Evaluating the Investment Potential of Invesco QQQ for Savvy Investors

When it comes to navigating the vast world of financial markets, many individuals seek out specific vehicles that offer an opportunity to harness the power of leading companies in the tech sector. As more people explore options for their portfolios, certain exchange-traded funds (ETFs) consistently steal the spotlight. The question often arises: is it worth considering this specific fund as part of your financial strategy?

The allure of this particular fund stems from its focus on high-growth technology stocks, which have been the pulse of the market in recent years. Understanding its structure and performance can provide valuable insights into whether it aligns with your own financial objectives. Many potential investors find themselves weighing the potential rewards against the inherent risks of such a concentrated approach.

Before diving in, it’s essential to consider various aspects, such as historical returns, market trends, and individual risk tolerance. Conducting thorough research can help clarify whether this vehicle fits your broader financial goals. Engaging with experts’ opinions and employing analytical tools further enriches the decision-making process.

Performance Analysis of Invesco QQQ

When exploring the landscape of popular financial instruments, it’s essential to examine their historical track record and how they’ve navigated various market conditions. This segment aims to shed light on the performance of a specific fund that tracks the tech-heavy index, highlighting its strengths, weaknesses, and overall trends.

Over the years, this fund has exhibited significant growth figures, often outpacing traditional benchmarks. One of the driving forces behind its rise is the inclusion of major players in the technology sector, which have demonstrated robust earnings growth and market leadership. This advantage often leads to higher returns compared to more diversified portfolios.

However, it’s crucial to consider the inherent volatility associated with tech-centric investments. Prices can swing dramatically based on market sentiment, regulatory changes, and global economic trends. Investors interested in this fund should be prepared for short-term fluctuations while keeping an eye on long-term gains.

On a comparative basis, this fund has shown resilience during economic downturns, often recovering faster than its peers. Factors contributing to this resilience include strong brand presence and innovative capabilities of the underlying companies. Such performance metrics can paint a favorable picture for those weighing their options.

In conclusion, analyzing the trajectory and resilience of this fund can provide valuable insights for those contemplating their strategies. Understanding past performance is fundamental to making informed decisions for the future.

Investment Risks and Considerations

When exploring opportunities in the financial markets, it’s essential to acknowledge the potential hazards and factors that could impact your financial journey. Regardless of where you choose to allocate your resources, understanding the landscape of risks can help you navigate the complexities involved.

Market Volatility is a key consideration. Prices can fluctuate dramatically in response to changes in economic conditions, investor sentiment, or global events. This unpredictability can lead to sudden losses or gains, making it vital to be prepared for such shifts.

Another important aspect is sector concentration. Certain vehicles may be heavily weighted in specific industries, exposing you to challenges if those sectors suffer downturns. Diversifying your portfolio can help mitigate this risk, but it requires thoughtful planning and research.

Additionally, management fees and other costs associated with maintaining a position can eat into your returns over time. It’s wise to be aware of these expenses and how they can influence your overall financial outcome.

Finally, consider your own risk tolerance. Everyone has a different comfort level when it comes to exposure to losses, so it’s crucial to reflect on what you can endure emotionally and financially. Setting clear goals and understanding your personal limits can lead to more informed decisions.

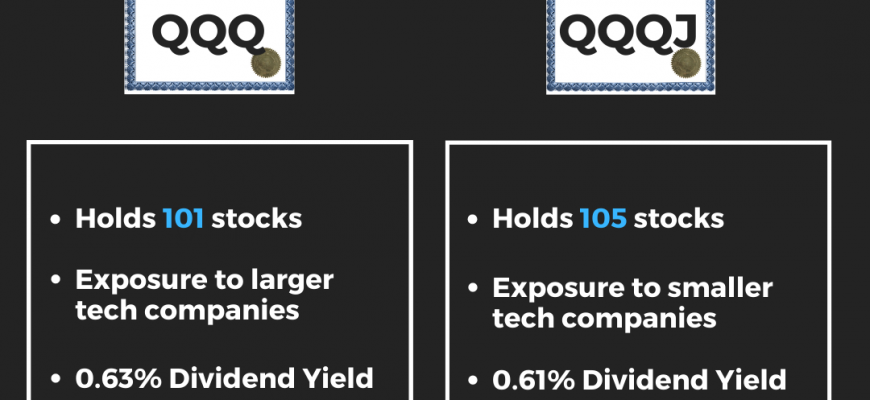

Comparing QQQ with Other ETFs

When it comes to exploring options in the world of exchange-traded funds, many investors find themselves evaluating different products based on various criteria. In this section, we will take a closer look at how this particular fund stacks up against its peers, focusing on aspects like performance, fees, and sector exposure. Each fund offers unique characteristics that cater to different investment strategies, and understanding these differences can help you make more informed choices.

One of the key factors to consider is the historical performance of the selected funds. Many investors gravitate towards those that have shown consistent growth over time. Comparing the return on investment between this fund and others can shed light on potential risks and rewards. It’s essential to examine not just short-term gains, but also long-term trends to get a holistic view.

Fees are another significant aspect to analyze. Lower expense ratios can contribute to higher net returns over time, so evaluating the cost structure among various ETFs is crucial. Some may have hidden fees that can eat into your profits, while others may offer more transparent pricing models.

Sector exposure can play a vital role in your overall portfolio diversification. This specific fund has a strong emphasis on the tech sector, which can lead to different performance dynamics compared to funds that prioritize other industries. Understanding the correlation between different sectors and your overall investment goals will help you to construct a well-balanced portfolio that aligns with your risk tolerance and time horizon.

In summary, comparing this fund with other ETFs involves a comprehensive look at multiple factors that affect performance and strategy. By doing thorough research and analysis, you can find the right balance that suits your financial aspirations.