Exploring the Potential of GCT as a Promising Investment Opportunity

When it comes to investing in a particular enterprise, many factors come into play. Enthusiasts and experienced financiers alike often seek to determine the potential for future growth and profitability. With a plethora of options available, the decision can be both exciting and daunting, especially when trying to gauge the overall potential of a specific asset.

To navigate this landscape, it’s essential to examine not only the financial performance and market positioning of the entity in question but also the broader economic climate and industry trends. Insights can come from various sources, making it crucial to critically analyze the information at hand. One should consider aspects such as recent developments, competitive advantages, and potential risks that could impact the overall outlook.

Ultimately, the goal is to make informed decisions based on a balanced assessment. By delving deeper into the underlying factors that affect market performance, one can better understand whether this opportunity aligns with their investment strategy. Let’s take a closer look and weigh the pros and cons of this intriguing option.

Analyzing GCT’s Market Performance

When it comes to evaluating a company’s standing in the financial arena, there are several key factors to consider. It’s essential to look at trends, metrics, and overall sentiment that drive market behaviors. By delving into the recent performance of this entity, we can gain insights into its potential trajectory.

Recent Trends: Observing the fluctuations in price over recent months provides a clear picture of how the market perceives the firm’s growth and stability. Notably, both upward and downward movements can signal varying levels of investor confidence and external influences affecting market dynamics.

Financial Metrics: Key indicators such as earnings reports, revenue growth, and profit margins paint a vivid landscape of the organization’s financial health. A consistent upward trend in these metrics may inspire confidence, while any signs of stagnation could raise concerns among potential investors.

Market Sentiment: It’s also worth noting how public perception and media coverage can shape the narrative surrounding an entity. Enthusiastic endorsements or critical reports can significantly influence investor decision-making, impacting the overall performance in the competitive market.

In summary, by closely examining these aspects, one can develop a more informed perspective regarding the potential implications of engaging with this particular entity. Understanding the nuances of market behavior is crucial for anyone looking to navigate the complexities of investment opportunities.

Investment Risks and Considerations

When diving into the world of financial opportunities, it’s essential to keep an eye on the potential challenges that might arise. Navigating the complexities of any asset involves understanding that not every decision leads to profit. There are factors at play that can significantly impact your financial journey, and being aware of them can make all the difference.

Market volatility is one of the key elements to consider. Prices can fluctuate based on a variety of influences, from economic reports to global events. This unpredictability can cause unease among investors, especially if the market takes an unexpected turn. It’s crucial to have strategies in place to manage such fluctuations and avoid hasty decisions fueled by panic.

Additionally, external conditions, such as government policies or changes in industry regulations, can affect the performance of an investment. Being informed about current events and understanding how they relate to your portfolio can better prepare you for potential shifts that may challenge your initial assumptions.

Lastly, personal risk tolerance plays a significant role in the decision-making process. Everyone has a unique comfort level when it comes to handling uncertainty. Prioritizing what aligns with your financial goals and emotional readiness can lead to more satisfying outcomes. Taking time to evaluate your position and assessing the landscape can provide greater clarity as you move forward.

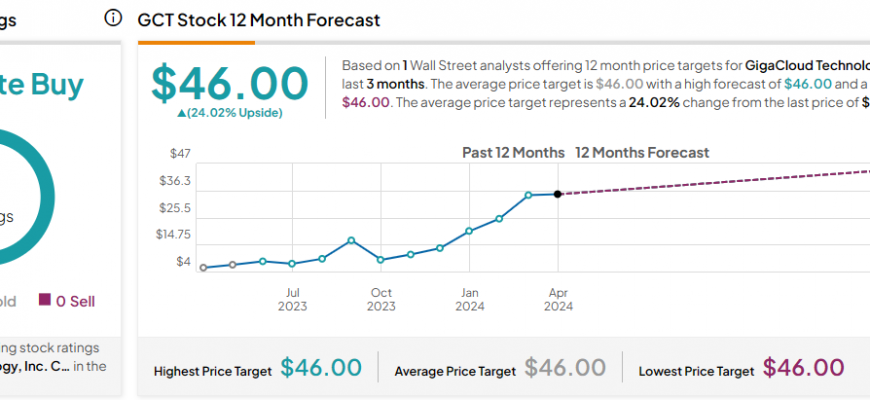

Expert Opinions on GCT Stock

In the realm of investment, insights from seasoned professionals can significantly shape one’s decision-making process. Analyzing the performance of a particular entity often requires delving into various expert evaluations that highlight potential risks and rewards. Understanding these perspectives can provide valuable context for prospective investors.

Market analysts have expressed a range of views, with some highlighting the potential for growth driven by recent developments within the company. They emphasize the innovative strategies implemented by the management team, asserting that these measures could lead to increased market share and profitability in the long run.

Conversely, financial advisors caution that there may be underlying challenges that could impede progress. They urge potential investors to consider factors such as market volatility and external economic conditions, which could influence performance unpredictably. This approach encourages a well-rounded assessment before making any commitments.

It’s also worth noting that institutional investors, who often have extensive resources and research capabilities, are keeping a close eye on developments. Their interest or lack thereof can be a telling indicator of the prevailing sentiment surrounding the entity in question.

Ultimately, gathering diverse viewpoints is essential for forming a comprehensive understanding of the landscape. By weighing expert opinions, individuals can make informed decisions tailored to their investment strategies and risk tolerance.