Understanding the Quarterly Distribution of Financial Aid

When it comes to the assistance provided to students, many people wonder about the schedule on which these resources become available. The question of frequency often arises: how often can one expect to receive this support? It’s important to grasp the nuances surrounding this aspect, as it plays a crucial role in planning one’s education financing.

There are various factors that determine the timing and availability of these resources. Each institution tends to have its own approach, influenced by policies, budget allocations, and individual needs. Therefore, understanding the rhythm at which these funds flow can significantly impact your educational journey and financial planning.

In this exploration, we will delve into the details of how these resources are structured and what students can generally anticipate. By dissecting the cycles of disbursement, we hope to provide clarity amidst the often confusing landscape of educational support systems.

Understanding Distribution Frequency

When it comes to educational support options, many students wonder how often they can expect their resources to be disbursed. This timing can play a crucial role in budgeting and managing expenses throughout the academic year. Knowing the distribution schedule can greatly impact your financial planning and overall stress levels.

Typically, the intervals at which support is provided can vary by institution and program. Some schools may opt for monthly disbursements, while others might choose to release funds on a semester basis. It’s essential to familiarize yourself with the specific policies of your educational institution to better align your spending habits with the influx of support.

Furthermore, understanding the process can help you plan ahead for major expenses like tuition, books, and living costs. Staying informed allows you to maximize the benefits available to you and ensures that you can make well-informed decisions regarding your finances.

In summary, grasping the nuances of how and when these resources become available can be pivotal in managing your overall educational journey. So, take the time to explore the options and schedules applicable to your situation, making sure you are fully prepared to navigate your financial landscape.

Types of Assistance Programs Available

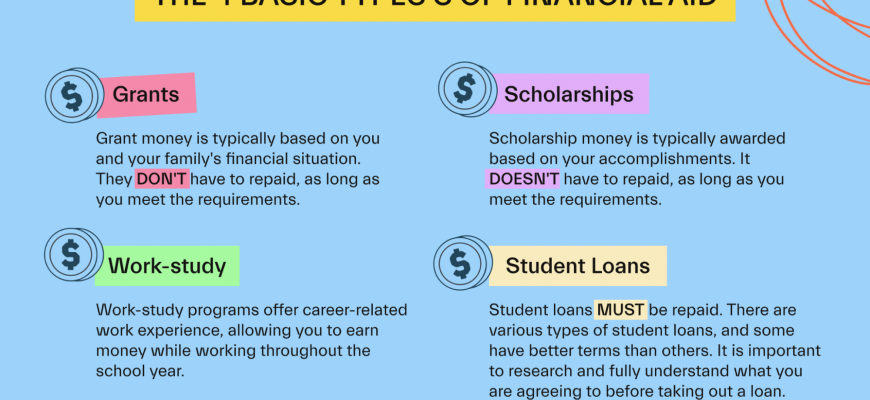

When it comes to support options for education, there’s a wealth of choices designed to make the journey a bit easier. From grants to scholarships, various programs exist to ensure that individuals have access to the resources they need to succeed. Understanding these different avenues can help you identify what might work best for your situation.

First up are scholarships, which are often awarded based on merit, talent, or special criteria. These funds don’t need to be repaid and can significantly ease the costs of tuition and other expenses. On the other hand, grants are typically aimed at those with demonstrated financial need, offering assistance without the expectation of repayment.

Then we have work-study programs that allow students to earn money while attending classes. This option not only helps cover costs but also provides valuable work experience. Additionally, some institutions and organizations offer loans, which need to be repaid but can serve as a useful resource when other forms of support fall short.

Lastly, there are community and state resources that provide a variety of programs tailored to specific needs, often based on local demographics. These options can be a great way to tap into additional support that might not be widely advertised.

How Support Impacts Student Budgeting

Managing expenses while studying can be challenging, especially for those relying on various forms of assistance to fund their education. The influx of resources not only relieves some financial pressure but also influences how students plan and allocate their monthly budgets. Understanding this dynamic can help learners maximize their resources and navigate their expenses more effectively.

When students receive periodic support, it can significantly alter their spending habits. Some may find themselves more willing to invest in necessities like textbooks, supplies, and even leisure activities, knowing they have a safety net. This can lead to improved academic performance as they have access to the tools and experiences needed for success.

However, with the positive changes come challenges. Students might mistakenly rely too heavily on this assistance, forgetting to plan for potential gaps or unexpected costs. It becomes vital for individuals to create a comprehensive budget that not only accounts for their incoming support but also sets aside funds for emergencies and necessary living expenses.

Ultimately, the influence of support plays a crucial role in shaping a student’s financial landscape. By approaching budgeting with a clear understanding of their resources, learners can cultivate better habits and prepare themselves for a more stable financial future after graduation.