Exploring the Potential of IWM as a Promising Investment Opportunity

When considering options in the ever-evolving financial arena, it’s crucial to evaluate various avenues that could lead to fruitful outcomes. Investors are often faced with a plethora of choices, each presenting unique risks and rewards. So, how do you determine which paths might yield favorable results?

Understanding market dynamics, historical performance, and overall economic indicators can provide valuable insights. One particular vehicle has garnered attention lately, prompting discussions about its viability and whether it aligns with the financial goals of savvy stakeholders. The question remains: is this choice a step towards wealth accumulation or simply a fleeting trend?

As we dive deeper into the attributes of this financial option, we’ll explore its structure, examine past performance, and assess potential implications for future growth. After all, making informed decisions can elevate the investing experience, transforming opportunities into substantial gains.

Analyzing Historical Performance

When diving into the past performance of certain financial instruments, it’s vital to look at various metrics and trends that reveal how they’ve fared over time. By examining price movements, volatility, and responses to market events, investors can glean insights that might help in making future decisions. Historical data serves as a crucial foundation for understanding potential risks and rewards.

One key aspect to consider is the trend trajectory. Analyzing how the price has fluctuated through different economic cycles can provide a clearer picture of resilience and adaptability. For instance, periods of economic downturn can highlight how well the asset holds up against adversity, while upswings reveal its capability to take advantage of bullish conditions.

Furthermore, it’s important to evaluate the consistency of returns. Regular patterns of growth or decline can indicate stability or turbulence within the market the asset is associated with. This consistency, or lack thereof, is what helps build a narrative around reliability, appealing to those who prefer a more stable approach to financial endeavors.

Lastly, context matters. Comparing performance against benchmarks or similar assets allows investors to contextualize results and determine if trends are indicative of broader market movements or are unique to the given instrument. This informed perspective can significantly influence decision-making for anyone considering future participation in the market.

Factors Influencing Market Value

Market value isn’t just a number; it’s shaped by a variety of elements that play crucial roles in determining how an asset performs over time. Understanding these influences can help you make more informed decisions regarding your financial strategies. Let’s dive into some key factors that contribute to the fluctuations in this specific market segment.

First off, economic indicators are vital. Metrics like GDP growth, unemployment rates, and consumer spending significantly impact investor sentiment. When the economy shows strength, it often leads to increased confidence among traders, driving prices higher. Conversely, economic downturns can lead to caution and sell-offs.

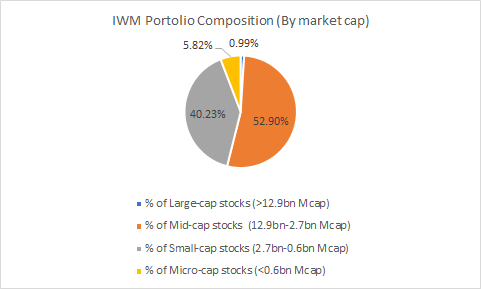

Another important factor is the performance of small-cap companies. As this segment often comprises companies that have more volatile earnings compared to larger firms, their performance can create ripples across the entire market. Positive earnings reports from these businesses can attract more buyers, while negative news can trigger a sell-off.

Additionally, changes in interest rates tend to have a significant effect. When central banks adjust rates, it can alter the borrowing costs for companies and consumers. Lower rates generally encourage spending and investment, while higher rates may lead to a slowdown, affecting market sentiment.

Market sentiment itself plays a pivotal role. Factors like geopolitical events, market trends, and overall investor mood can lead to rapid changes in demand. If traders feel optimistic, it can lead to price surges, whereas uncertainty can result in declines.

Finally, liquidity should not be overlooked. The ease with which an asset can be bought or sold without affecting its price is crucial. A high degree of liquidity typically attracts more investors, increasing market stability and potentially driving values upward.

Pros and Cons of Investing in IWM

When considering where to place your financial resources, it’s essential to weigh the advantages and disadvantages. Each option has its merits and drawbacks, and understanding these can help guide your decision-making. Let’s explore some critical points you should keep in mind.

Advantages:

One significant benefit is diversification. By allocating funds to this particular asset, you can spread risk across various sectors, which may lead to a more stable portfolio. Additionally, many investors appreciate the potential for higher returns, especially when the market favors small-cap companies. This component often attracts those looking for growth opportunities, particularly during bullish market phases.

Moreover, accessibility plays a pivotal role. With relatively low barriers to entry, these types of assets can be attractive for both novice and seasoned investors. The transaction costs are generally lower compared to direct stock purchases, making it a budget-friendly choice.

Disadvantages:

On the flip side, the volatility of such assets can be unsettling. Since small-cap stocks are often subject to more significant market fluctuations, your capital may experience larger swings in value. This unpredictability can be stressful for those who prefer a more stable approach.

Another consideration is performance consistency. While potential rewards are enticing, it’s worth noting that not every market cycle favors small-cap ventures. There might be prolonged periods when performance lags behind larger, more established companies.

In summary, like any financial strategy, this option comes with both appealing features and notable risks. Being well-informed will help you determine if it aligns with your financial goals.

What a breathtaking presence! Her beauty and grace light up the screen in this mesmerizing video.