Understanding Whether Financial Aid Is Distributed Through Direct Deposit Options

When it comes to accessing resources that assist students in their educational journeys, many have questions about how these vital funds are delivered. In today’s fast-paced world, efficiency and convenience are key, and the method of transfer can play a significant role in how swiftly individuals receive the necessary support. Understanding the process behind the transmission of these essential resources is crucial for anyone navigating through academic expenses.

People often ponder whether there’s a simpler way to receive these beneficial resources. The idea of having money transferred straight into their bank accounts is appealing to many. This method not only saves time but also reduces unnecessary trips to the bank. Grasping the nuances of how these processes work can make all the difference for students who rely on such support.

In this article, we’ll explore the ins and outs of how these funds make their way to recipients, focusing on the electronic transfer system. You’ll learn about the benefits it offers, how to ensure a smooth transaction, and what to consider when opting for this modern approach to receiving support. Let’s delve into the details!

Understanding Payment Methods for Support

When it comes to receiving help in the form of funds, there are various ways that institutions can transfer money to you. It’s useful to know how these methods work to ensure you get your assistance in a timely manner. In this section, we’ll explore the different ways you might receive your funds, focusing on the pros and cons of each option.

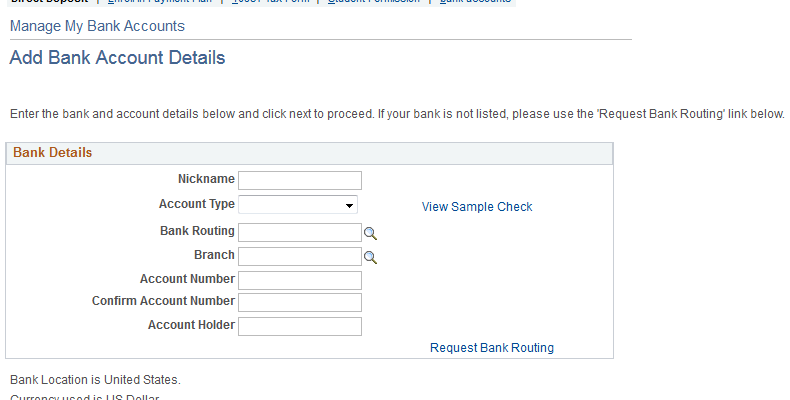

One common method involves automatic transfers to your bank account. This option is typically favored for its convenience and speed. You’ll usually find the money in your account within a few days after the institution processes your request. However, it’s vital to keep your banking details updated to avoid any delays.

Another way to receive your support is through paper checks. While this method may sound traditional, it can sometimes lead to longer waiting times. Checks have to be physically mailed, which means there’s always a chance of delays in the postal system. On the bright side, some people prefer checks because they allow for better tracking of transactions.

Some institutions might also offer prepaid cards as a way to facilitate payments. These cards can be loaded with the funds and can be used like a debit card. They provide a flexible way to access your resources but might come with fees or limitations, so you should read the fine print.

Understanding these transfer options ensures you can select the method that fits your needs best, helping you manage your resources effectively without unnecessary hassles.

Timing of Support Payments

Understanding when you’ll receive your assistance can make a huge difference in managing your finances. It’s essential to know the schedule for payments so you can plan your expenses accordingly. Some sources of support follow a regular timeline, while others may have varying disbursement dates.

Typically, institutions have set periods for payment releases, often aligned with the academic calendar. These can occur at the beginning of a semester or term, helping students cover immediate costs like tuition and housing. It’s worth checking with your school to get the exact dates specific to your situation.

While many institutions offer electronic transfers for convenience, the processing time can vary. Although some payments may appear almost immediately in your account, others might take a few days to finalize. Staying informed about these timeframes can help you avoid any unexpected financial stress.

Be proactive in tracking your payment history. Knowing when to expect funds gives you the ability to effectively manage your budget and prepare for any potential gaps. Remember, reaching out to your institution’s financial office can provide clarity if anything seems uncertain.

Benefits of Direct Payment for Students

In today’s fast-paced world, having a reliable method to receive funds is crucial, especially for students juggling classes and expenses. There’s a seamless option that simplifies getting money right into your account without the hassle of checks or cash. This method not only ensures timely access to resources but also helps in managing personal finances more effectively.

One of the biggest perks of this payment method is convenience. Instead of waiting for checks to arrive and then cashing them, students can enjoy instant access to their funds. This means less time worrying about when money will arrive and more focus on studies and other important activities.

Another major advantage is security. Carrying large amounts of cash can be risky, and mailing checks increases the chance of loss or theft. With funds transferred electronically, students can rest easy knowing their money is safely in their bank account, reducing the risk of unauthorized access.

Additionally, this streamlined process can lead to better budgeting. When funds enter the bank account automatically, it helps students track their spending and manage their finances more effectively. They can plan ahead knowing exactly when their resources will arrive, which makes it easier to balance expenses like rent, books, and everyday necessities.

Lastly, this method often comes with the ability to receive notifications and updates. Many banks offer alerts when funds are added, allowing students to stay on top of their finances without constantly checking their accounts. This feature can promote responsible spending and help in saving for unexpected costs.