Exploring the Benefits and Drawbacks of IUL as an Investment Option

When considering ways to grow your wealth, it’s important to explore various options that can offer both security and potential returns. One intriguing choice has emerged, piquing the interest of individuals looking to balance risk and reward. This particular financial product combines features of both insurance and savings, creating a hybrid that appeals to many.

In today’s ever-changing economic landscape, the need for a strategy that not only protects your assets but also enables growth is more critical than ever. This option stands out as a versatile tool, allowing policyholders to benefit from market performance while enjoying a degree of stability. But how does it really work, and is it the right fit for your financial goals?

As we delve deeper into this topic, we’ll uncover the advantages and disadvantages, shedding light on its mechanics and potential outcomes. By the end of our exploration, you’ll have a clearer understanding of whether this financial alternative aligns with your aspirations for the future.

Understanding Indexed Universal Life Insurance

When it comes to financial planning, finding a solution that provides both protection and potential growth can be quite the challenge. One option that often comes up is a type of life insurance that combines a death benefit with a chance to accumulate cash value. This unique product offers policyholders the flexibility to adjust their premiums and death benefits, making it an intriguing choice for many.

The appeal of this insurance comes from its dual nature. On one hand, it offers a safety net common to traditional life insurance. On the other, it provides the opportunity to link the cash value growth to a stock market index, which can lead to returns that are often more favorable than standard savings accounts.

Many people are drawn to this approach because it allows for the possibility of growth while protecting against market downturns. The cash value can be accessed through loans or withdrawals, giving individuals a degree of control over their finances. However, it’s important to carefully navigate the fees and potential impacts on the death benefit when considering this route.

Overall, the combination of insurance coverage with potential cash accumulation makes this financial tool an interesting alternative for those looking to diversify their long-term strategy. As with any financial product, thorough research and understanding are key before making a decision.

Pros and Cons of Indexed Universal Life Policies

When considering various financial products, it’s essential to weigh their advantages and disadvantages. This specific type of policy offers unique features that appeal to many, but it’s not without its drawbacks. Understanding both sides can help you make an informed decision that aligns with your financial goals.

One of the main benefits of this type of plan is the potential for cash value growth, tied to a stock market index. This allows for some exposure to market gains while usually offering a level of protection against losses. Additionally, the flexibility in premium payments and death benefit options can cater to individual needs over time. Many appreciate the tax-deferred growth and the possibility of accessing cash value during their lifetime.

On the flip side, there are significant downsides to consider. Fees can be quite high, affecting overall returns and causing frustration for policyholders. The complexity of these financial products might lead to misunderstandings about how they function. Additionally, the caps on returns can limit potential gains, leaving some feeling that they missed out. Finally, relying heavily on a single product for financial planning can be risky, especially if market conditions shift unexpectedly.

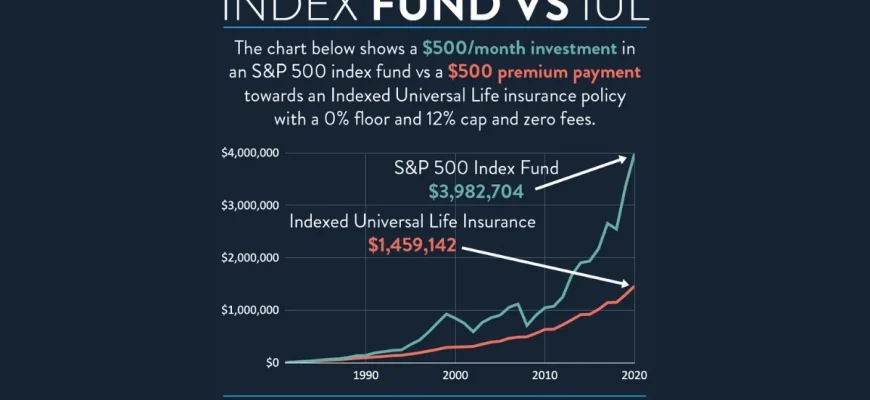

Comparing IUL to Other Investment Options

When it comes to choosing a financial strategy, there are many paths one can take. Each option comes with its own set of benefits and challenges, making the decision a personal one. It’s essential to weigh these choices against your individual goals and risk tolerance. In this section, we will explore how one particular type of policy measures up against traditional routes such as stocks, bonds, and real estate.

For starters, let’s consider the stock market. Investing in shares can offer significant growth opportunities, especially over the long term. However, the volatility can be daunting; market fluctuations can lead to considerable losses if not monitored closely. On the flip side, certain types of policies can provide a buffer against this risk, allowing for growth without the constant anxiety of market swings.

Bonds present another contrast. Known for their stability and predictable returns, they are often viewed as a safe haven during market turbulence. Yet, the trade-off is usually lower potential growth compared to equities. In comparison, insurance solutions may offer a blend of protection and the chance for upside, making them appealing for those who prioritize security alongside growth.

Finally, real estate brings a unique angle with its potential for appreciation and rental income. However, it requires significant capital and ongoing management, which could be daunting for some. This type of financial strategy might not be as accessible to those looking for simplicity and lower commitment, whereas alternatives can provide a more structured approach to accumulating wealth.

Ultimately, the choice depends on your personal financial outlook, goals, and comfort level with risk. Comparing these options gives insight into what might align best with your aspirations, helping you make an informed decision on the right strategy for your future.