Exploring the Potential of Hims Stock for Investment Opportunities

When it comes to navigating the world of market investments, enthusiasts often find themselves weighing various factors that might influence their decisions. An intriguing company has recently captured the attention of many investors, sparking discussions around its future performance. With a unique approach to addressing contemporary challenges, this entity has carved out a niche that warrants closer examination.

Investors are eager to understand the underlying fundamentals that could impact the overall trajectory of this organization. Key metrics, market trends, and industry positioning all play a vital role in shaping opinions. Furthermore, innovations and customer responses could signal whether this venture is poised for growth or facing potential hurdles.

As we delve deeper into this analysis, it’s essential to explore not just the numbers, but also the broader implications of engaging with this venture. With so many moving parts, determining the viability of an investment in this company will require a thoughtful assessment of various elements that contribute to its market footprint.

Analyzing Hims’ Market Performance

When diving into the financial landscape of a particular company, it’s essential to take a closer look at its recent performance and overall market standing. Understanding various metrics and trends helps potential investors make informed choices. In this section, we will explore how this entity has been faring in a competitive environment and what factors might influence its future trajectory.

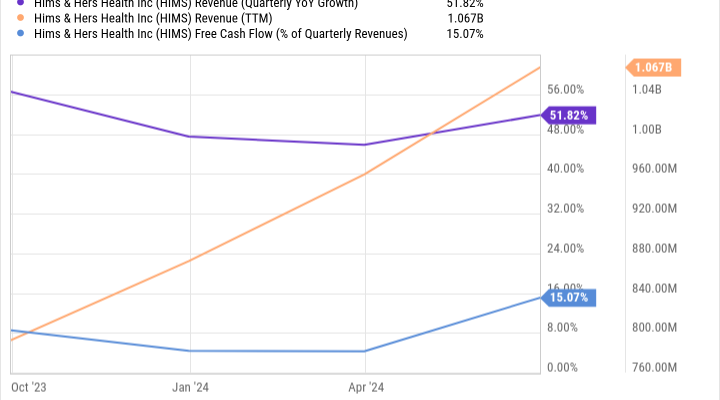

The company has shown interesting fluctuations in its valuation, reflecting both challenges and opportunities inherent in its sector. Sales growth and customer acquisition rates are pivotal indicators that warrant attention. Moreover, the effect of broader economic trends, such as consumer spending habits and industry innovations, cannot be overlooked, as they play a substantial role in shaping the company’s financial health.

Additionally, examining quarterly earnings reports offers valuable insights into operational efficiency and profitability. Analysts often focus on key performance indicators that highlight not just revenue, but also the sustainability of the business model. The interplay between costs, margins, and market demand serves as a lens through which one can gauge the organization’s resilience and adaptability.

Finally, external factors, including regulatory developments and competitive dynamics, further complicate the picture. Keeping an eye on how these elements intersect can provide a clearer understanding of potential risks and rewards associated with engaging with this business. It’s all about painting a comprehensive picture that helps to illuminate possible future outcomes.

Future Growth Potential of Hims

When considering the prospects of a particular company, it’s essential to delve into its growth trajectory and market strategies. This entity has carved a niche in its field, catering to a demographic increasingly interested in innovative healthcare solutions. The ongoing trend towards telemedicine and personalized wellness indicates a favorable environment for expansion.

The brand’s approach focuses on direct-to-consumer marketing and an accessible online presence, making healthcare more reachable for many. As societal attitudes shift towards proactive health management, the potential for their offerings to gain traction is significant. Moreover, partnerships with various healthcare providers could pave the way for enhanced services, further amplifying growth opportunities.

In an era driven by technology, the integration of artificial intelligence and data analytics could transform how the company interacts with clients, tailoring services to individual needs. This adaptability positions the brand well to capitalize on emerging trends and consumer behaviors, ensuring a dynamic response to an ever-evolving market.

Overall, the combination of innovation, customer-centric solutions, and a commitment to addressing modern health challenges suggests a promising horizon for this player in the wellness industry.

Risks Associated with Investing in Hims

When considering a financial commitment in a specific company, it’s vital to be aware of potential pitfalls that could impact your investment journey. Every enterprise carries its own set of uncertainties, and being informed can help you navigate through them effectively. This is especially true in the dynamic landscape of healthcare and consumer wellness, where factors can shift rapidly.

One major concern lies in market competition. The industry is characterized by numerous players vying for market share, which can lead to price wars and reduced margins. Additionally, regulatory changes can significantly affect operations; any new laws or modifications to existing regulations might create hurdles that affect profitability. It’s essential to keep an eye on how such factors could influence performance over time.

Financial health is another critical aspect. Investors should thoroughly scrutinize balance sheets, cash flow statements, and income sources. High debt levels can lead to increased vulnerability during economic downturns, impacting the ability to sustain growth. Moreover, revenue volatility can pose challenges, especially if the company relies heavily on a few key products or services.

Lastly, there are external factors like shifts in consumer preferences and technological advancements. The landscape can change quickly, and what is popular today might not hold the same appeal tomorrow. Staying updated on these trends is crucial for understanding the future potential of any investment.

Every second of this video had me glued to the screen. It’s amazing how you keep everything so fresh!