Understanding the Differences Between Financial Aid Forms Loans and Grants

When it comes to pursuing education, many people find themselves exploring various sources of support to fund their endeavors. This realm of support can be complex, often leading individuals to wonder about the nature of the help available to them. Is this type of support something that needs to be paid back, or is it a gift that one can receive without any strings attached? Understanding these nuances is crucial for making informed decisions about your financial journey.

On one hand, there are options that require repayment, which can weigh heavily on your future. On the other hand, there are alternatives that, once received, allow students to focus solely on their studies without the burden of future expenses looming over them. In this discussion, we’ll navigate through these distinct forms of assistance and explore the implications of each. Are you ready to unravel the mysteries of educational funding?

Types of Support Explained

Understanding the different forms of assistance available can be a game-changer when it comes to pursuing your education. There are various categories designed to help students manage their expenses, each with its unique features and requirements. Let’s break them down so you can navigate your options more easily.

One-Time Contributions are among the most desirable forms of support. These are typically provided with no expectation of repayment, making them a financial boost that can cover tuition, books, or other necessary costs. They often come from government sources, institutions, or private organizations aimed at helping learners succeed.

Repayable Funds are another common alternative. These resources are made available with the expectation that recipients will pay back the amount received over time, usually after they graduate or leave their studies. The terms can vary widely, including interest rates and repayment schedules, which is essential to consider before accepting these offers.

Work Programs offer a different approach, allowing students to earn money while studying. Participants typically take on part-time jobs associated with their educational institutions, helping them cover living expenses while gaining valuable experience in their field. This can be a great way to balance academics with practical learning.

Scholarships are often viewed as the holy grail of support options. They come in various forms and are awarded based on merit, need, or specific criteria like community service or academic achievements. Since these funds don’t require repayment, they can significantly alleviate the financial burden of education.

Choosing the right path depends on your personal circumstances, career goals, and the assistance you are eligible for. By thoroughly exploring these options, you can find the best way to fund your educational journey and ensure you have the resources you need to succeed.

Understanding Loans vs. Grants

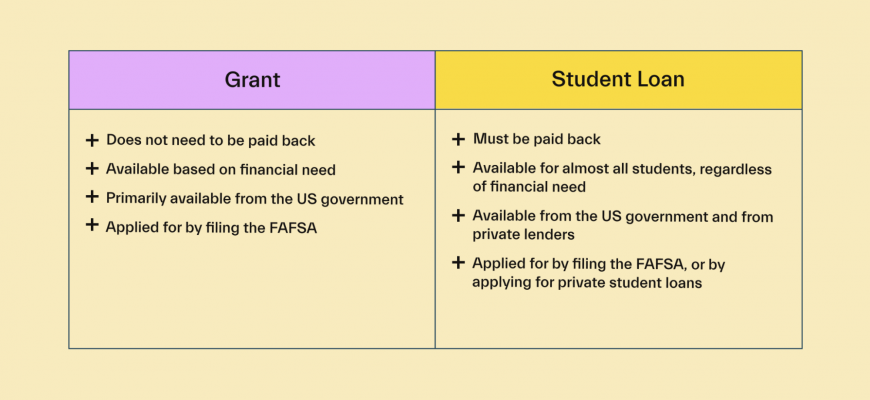

When it comes to funding your education or other needs, there are two primary options that often come into play: borrowed money and monetary contributions that don’t require repayment. Both have their own unique features and functions, depending on what you’re looking to accomplish and your financial situation.

Borrowed funds are amounts given with the expectation that you’ll pay them back, usually with added interest. They’re often seen as a way to bridge a financial gap, allowing you to access necessary resources now while you tackle repayment later. On the flip side, contributions that don’t require reimbursement provide support without the burden of future obligations, making them an attractive choice for many. Understanding these differences helps you make informed decisions about what works best for your circumstances.

The former can sometimes feel like a weight on your shoulders, especially if repayment terms are stringent or if interest accumulates quickly. However, they may also offer larger sums, which can be beneficial in significant investments. In contrast, the latter category can be more limited in scope but removes the stress of future financial commitments, allowing you to focus solely on your goals.

Ultimately, recognizing the distinctions between these two funding avenues is crucial. It helps you navigate your choices wisely and align them with your long-term plans. Being informed opens the doors to opportunities that best fit your needs without unnecessary strain.

The Impact of Financial Assistance

When support systems are put in place to ease the burden of educational costs, they play a significant role in shaping the paths of many individuals. These resources can effectively determine whether someone can pursue their academic dreams or if financial obstacles will hinder their journey.

Typically, the influence of these resources extends beyond just alleviating expenses. They can boost confidence, enhance focus on studies, and open doors to opportunities that might have seemed out of reach. For many, this kind of support transforms aspirations into realities, allowing students to engage in extracurricular activities, internships, or even study abroad programs, which further enrich the educational experience.

However, the effects can vary widely depending on the individual’s circumstances. For some, these benefits may lead to a more successful career trajectory, while others might feel additional pressure due to the responsibilities tied to receiving such support. Understanding the different facets of these programs is crucial for both students and educational institutions as they navigate the complexities of funding education.