Exploring the Potential of Land as a Profitable Investment Option

When considering various avenues for building wealth, one concept often emerges as a topic of discussion: the notion of acquiring property. This approach raises questions and curiosity among many looking to enhance their financial portfolio. While some view it as a path laden with potential rewards, others harbor doubts about its profitability.

In an ever-evolving economic landscape, choices regarding real estate can be both exciting and daunting. Factors such as location, market trends, and personal goals play a significant role in determining whether this venture will yield favorable outcomes. It’s crucial to explore the dynamics at play and understand the implications of engaging in such pursuits.

As we delve deeper, we will examine the benefits and drawbacks of entering this realm. From leveraging appreciation rates to navigating regulatory hurdles, having a clear strategy is essential. The key lies in assessing the various elements involved and making informed decisions that align with your aspirations.

Understanding the Value of Land

When it comes to acquiring tangible assets, the worth of real property often sparks curiosity. Many people ponder whether acquiring a piece of earth is a savvy choice for their portfolio. The allure usually lies in its potential for appreciation, unique characteristics, and the ability to utilize it in various ways, depending on the needs and visions of the owner.

The true essence of a parcel is tied to multiple factors, such as location, surrounding developments, and zoning regulations. A prime site can serve as a remarkable foundation for future projects, while certain areas may experience surges in demand over time. The fluctuation in value can also be influenced by economic trends and demographic shifts, making it essential for potential buyers to analyze market conditions thoroughly.

Moreover, the natural features of the property–like its accessibility, terrain, and available resources–play a pivotal role in assessing its worth. Prospective holders often weigh these aspects against their personal ambitions or commercial objectives. Whether one envisions constructing a lively community, fostering agricultural endeavors, or simplifying recreational pursuits, the possibilities are extensive.

Status and external factors can elevate the significance of a particular site. Proximity to urban centers, infrastructure developments, and the overall climate can all contribute to increasing desirability. Understanding these elements is vital for anyone contemplating the acquisition of such assets.

In summary, recognizing the importance of these parcels intertwines with a broader comprehension of economics, geography, and innovation. Navigating this multifaceted landscape requires attention to detail and an appreciation for potential opportunities that lie ahead.

Benefits of Investing in Real Estate

When considering where to allocate your resources, diving into the real estate market can provide a range of advantages that are hard to overlook. Owning properties not only offers the potential for financial growth but also brings a sense of stability and security that many other options simply can’t match.

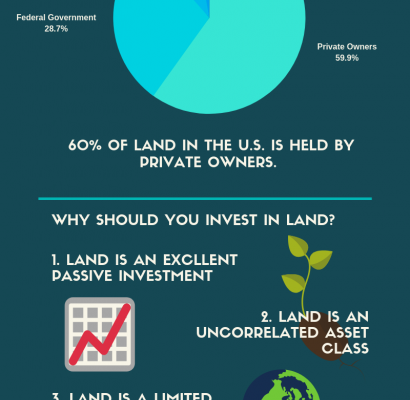

One of the most appealing aspects is the opportunity for passive income. By leasing out properties, you can establish a steady stream of revenue that can supplement your finances or achieve financial independence over time. Moreover, as the value of your properties appreciates, so too does your overall portfolio strength, allowing for lucrative future decisions.

Real estate also serves as an effective hedge against inflation. As the prices of goods and services rise, so too does the value of your holdings. This means that your investments can retain their purchasing power, unlike cash sitting in a bank account, which may dwindle in value over time.

Additionally, there are numerous tax advantages linked with property ownership. Many owners benefit from deductions on mortgage interest, property taxes, and even certain expenses related to managing their properties. This can significantly improve your cash flow and overall returns.

Lastly, engaging in this field can foster a sense of community involvement. By improving properties and neighborhoods, you can directly impact the quality of life for residents and enhance the overall environment, creating a win-win scenario for both you and the community at large.

Risks and Challenges of Property Ownership

Owning a piece of property can be an exciting venture, but it also comes with its fair share of hurdles. From unexpected expenses to regulatory issues, there are many factors that potential owners should consider before making a commitment. Understanding these potential downsides can help individuals prepare and possibly even mitigate some of the associated risks.

One of the primary concerns is maintenance costs. Properties require upkeep, and failure to address issues promptly can lead to more significant and expensive problems down the line. Whether it’s a leaky roof or overgrown vegetation, unforeseen repairs can quickly add up, impacting your budget.

Market fluctuations also pose a considerable risk. The value of a parcel can change dramatically over time based on economic conditions and demand. This unpredictability means that, while the initial purchase might seem promising, the financial outcome isn’t always guaranteed. Be prepared for the possibility that your asset might not appreciate as expected, or may even lose value.

Additionally, some individuals face zoning restrictions and regulations that limit how they can use or develop their property. Local laws can significantly impact your plans, so it’s crucial to research and understand these regulations before diving in. Ignoring this component can lead to frustration and potential financial loss.

Lastly, there’s the issue of environmental risks. Depending on the location, properties can be susceptible to natural disasters, pollution, or other hazards that can threaten both safety and value. These concerns might require additional insurance or reforms, adding another layer of complexity to ownership.