Exploring the Potential of FXAIX as a Smart Investment Choice

When it comes to growing your financial assets, many people find themselves considering a variety of options. Each choice brings its own set of advantages and risks, and understanding these can be crucial in shaping your financial future. In this discussion, we will explore a particular fund that has caught the attention of both novice and seasoned investors alike.

It’s important to delve into the specifics of any financial vehicle you may be contemplating. Analyzing its past performance, management structure, and the market conditions can help clarify whether it aligns with your personal financial goals. There are numerous factors to consider, from expense ratios to historical returns, and it’s essential to gather all relevant information.

In the end, the primary goal remains the same: seeking opportunities that can yield favorable outcomes for your portfolio. By looking closely at the characteristics of this fund, you can make a more informed decision and potentially steer your financial journey in the right direction. So, let’s dive deeper into the particulars and see what this option has to offer.

Understanding FXAIX Performance Trends

When it comes to assessing the effectiveness of a financial product, analyzing historical performance is key. Observing patterns and fluctuations can provide insights into potential future behavior, helping individuals make informed decisions. Various factors contribute to these trends, influencing how assets perform over time.

One of the significant aspects to consider is market conditions. Economic indicators, interest rates, and even geopolitical events can have lasting impacts on returns. By looking at these influences, one can gauge how resilient a particular asset might be in different environments. Understanding these dynamics can shed light on periods of growth as well as downturns.

Additionally, examining the asset’s volatility offers valuable insights. Some periods may reveal steady increases, while others might demonstrate more erratic behavior. By studying these variations, investors can align their strategies with their risk tolerance and financial goals. A closer look at the asset’s resilience during challenging times can help determine its stability in a diverse portfolio.

In summary, comprehending performance patterns requires a thoughtful examination of historical data, market influences, and volatility. Understanding these elements can empower individuals to navigate the financial landscape more effectively. As with any financial endeavor, being well-informed is the foundation of smart decision-making.

Evaluating Risks Associated with FXAIX

When considering any financial vehicle, understanding the potential downsides is crucial. Every option comes with its own set of uncertainties that can affect overall performance. The key is to analyze these risks carefully and weigh them against the potential rewards.

Market Volatility is one of the primary factors to consider. Economic shifts, political events, or global crises can lead to sudden price fluctuations that impact value significantly. Investors should be prepared for the possibility of short-term losses during turbulent periods.

Another aspect is management fees. While the expenses associated with this particular choice may be lower compared to actively managed funds, even minor fees can slowly erode profits over time. It’s important to assess how these costs compare to potential returns.

Diversification plays a vital role in risk management. While this option may provide exposure to a broad range of assets, it’s essential to ensure that your overall portfolio isn’t overly concentrated. Balancing different types of assets can help mitigate unexpected downturns.

Lastly, interest rate changes can have a profound effect on the performance of various financial tools. Rising rates often indicate a stronger economy but can lead to declines in bond prices and affect overall returns. Keeping an eye on economic indicators can assist in making informed decisions.

In summary, while examining any financial choice, it’s essential to recognize the various risks involved. By understanding and addressing these potential challenges, individuals can make more informed evaluations about how to proceed.

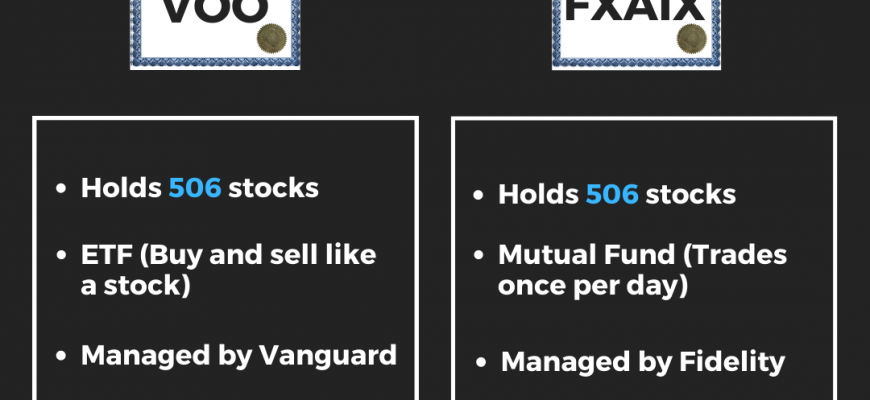

Comparing FXAIX with Other Index Funds

When evaluating various investment options, it’s essential to understand how different index funds stack up against each other. Index funds are popular choices for those looking to gain broad market exposure, but not all are created equal. This comparison will shed light on the features, costs, and performance of a key player alongside its peers in the market.

One primary factor to consider is expense ratios. Funds with lower fees can have a significant impact on long-term returns. Comparing these costs can help investors identify which funds offer the best value. Additionally, it’s crucial to analyze the holdings within each fund; some may emphasize growth stocks, while others might focus on dividends or value investments.

Performance history is another essential aspect. Reviewing how different funds have fared during various market conditions can provide insight into their potential future behavior. It’s also wise to look at tracking error, which measures how closely a fund follows its benchmark index. A smaller tracking error often indicates a fund is effectively mirroring the index, which can be beneficial for those looking to replicate market returns.

Beyond these metrics, assessing the fund manager’s reputation and the firm’s overall stability can add an extra layer of confidence in your choice. Some institutions are known for their robust management practices and customer service, which can enhance the overall experience for investors.

Ultimately, each index fund has unique characteristics that cater to different investor preferences. By carefully analyzing these factors, one can make a more informed decision that aligns with personal financial goals and risk tolerance. Whether seeking aggressive growth or consistent income, the right fund can play a crucial role in achieving overall financial aspirations.