Are Loans Recognized as Financial Assistance Options for Students?

When it comes to funding education, many people find themselves navigating through a maze of options designed to assist with expenses. The landscape is dotted with various forms of assistance that promise financial relief, yet not all methods are created equal. It’s essential to understand the various paths available and how they might impact your overall fiscal picture.

While many envision traditional support as gifts or grants that don’t require repayment, other avenues exist that might also provide necessary resources. The question arises: do these options that require repayment also fall within the same category of support? The answer involves a closer look at the benefits and responsibilities tied to these resources.

As individuals weigh their choices, they must evaluate both the immediate advantages and long-term implications. Understanding the difference between resources that lighten the burden without strings attached and those that come with obligations is crucial. Let’s dive deeper into this subject and clarify how different types of support function in the larger scheme of financing education.

The Definition of Support

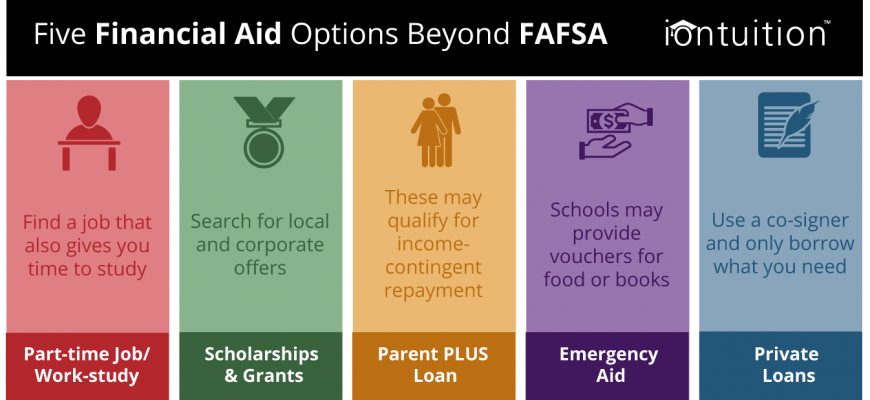

When we talk about support for education, we’re diving into a world of options that help students bridge the gap between their dreams and the costs associated with achieving them. It’s not just about funding but encompasses a range of resources that assist individuals in managing their educational expenses. From grants to work-study programs, the landscape is quite diverse.

Understanding this type of assistance means recognizing that it can come in various forms, each tailored to meet different needs and circumstances. For instance, some programs offer funds that do not need to be repaid, while others might help students earn money through employment opportunities tied to their studies. This mix ensures that learners have multiple avenues to pursue their academic goals without excessive financial pressure.

Ultimately, the essence of such resources is the commitment to making education accessible to all. By providing support, these systems empower individuals to focus on their studies rather than being burdened by financial worries. Whether it’s receiving a scholarship or participating in a community program, every little bit helps pave the way for a brighter future.

Support through Borrowing

When it comes to the various methods individuals use to achieve their financial goals, one of the most common strategies involves seeking help through borrowed funds. This approach allows people to access resources they might not have immediately at their disposal, enabling them to invest in education, start a business, or manage unexpected expenses.

Many view this form of assistance as a necessary tool in navigating life’s financial challenges. By obtaining these resources, individuals can pursue opportunities that may lead to personal growth and development. It’s important, however, to keep in mind that such support comes with obligations that need to be met in the future.

While this type of support can be beneficial, it also requires careful consideration. Understanding the terms, the interest that will accrue, and the repayment schedule is crucial for anyone taking this route. A well-informed approach can ensure that receiving help in the form of borrowed funds contributes positively to one’s financial journey.

Comparing Loans and Grants

When exploring options for funding education, it’s essential to understand the differences between various types of support. Some avenues offer assistance that you eventually repay, while others provide funds that do not require repayment at all. This distinction is crucial in determining how you manage your financial journey through school.

The primary feature of repayable financial support is the obligation to return the funds over time, usually with interest. This type of support can be helpful for those who need immediate resources to cover expenses but must be approached with an understanding of the future financial commitment involved.

On the other hand, non-repayable assistance provides a sense of relief, as recipients can use the funds without worrying about future repayments. This form of support typically hinges on financial need or specific qualifications, making it an attractive option for many students.

In summary, while one type requires a return on investment, the other offers a gift-like approach to funding education, impacting financial decisions in different ways. Understanding these parallels can help individuals make informed choices regarding their educational financing options.