Exploring Whether a Line of Credit Should Be Considered a Loan

When it comes to managing finances, many people often find themselves navigating through a maze of options. One common question that arises is whether a certain financial arrangement can be classified the same way as a traditional borrowing method. This topic is important to explore, as understanding the nuances can lead to better financial decisions and strategies.

At its core, the concept revolves around how funds are accessed and utilized. While some might think of it strictly as a resource for immediate cash needs, others view it as a flexible solution for ongoing expenses. The pivotal difference often lies in the terms of repayment and accessibility. Thus, it’s crucial to dissect these types of financial arrangements to see how they align or differ from conventional borrowing methods.

As we delve deeper, we will unravel the intricacies of this borrowing mechanism, examining its purpose, advantages, and potential drawbacks. It’s all about finding out whether this arrangement suits your financial situation as effectively as a standard borrowing option would.

Understanding Lines of Credit

When it comes to financing options, many people find themselves exploring different avenues to access funds. One such method allows individuals or businesses to tap into a flexible pool of money whenever needed. This approach is particularly appealing because it offers the availability of cash without the necessity to obtain a large sum upfront.

This financial tool functions somewhat like a safety net, enabling users to borrow only what they require, making repayments specifically on that amount. The beauty of this system lies in its adaptability. Individuals can draw on it during emergencies or for planned expenses, providing a significant degree of financial freedom.

Moreover, the costs associated with this option can vary widely. Interest is usually only charged on the amount drawn rather than the total available sum. This makes it a potentially economical choice for those who manage their borrowing wisely and need to keep their expenses in check.

Having access to such a financial mechanism can simplify budgeting and improve cash flow management, especially for businesses facing variable income streams or individuals with fluctuating financial situations. Understanding how to navigate this landscape can lead to better financial decisions in the long run.

Differences Between Funding Options

When it comes to obtaining financial support, there are different methods available to individuals and businesses. Each option comes with its unique characteristics, making them suitable for various needs and circumstances. Understanding how these methods differ can help you make more informed decisions based on your situation.

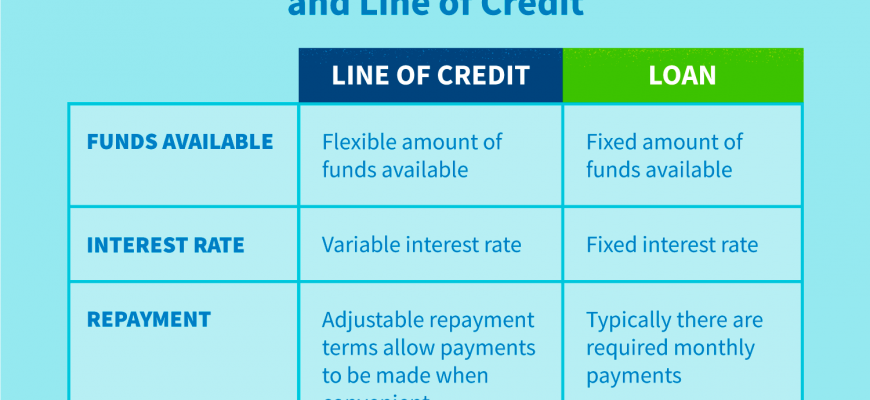

- Structure: One option provides a lump sum upfront which must be repaid over time with interest. The other allows users to access funds as needed, giving them the flexibility to borrow and repay multiple times.

- Repayment Terms: The former typically has fixed schedules with consistent payment amounts, while the latter may have variable repayment depending on how much has been used and when it is paid back.

- Interest Rates: Interest for the first option is often calculated on the entire amount borrowed. In contrast, interest for the second approach may only apply to the amount that is currently utilized, potentially leading to lower overall costs.

- Usage: The initial option is usually intended for specific purposes, such as purchasing a home or financing a vehicle. The alternative offers more versatility, allowing funds to be used for anything from unexpected expenses to ongoing operational costs.

Recognizing these distinctions can help you determine which type aligns better with your financial goals and borrowing preferences.

Advantages of Using a Line of Credit

Opting for this financial tool comes with a host of benefits that can significantly ease your monetary management. It’s designed to provide flexibility, allowing you to access funds as needed, rather than receiving a lump sum upfront. This makes it a versatile option for various spending circumstances.

One of the primary perks is the ability to borrow what you need without being tied to a large sum. Whether it’s for home renovations, unexpected expenses, or managing cash flow, you can withdraw just the amount necessary. This tailored approach often leads to lower interest costs compared to traditional forms of borrowing, as you only pay interest on the portion you utilize.

Moreover, having this resource at your disposal enhances your financial security. It acts as a safety net, ensuring you’re prepared for unforeseen events without the stress of immediate repayment. Additionally, regular, responsible use can boost your credit standing, making you a more attractive candidate for future financing options.

Lastly, the ease of access is a significant advantage. Many financial institutions offer online management tools that allow you to monitor your balance, track spending, and make payments conveniently. This empowers you to maintain control over your finances and make informed decisions swiftly.