Exploring the Potential of Gold as an Investment Opportunity in the UK Market

When it comes to securing one’s financial future, many people ponder over the best avenues to explore. With countless options available, it’s natural to find oneself in a dilemma. Among the popular choices, a certain shimmering element often stands out as a potential harbor during turbulent economic times. Curious about how this metal stacks up against other options? Let’s delve into the various aspects that make it a topic of interest for many savvy individuals.

The allure of this timeless commodity can be traced back centuries. Whether it’s the glimmering aesthetics or the perceived safety it offers during market fluctuations, there are plenty of reasons people consider it as a part of their portfolio. Yet, the question remains: does it truly hold its value and can it provide financial security in the long run? Exploring the intricacies will unveil some fascinating insights.

In an ever-changing economic landscape, understanding the dynamics behind this asset is crucial. It’s not merely about following the crowd; it’s about making informed decisions. Looking at historical trends and current market behaviors can provide a clearer picture of whether this metallic option is a worthy choice in the UK context. Ready to explore further? Let’s dig into the details that matter.

Understanding Market Trends in Precious Metals

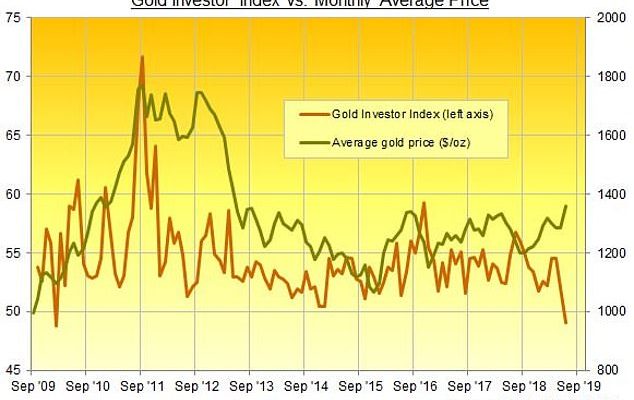

When it comes to navigating the world of valuable assets, many people find themselves intrigued by the fluctuations and patterns that characterize these resources. It’s essential to recognize the various factors that influence their worth over time. By examining historical data and current developments, we gain insight into how these assets perform and what drives their appeal.

Economic indicators play a significant role in shaping the value of such resources. For instance, inflation rates, currency strength, and geopolitical events can create shifts that affect buyer sentiment. Many individuals look to these types of assets as a hedge against uncertainty, making understanding such trends crucial for those considering diversifying their portfolios.

Additionally, supply and demand dynamics significantly impact prices. When exploration and mining activities face challenges, or if there’s a surge in interest from collectors and industries, the market can react dramatically. Observing these nuances enables one to make informed decisions and time actions effectively.

Moreover, sentiment in the broader financial landscape cannot be overlooked. Market psychology often leads to fluctuations that may seem irrational at times; however, they reflect collective attitudes and expectations. Staying attuned to these shifts can provide valuable insights into how the environment surrounding these assets evolves.

In summary, recognizing the trends within the market not only helps in understanding the past but also sheds light on potential future movements. By keeping an eye on economic situations and societal attitudes, one can grasp the intricate dance that defines the realm of precious resources.

Factors Influencing Precious Metal Prices in the UK

When considering the value of a certain shimmering asset in the UK, it’s essential to understand the various elements that can cause its price to fluctuate. Multiple variables contribute to the dynamics of the market, impacting how people perceive and engage with this asset over time.

Economic Indicators: One significant aspect is the state of the economy. Indicators such as inflation rates, employment figures, and GDP growth all play a role in shaping public sentiment. When the economy faces challenges, many turn to secure assets, driving prices upwards.

Geopolitical Events: Additionally, global uncertainties can significantly sway the market. Conflicts, elections, and diplomatic tensions can lead investors to seek safety in more stable choices, pushing demand and consequently, pricing higher.

Currency Value: The strength of the British pound against other currencies also influences the price of this shiny asset. When the currency weakens, the cost of acquiring it often increases for local buyers, leading to a potential rise in perceived value.

Market Speculation: Speculation by traders can lead prices to swing dramatically. When sentiment is optimistic or pessimistic, traders act accordingly, causing rapid shifts in valuation based on market predictions or trends.

Supply and Demand: Lastly, the basic economic principle of supply and demand cannot be overlooked. Changes in mining output or discovery of new reserves can impact availability. Simultaneously, trends in consumer behavior, such as increasing interest in sustainability, may further influence how much people are willing to pay.

Long-Term Benefits of Gold Ownership

Owning precious metals can be a rewarding strategy for those looking to secure their financial future. This practice has stood the test of time, proving to be a reliable option across generations. Many individuals appreciate the stability it offers, especially during uncertain economic times.

One of the most appealing aspects is the hedge against inflation. When currency values fluctuate, these valuable assets tend to maintain their worth, providing a safeguarding element that can offset potential losses in other areas. This characteristic often makes them a preferred choice among those seeking to preserve their purchasing power.

Additionally, holding physical assets can bring peace of mind. Unlike digital currencies or stocks, tangible items don’t rely on technology or third-party systems. Many find comfort in knowing they possess something substantial that can’t be easily devalued or manipulated.

Furthermore, this type of possession can often enhance a diversified portfolio. By including various asset classes, individuals can reduce risks and potentially increase overall returns. It’s a strategy that many seasoned financial planners recommend for long-term stability.

Finally, the allure of these metals often extends beyond finance. They have a historical and cultural significance that resonates with many. The appreciation for their beauty and craftsmanship can bring personal fulfillment, enriching the ownership experience beyond mere numbers.