Understanding the Role of Federal Financial Aid in Higher Education

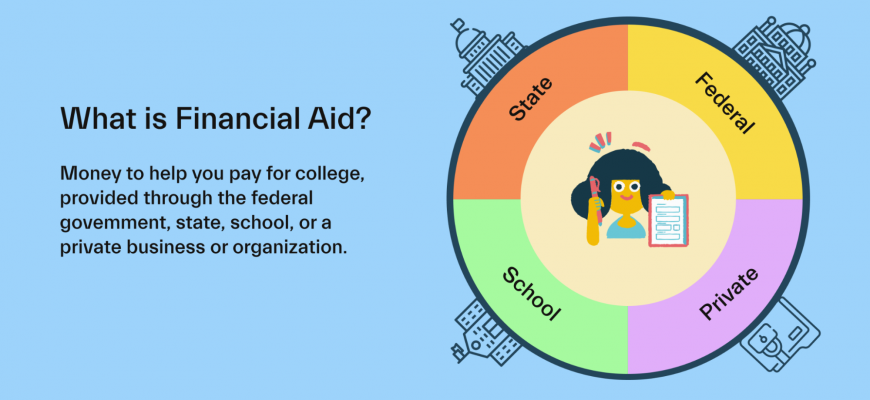

When it comes to pursuing higher education, many students find themselves grappling with the challenge of affording tuition and associated costs. Most people are aware that there are various forms of assistance available to help alleviate the burden, but not everyone knows the specifics. This section will delve into the different types of resources and benefits that are designed to support learners in their academic journeys.

In this discussion, we’ll explore the processes and programs that aim to provide monetary assistance to students in need. From scholarships to loans, the landscape is rich with options that can make education more accessible. It’s essential for prospective students to familiarize themselves with these offerings, as they can significantly impact their experience and future opportunities.

Whether you’re a first-time college student or someone looking to further your education, understanding the available options is crucial. Knowledge is power, and knowing how to navigate the system can lead to a smoother and more affordable academic path. Let’s uncover the various opportunities that can turn your educational aspirations into reality.

Understanding Federal Financial Aid Options

Navigating the realm of monetary support for education can feel overwhelming. With a variety of programs available, it’s essential to comprehend what options are out there to ease the burden of tuition and related expenses. From grants to loans, each type serves a unique purpose and is designed to assist students in different ways.

Grants are typically awards that do not require repayment, making them highly desirable. They are often based on need and can come from governmental sources or educational institutions. Many students find these resources to be a significant boost in covering costs without the stress of future repayment.

Loans, on the other hand, are amounts borrowed to pay for schooling that must be returned with interest. These can be a practical option when grants don’t cover the entire expense. It’s essential for students to understand the terms, interest rates, and repayment plans before committing to ensure they make informed financial decisions.

Another avenue worth exploring is work-study programs, allowing students to earn income while pursuing their studies. This not only helps lessen the financial load but also provides valuable work experience. It’s a win-win situation that many overlook when planning their educational journey.

Finally, don’t forget about scholarships, which can be awarded based on various criteria such as academic achievement, talent, or even personal circumstances. While some may be competitive, many are attainable and can provide substantial support without the need for repayment.

By exploring these diverse resources, students can create a more manageable financial plan as they embark on their academic adventures. Understanding each option thoroughly can empower them to make choices that align with their goals and circumstances.

Eligibility Requirements for Federal Assistance

Navigating the world of support options can be a bit daunting, especially when it comes to understanding who qualifies for all those resources available. It’s essential to know what criteria you need to meet to access these opportunities. The good news is that there are specific guidelines designed to help you determine your eligibility, making the process a little clearer.

First and foremost, your citizenship status plays a vital role. Typically, individuals who are citizens or eligible non-citizens can apply for support. This means having a valid Social Security number or being a permanent resident, among others. Additionally, your enrollment status matters. If you’re planning to attend or are currently enrolled in an accredited institution, chances are you’re on the right track.

Academic progress is another factor to consider. Most programs require you to maintain satisfactory performance in your studies, which usually means keeping a specific GPA. It’s also important to be aware of any previous funding you may have received; in some cases, there are limitations on how much assistance you can obtain over time. Lastly, some support options may have income caps or other financial criteria that you need to meet, reflecting the aim to assist those who truly need it.

The Application Process for Assistance

Navigating the pathway to receive support for your education can feel daunting, but it doesn’t have to be. This journey typically begins with gathering necessary documents and information that showcase your financial situation. Understanding the steps involved can make the process smoother and more manageable.

First, it’s essential to determine your eligibility by checking the requirements set by various programs. You might need to provide details about your income, expenses, and sometimes even your family’s financial standing. This information helps institutions assess your needs and match you with suitable opportunities.

Next, complete the required forms, which serve as the backbone of your application. Make sure every section is filled accurately to avoid delays in processing. Many applicants find it helpful to double-check their inputs or even enlist a trusted advisor to review their submissions.

After submitting, it’s important to keep track of any deadlines and follow up if necessary. Institutions often require additional documentation or clarification, so staying proactive will ensure your application remains on their radar. Patience is key during this period, as decisions can take time.

Once you receive notification about your status, carefully review the options available to you. Each offer may have different conditions or requirements, so understanding the terms is vital. If you have questions or concerns, don’t hesitate to reach out to the representatives of the organization.

Lastly, preparing for the next steps, whether they are accepting an offer or exploring further opportunities, will set you up for success. The process may seem overwhelming at first, but with each step, you’re getting closer to securing the support you need for your educational journey.