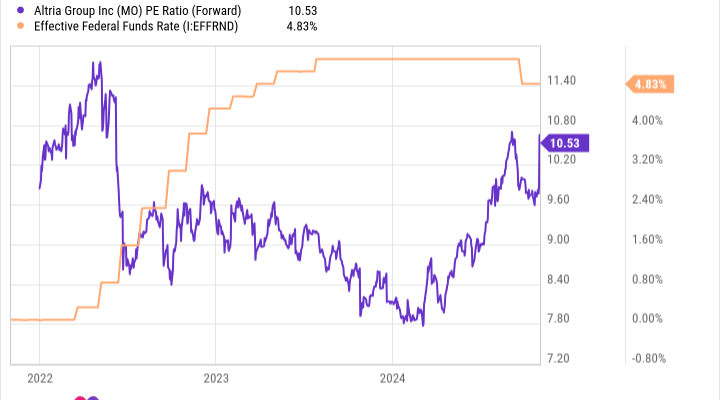

Factors Influencing MO’s Stock Performance

When examining the dynamics of a company like MO, it’s essential to consider a variety of elements that can impact its valuation and market presence. These factors contribute significantly to investor sentiment and can shape the overall trajectory of its financial standing.

Market Trends: The broader economic landscape plays a crucial role. Fluctuations in consumer preferences, regulatory changes, and emerging trends within the industry can significantly sway performance. Monitoring these shifts is vital for understanding potential impacts on valuation.

Regulatory Environment: Government policies and regulations surrounding the industry directly affect MO’s operations. Changes in taxation, public health initiatives, or legal restrictions can create both opportunities and challenges, influencing investor confidence.

Financial Health: A company’s earnings reports, debt levels, and cash flow are key indicators of its financial stability. Positive quarterly results can uplift perception, while any signs of distress may lead to skepticism among investors.

Dividend Policy: For many investors, attractive dividend yields are a significant attraction. MO’s approach to returning value to shareholders can affect demand for its shares, especially in times of market volatility.

Competitive Landscape: The actions of peers and new entrants into the market can reshape competitive dynamics. Staying informed on how MO stacks up against its rivals offers deeper insight into potential risks and rewards.

Technological Innovations: Advances in production processes and marketing can enhance efficiency and market reach. Companies embracing technology often gain a competitive edge, influencing market perception positively.

Understanding these elements enables stakeholders to make more informed decisions regarding their involvement with MO, as they navigate the complexities of the market.

Investment Risks and Rewards for MO

When looking at potential opportunities in the market, it’s crucial to weigh both the advantages and potential pitfalls. This analysis can often reveal a complex landscape where high returns are often accompanied by significant challenges. With that in mind, understanding the nuances of investing in MO provides valuable insights for any interested party.

On the rewards side, one of the appealing factors of MO is its track record of providing consistent dividends. Many investors are drawn to the predictable income stream that can support their financial goals. Additionally, MO has demonstrated resilience in various market conditions, showcasing its ability to thrive even in tougher economic climates. This level of stability can be quite attractive for those seeking long-term growth.

However, every opportunity comes with its own set of risks. The regulatory environment surrounding the industry can be uncertain, leading to fluctuations that impact overall performance. Furthermore, shifts in consumer preferences and public perception may create challenges for MO’s business model. Keeping an eye on these potential hurdles is essential for anyone considering this investment.

Ultimately, the decision revolves around balancing these risks with the potential rewards. By carefully evaluating both sides, investors can make informed choices that align with their financial strategies and risk tolerance. Such a thorough understanding is key to navigating any investment landscape successfully.