Exploring the Investment Potential of JEPI and Its Long-Term Viability

When it comes to navigating the complex world of finance, many individuals find themselves questioning the value of certain products in their portfolio. With a plethora of options available, determining which assets might yield favorable returns can feel overwhelming. Today, we’ll dive into one particular option that has been generating buzz among investors and analysts alike.

Understanding the nuances of any financial vehicle is crucial before making the leap. This means considering various factors such as performance metrics, market conditions, and your personal financial goals. The allure of potential gains often leads to excitement, but it’s essential to maintain a balanced perspective and conduct thorough research.

In this discussion, we’ll analyze the features and characteristics of this intriguing entity, aiming to clarify whether it deserves a spot in your financial strategy. By the end of our exploration, you’ll be equipped with insights that help you make informed decisions about this asset.

Understanding JEPIs Investment Potential

When exploring financial options, it’s important to evaluate various elements that contribute to their appeal and viability. In this section, we’ll delve into crucial aspects that can impact an asset’s performance and its ability to generate favorable returns. An analysis of trends, historical data, and market behavior can help paint a clearer picture of what investors might expect.

One primary factor to consider is the income generation mechanism associated with this particular asset. By examining how it distributes returns and the frequency of those distributions, one can gain insight into its attractiveness for those seeking consistent earnings. Additionally, understanding the correlation between the underlying assets and broader market conditions is vital, as it can reveal how resilient this option may be during varying economic climates.

Another important aspect is the risk profile tied to this financial choice. Assessing potential volatility and comparing it to similar opportunities in the market will provide a framework for understanding the level of caution one may need to exercise. As with any financial decision, being aware of both the downsides and benefits is crucial for making an informed choice.

Lastly, considering the historical performance and tracking relevant metrics can offer additional clarity. Past trends, while not always indicative of future outcomes, can serve as benchmarks for potential performance. By analyzing how this option has fared during different market conditions, one can develop a more nuanced perspective on whether it aligns with personal financial goals.

Comparative Analysis with Traditional Assets

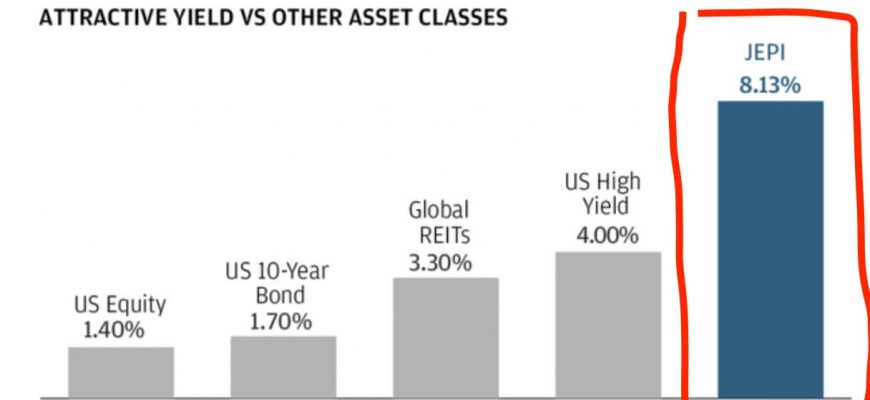

When considering various avenues for capital allocation, it’s essential to examine how newer financial instruments stack up against the time-tested options that have been around for decades. This analysis seeks to explore the intricacies that define these alternatives, highlighting their distinctive features, advantages, and potential drawbacks in comparison to widely recognized assets such as stocks and bonds.

One of the most intriguing aspects of modern financial options is their structure and yield potential. Traditional stocks may fluctuate based on market sentiment, corporate performance, and economic indicators, while other instruments often provide more predictable outcomes with a different risk profile. This can be particularly appealing for those seeking stability amidst market volatility. In essence, the choice often boils down to an investor’s risk tolerance and financial objectives.

Moreover, liquidity plays a crucial role. Conventional assets typically offer established markets with well-defined trading volumes, making it easier to buy and sell as needed. On the other hand, emerging options might introduce varying degrees of liquidity, which could impact an individual’s ability to access their funds quickly. Understanding these nuances is key to making informed decisions.

Additionally, the factors influencing pricing mechanisms can vary significantly. Traditional assets often react to economic signals, while newer products might be influenced more by speculative trends and investor behavior. This divergence can lead to unique opportunities and risks that savvy players in the market need to navigate carefully.

Finally, consider the diversification benefits. By incorporating diverse types of assets into a portfolio, one might reduce overall risk. This strategy is fundamental for anyone looking to balance growth potential with risk management. The blend of conventional and modern options can create a robust foundation for achieving financial aspirations.

Risks and Rewards of JEPIs

When considering whether to dive into a particular financial vehicle, it’s essential to weigh both the potential benefits and the inherent dangers. Understanding the balance between rewards and risks can provide clarity and help you make informed choices. In this context, let’s explore what this specific option has to offer.

On one hand, the allure of attractive returns can be compelling. Many investors are drawn to the possibility of earning a significantly higher yield compared to traditional savings accounts or bonds. The opportunities for capital appreciation can create a sense of excitement and hope for a prosperous future.

However, along with those appealing prospects come certain uncertainties. Market fluctuations, economic changes, and other external factors can impact performance and lead to losses. It’s vital to recognize that high returns often come with increased volatility, which may not be suitable for everyone.

In summary, weighing the benefits against the risks is crucial. A thoughtful approach can help you navigate through the complexities of this financial avenue and potentially lead to a rewarding experience.