Evaluating the Investment Potential of KMI Stock for Your Portfolio

When contemplating potential opportunities in the financial market, it’s essential to examine various elements that could influence your decision. Investors often find themselves evaluating parameters such as company performance, market trends, and overall sector health. Each of these factors can provide insight into whether a particular acquisition aligns with your financial goals.

In today’s fast-paced trading environment, making informed choices can be challenging. With countless options available, determining which entities possess strong fundamentals, growth potential, and resilience becomes crucial. By delving into the specifics of a certain entity’s recent developments and projections, one can gain a clearer picture of what lies ahead.

Ultimately, the journey to understanding whether to engage with a specific entity requires a combination of research, analysis, and a keen eye for emerging opportunities. Engaging with this process can lead to more informed decisions, potentially paving the way for fruitful results in your investment endeavors.

Analyzing KMI’s Market Performance

The evaluation of a company’s financial standing and overall performance in the market can provide valuable insights for potential investors. It’s essential to scrutinize various factors influencing its position, including recent trends, revenue generation, and broader economic indicators. Understanding these elements helps in forming a well-rounded perspective on the company’s future potential.

One significant aspect to consider is the consistency of earnings and how they align with market expectations. Strong revenue growth accompanied by effective management practices often reflects positively on a company’s ability to navigate challenges. Additionally, examining the company’s balance sheet reveals vital information regarding its debt levels and liquidity, which are crucial for long-term sustainability.

Moreover, fluctuations in stock prices can be reflective of market sentiment and external influences like regulatory changes or shifts in consumer behavior. Sometimes, a deep dive into historical performance can uncover patterns that might aid in predicting future movement. Coupling this with industry comparisons can further clarify where the company stands relative to its competitors.

Engaging with expert analyses and market forecasts can also shed light on the anticipated trajectory of the corporation. Keeping an eye on upcoming projects or expansions can provide context on growth potential, while dividends can indicate financial health and shareholder satisfaction. Ultimately, understanding these dynamics equips investors with the knowledge they need to make informed decisions.

Factors Influencing KMI’s Investment Appeal

When considering where to place your funds, it’s essential to look at various elements that can impact the attractiveness of a particular entity. Several aspects play a crucial role in shaping perceptions and influencing decisions. From financial health to market trends, these factors can significantly affect potential returns.

Market Conditions: The broader economic environment can significantly sway investment choices. Changes in interest rates, inflation levels, and overall market stability determine how attractive a particular option might appear. Investors often seek opportunities that align with favorable economic indicators.

Company Performance: Analyzing a company’s financial statements and growth trajectories is vital for making informed decisions. Metrics such as revenue growth, profit margins, and debt levels can provide insights into operational efficiency and potential for future expansion.

Regulatory Environment: Government policies and regulations can also influence the viability of an investment. Changes in laws or regulatory frameworks can present both challenges and opportunities, making it essential to stay updated on legislative developments that may affect the industry.

Dividends and Returns: The appetite for regular income can motivate many investors. Assessing dividend yields and historical payout trends is crucial when evaluating long-term prospects. A reliable stream of income can be particularly appealing in uncertain times.

Technological Advancements: In today’s fast-paced world, innovation plays a pivotal role. Companies that embrace new technologies and adapt to evolving trends often perform better than those that do not. Keeping an eye on how a specific player integrates advancements can provide a competitive edge.

By considering these various factors, investors can gain a more comprehensive view of what makes a particular opportunity worth exploring. It’s not merely about numbers; it’s about understanding the broader context in which an entity operates.

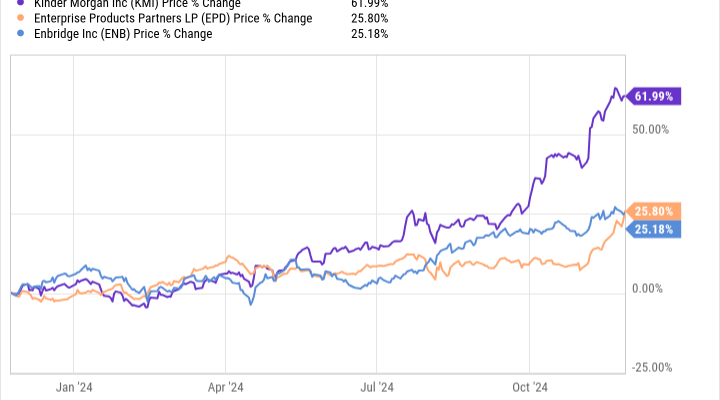

Comparative Review of KMI and Competitors

When considering an investment in the energy sector, it’s essential to analyze various players in the market and see how they stack up against one another. Each company has its own strengths and weaknesses, which can significantly impact an investor’s decision. This section focuses on comparing one particular entity with its competitors, highlighting performance metrics, strategic initiatives, and market positioning.

First, let’s delve into financial performance. This particular entity has shown consistent revenue growth over the past few years, whereas some rivals have struggled to maintain stability in their earnings. Furthermore, looking at profitability margins, you’ll find that certain competitors are either keeping pace or even outperforming in specific areas, creating an intriguing landscape for potential investors.

Next, consider the approach to innovation and technology adoption. A few firms in this industry are investing heavily in renewable energy solutions, which is a strategic pivot aimed at addressing regulatory changes and shifting consumer preferences. This entity, however, appears to be maintaining a more traditional model, which could be viewed as a risk or a benefit, depending on the investor’s long-term outlook.

Lastly, let’s discuss market share and competitive advantages. This player has carved out a significant niche, but some alternative options boast larger market capitalization and broader geographical reach. Evaluating these factors is crucial for anyone looking to navigate this dynamic market effectively.