Understanding the Difference Between Financial Aid as a Loan and Financial Aid as Free Money

When it comes to pursuing higher education, navigating the world of financial support can be quite confusing. Many individuals often find themselves wondering whether the assistance they receive is essentially a debt they need to repay later or a generous gesture that doesn’t come with strings attached. This question is crucial, as it impacts long-term planning and financial well-being.

Understanding the nature of these support systems is vital for students and their families. While some options require repayment, others might truly offer a helping hand without the obligation to return the funds. The key lies in dissecting the terms of each opportunity–some may present attractive terms, while others could lead to unexpected burdens down the line.

In this discussion, we’ll explore various types of support available to students and clarify whether they come with financial strings attached. By examining the specifics, we aim to help you make informed decisions and choose the best path for your educational journey.

Understanding Support Options

When it comes to pursuing higher education, the landscape of support can often feel overwhelming. Various types of resources exist to help individuals cover educational expenses, and understanding the differences between them is crucial for making informed decisions. This section will break down the options available, ensuring you grasp what each entails and how they can benefit you.

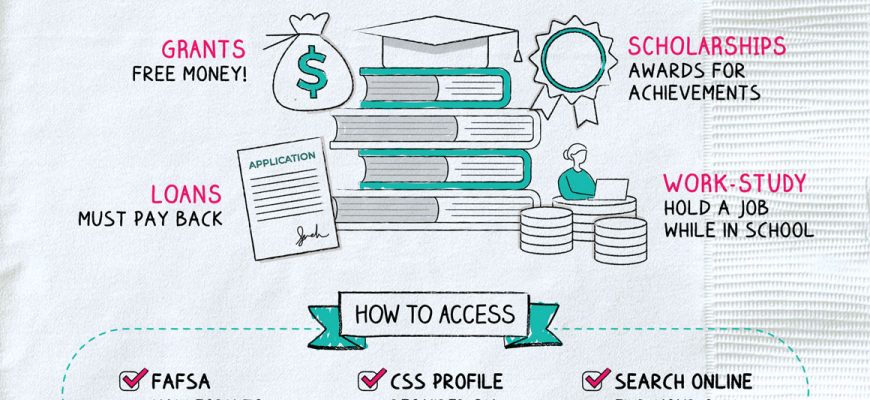

There are generally two categories of support: those that require repayment and those that do not. The first group includes funds that you borrow, which means you’ll need to pay back the amount you received, often with added interest over time. This type of financing can assist in covering tuition and related costs, but it’s important to remember that what you take now will impact your budget later.

On the flip side, certain resources come without the need for repayment. These often consist of scholarships or grants that are awarded based on various criteria like academic performance, specific talents, or financial circumstances. They provide an excellent opportunity for students to obtain necessary funding without the burden of future debt.

Additionally, there are work-study programs that offer the chance to earn income while studying. By balancing part-time employment with academic commitments, students can alleviate some of their financial burdens while gaining valuable experience.

Navigating these choices requires careful consideration of your individual situation, goals, and long-term plans. Understanding the differences between borrowing funds, receiving non-repayable support, or earning income through work can lead to a healthier financial path throughout your educational journey.

Loans vs. Grants: Key Differences

When it comes to funding education or other projects, two popular options often come into play. Understanding the main distinctions between these choices is crucial for making informed decisions. While both may provide essential support, they come with different expectations and conditions.

- Repayment:

- Monetary support that requires repayment is typically given with the expectation that the recipient will return the amount received over time.

- Conversely, funds provided without the need for repayment can lighten the financial burden significantly.

- Eligibility:

- Access to repayable funds often depends on credit history or financial need, while non-repayable support might be based on academic merit or specific criteria.

- Different eligibility requirements can affect which option is more accessible to potential recipients.

- Application Process:

- Securing repayable assistance usually involves a more extensive application process, including credit evaluations.

- In contrast, applying for non-repayable support can be more straightforward, focusing on eligibility documentation rather than credit checks.

- Impact:

- Monetary support with a repayment obligation can affect future finances and budgeting, as recipients need to plan for repayments.

- Non-repayable assistance, on the other hand, allows individuals to allocate resources to other areas without worrying about future repayments.

Knowing these key differences will help you navigate the world of educational support more effectively and choose the option that best fits your needs.

How Support Programs Impact Students’ Finances

The way students receive assistance can significantly shape their financial landscape throughout their academic journeys. These programs are designed to alleviate the burden of tuition and living expenses, allowing learners to focus more on their studies and less on their economic responsibilities. Understanding the implications of such support is crucial for making informed decisions.

For many, these resources provide a lifeline, helping to reduce the overall cost of attending school. With this financial relief, students often find they have more flexibility in their budgeting, enabling them to allocate funds for necessary living costs such as housing, meals, and transportation. This support can be a game-changer, allowing learners to fully engage in their educational experience without the constant worry of financial strain.

However, it’s essential to approach these programs with care. While some forms of support require repayment, others do not, leading to differing impacts on long-term financial situations. Students must weigh the benefits against potential future obligations, ensuring they understand the implications of their choices. By considering their options carefully, individuals can better navigate the challenges of their educational finances.

Ultimately, these programs offer various pathways to enhance educational opportunities, but students must remain vigilant and informed. Proper planning and understanding of the financial landscape will empower learners to make choices that align with their aspirations and financial goals, fostering a more secure future.